Master Real Estate Traps to Secure Financial Success

Unlock the secrets of real estate investment success by mastering common traps and pitfalls to ensure your financial future is secure, and as you browse options, you'll discover the strategies that could transform your investment journey.

Understanding Real Estate Traps

Real estate investment is often seen as a lucrative path to financial independence, but it comes with its own set of challenges. These challenges, or "traps," can ensnare even experienced investors if not navigated carefully. By understanding these traps, you can make informed decisions that bolster your financial security. The key is to be aware of the common pitfalls and to arm yourself with the knowledge needed to avoid them.

Common Real Estate Traps

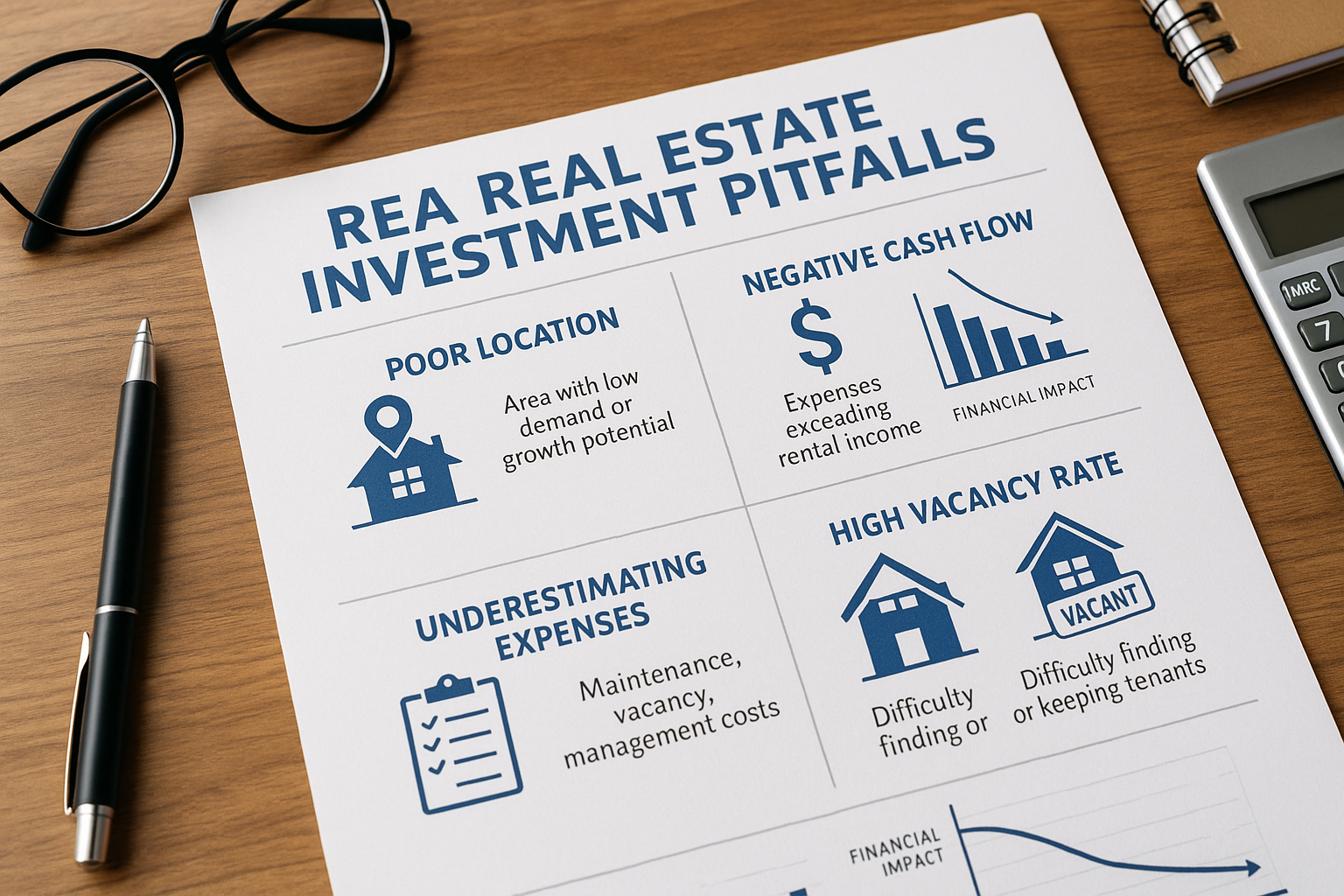

One of the most prevalent traps is overestimating rental income potential. Many investors assume that rental properties will always generate a steady cash flow, but this is not always the case. Factors such as market demand, location, and property condition can significantly impact rental income. According to a study by Zillow, rental prices can vary widely even within the same city1.

Another trap is underestimating maintenance costs. Properties require ongoing maintenance, and unexpected repairs can quickly eat into profits. It's essential to budget for these expenses and have a contingency fund in place. A report from the National Association of Realtors highlights that maintenance costs can account for up to 20% of rental income annually2.