South Africa Wealth Secrets Property Portfolio Mastery Revealed

Unlock the secrets to mastering a property portfolio in South Africa, where lucrative opportunities await those ready to browse options and explore the wealth-building potential of real estate investments.

Understanding the South African Property Market

South Africa's property market is a dynamic landscape that offers diverse opportunities for investors looking to build a robust portfolio. The country's real estate sector is characterized by a wide range of properties, from affordable housing to luxury estates, each providing unique investment potential. The key to success in this market lies in understanding the local economic factors, property trends, and the legal framework governing real estate transactions.

The South African property market has shown resilience in recent years, with a steady demand for both residential and commercial properties. According to the South African Reserve Bank, real estate remains a significant contributor to the national GDP, highlighting its importance in the economy1. This makes it an attractive option for investors seeking long-term growth and stability.

Strategies for Building a Successful Property Portfolio

1. **Diversification**: A well-diversified portfolio can mitigate risks and maximize returns. Investors should consider a mix of property types, such as residential, commercial, and industrial properties, to balance their investments against market fluctuations.

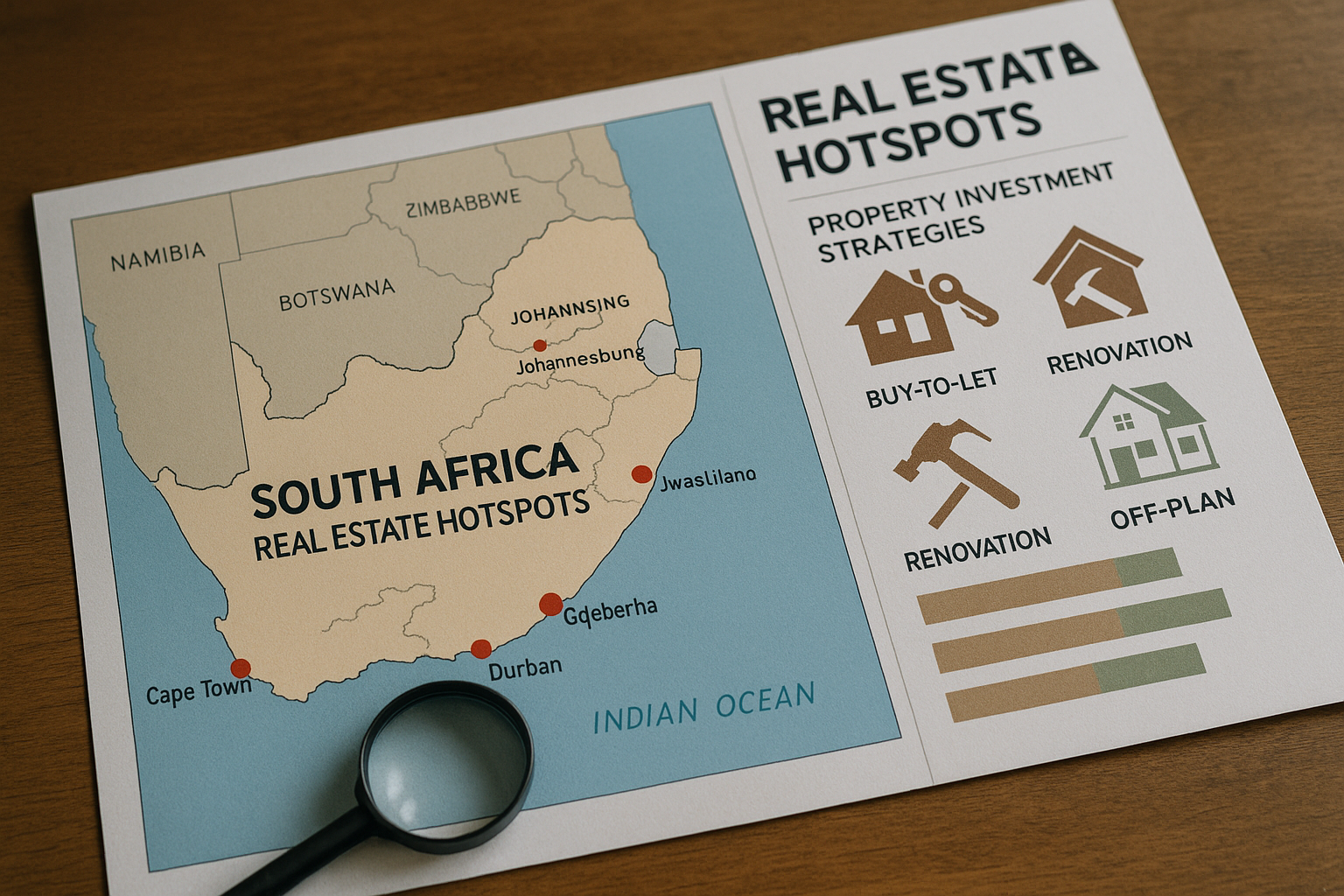

2. **Location Analysis**: Location is a critical factor in property investment. Areas with strong economic growth, infrastructure development, and increasing population density tend to offer higher returns. Cities like Johannesburg, Cape Town, and Durban are popular choices due to their robust economies and vibrant real estate markets2.

3. **Financing and Leverage**: Understanding financing options is crucial for property investors. Leveraging bank loans or mortgage financing can amplify investment potential, allowing investors to acquire more properties with less capital. However, it's essential to manage debt levels to avoid over-leverage.

4. **Legal and Tax Considerations**: Navigating the legal and tax landscape is vital for property investors. South Africa has specific regulations regarding property ownership, transfer duties, and capital gains tax. Consulting with a legal expert can ensure compliance and optimize tax efficiency3.