Transform Your Wealth with Real Estate Cash Flow Insights

Unlock the potential of your financial future by delving into real estate cash flow insights, where you can browse options and explore pathways to transform your wealth.

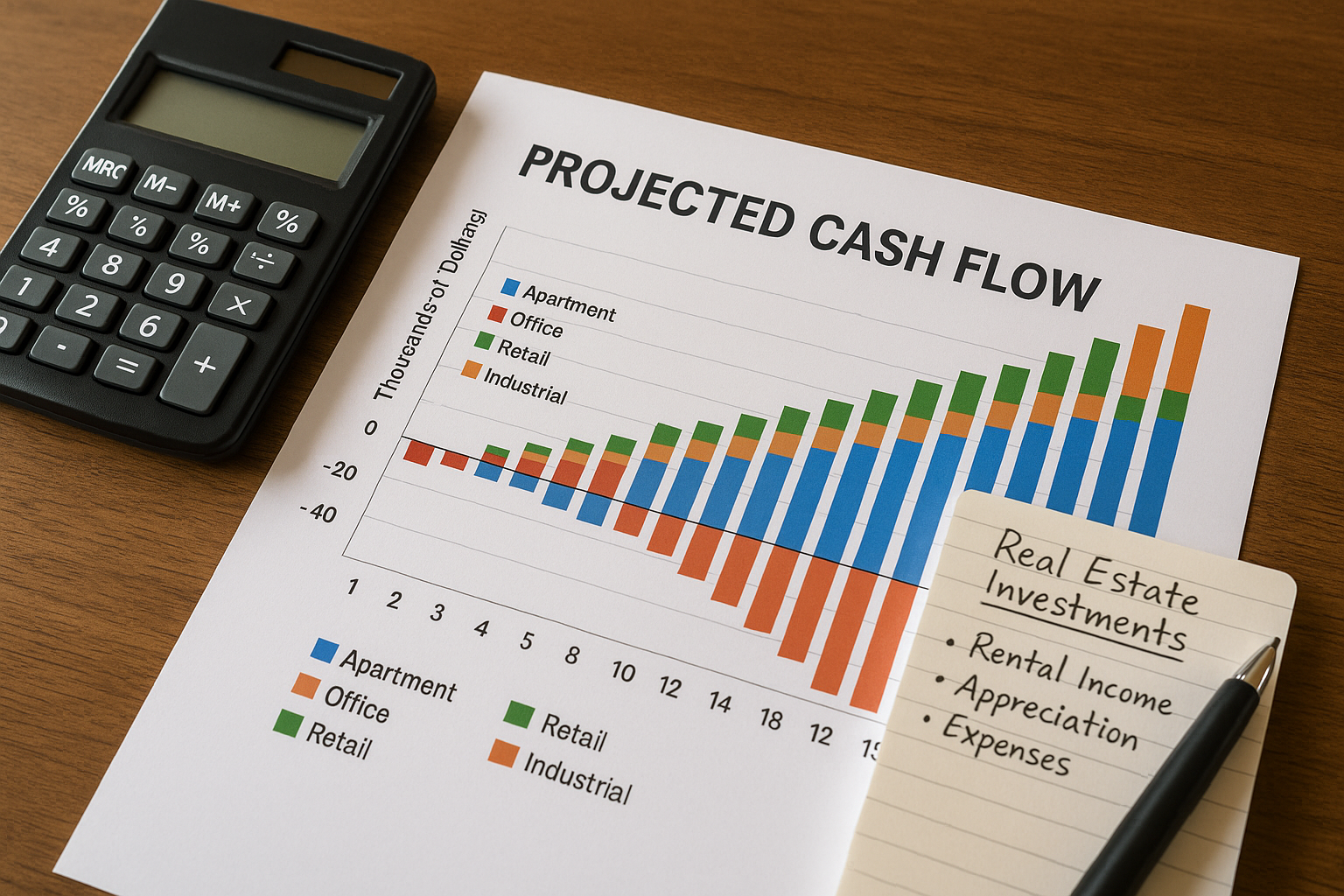

Understanding Real Estate Cash Flow

Real estate cash flow is the net amount of money moving in and out of your property investments. It's calculated by subtracting all property expenses, including mortgage payments, property management fees, taxes, and maintenance costs, from the rental income. Positive cash flow indicates that your property is generating more income than expenses, which is a crucial aspect of building sustainable wealth through real estate.

Investing in properties with strong cash flow potential can offer a reliable income stream and enhance your portfolio's stability. To maximize these benefits, investors often seek properties in high-demand areas with low vacancy rates, ensuring consistent rental income. By focusing on cash flow, you can mitigate risks and create a buffer against market volatility.

Opportunities and Benefits of Real Estate Cash Flow

One of the primary benefits of real estate cash flow is its ability to provide passive income. This income stream can be reinvested to acquire more properties, thereby compounding your wealth over time. Additionally, properties with positive cash flow can appreciate in value, offering capital gains upon sale. The tax advantages associated with real estate investments, such as depreciation and interest deductions, further enhance the financial appeal1.

Moreover, real estate cash flow can serve as a hedge against inflation. As the cost of living rises, rental income typically increases, preserving your purchasing power. This makes real estate a compelling option for those seeking long-term financial security. By strategically selecting properties with growth potential, you can ensure that your investments remain profitable and resilient to economic changes.