Retire Comfortably Use Reverse Mortgages Smartly Now

Retiring comfortably is a dream for many, and by using reverse mortgages smartly, you can unlock the financial freedom to enjoy your golden years without the typical monetary constraints, so browse options and explore how these strategies can enhance your retirement lifestyle today.

Understanding Reverse Mortgages

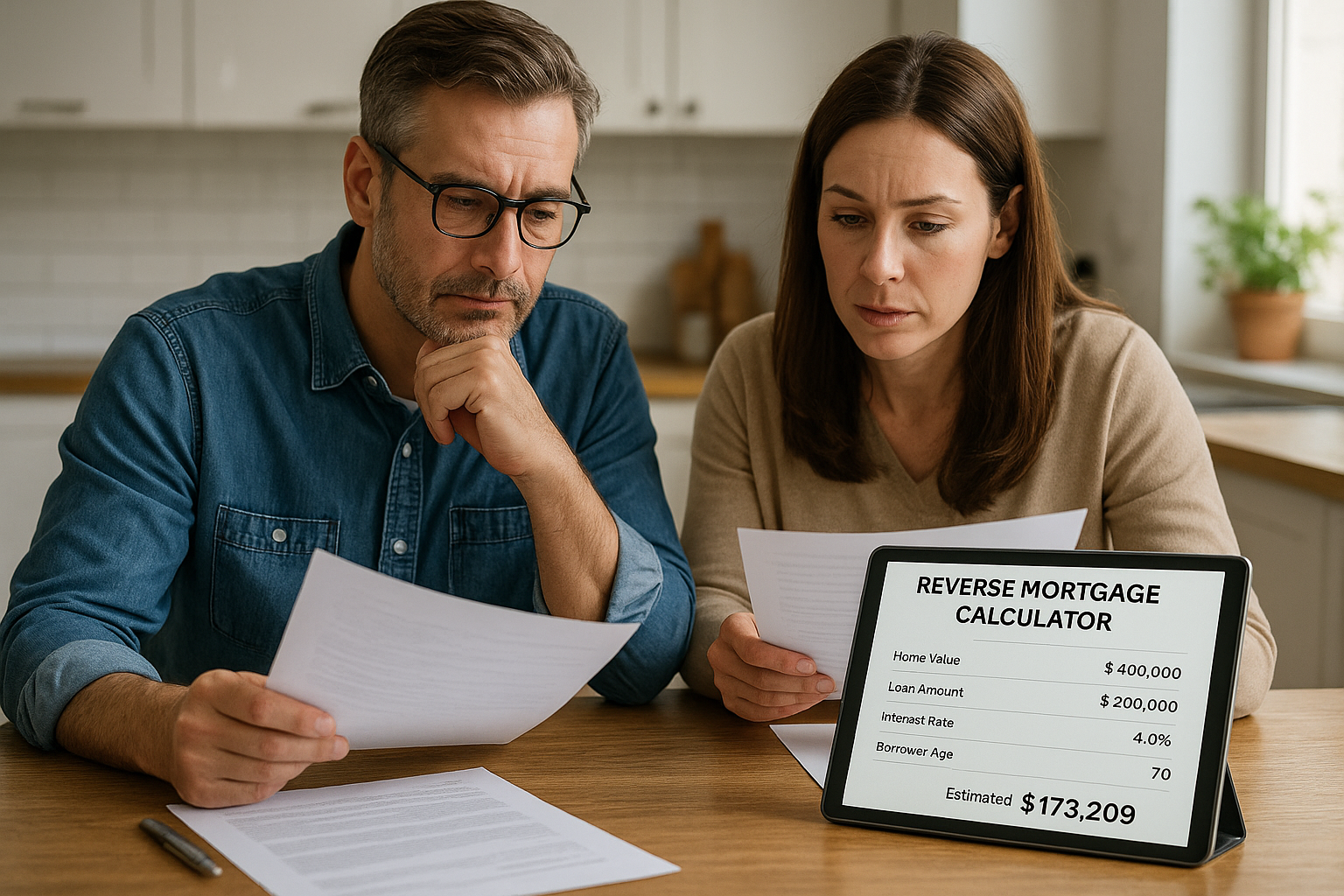

Reverse mortgages have become an increasingly popular financial tool for retirees looking to supplement their income. Unlike traditional mortgages where you make payments to a lender, a reverse mortgage allows you to receive payments, using your home equity as collateral. This can be particularly beneficial for those who have significant equity in their homes but are lacking in liquid assets. By converting part of your home equity into cash, you can cover living expenses, medical bills, or even travel, without having to sell your beloved home.

Types of Reverse Mortgages

There are primarily three types of reverse mortgages: Home Equity Conversion Mortgages (HECMs), proprietary reverse mortgages, and single-purpose reverse mortgages. HECMs are federally insured and the most common type, offering flexibility in how funds are received, such as a lump sum, monthly payments, or a line of credit. Proprietary reverse mortgages are private loans that cater to homeowners with high-value properties, while single-purpose reverse mortgages are typically offered by state or local governments for specific uses like home repairs or property taxes1.