Crack Ultimate Student Loan Repayment Secrets Today Only

Unlock the secrets to conquering your student loans today by exploring tailored repayment options that can ease your financial burden and lead you to financial freedom; see these options to discover how you can start this transformative journey now.

Understanding Student Loan Repayment

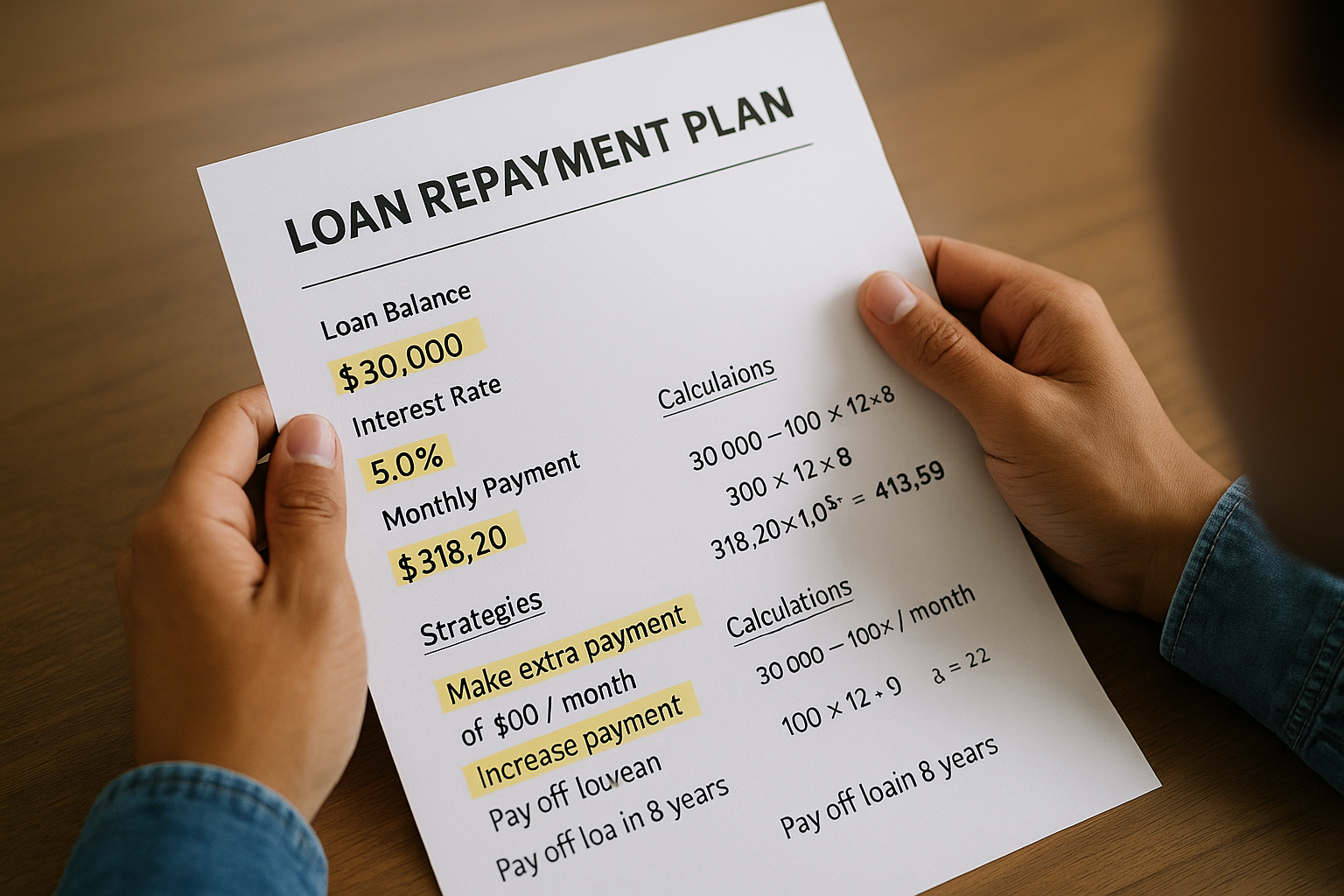

Navigating the maze of student loan repayment can be daunting, but with the right strategies, you can manage your debt effectively and even save money in the long run. The key is understanding the various repayment plans and options available to you. Federal student loans offer several repayment plans, including the Standard Repayment Plan, which spreads payments over 10 years, and Income-Driven Repayment (IDR) Plans, which adjust your monthly payment based on your income and family size1.

Private loans, however, are less flexible, often lacking income-based repayment options, but refinancing can be a solution. Refinancing allows you to consolidate your loans at a potentially lower interest rate, which can reduce your monthly payments and the total interest paid over time2.

Exploring Income-Driven Repayment Plans

Income-driven repayment plans can be a lifeline for borrowers struggling to make ends meet. These plans cap your monthly payment at a percentage of your discretionary income and extend your repayment term to 20 or 25 years. After this period, any remaining loan balance may be forgiven, though it could be considered taxable income3.

The four main IDR plans—Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR)—each have unique eligibility criteria and benefits. For instance, PAYE and REPAYE plans may offer lower payments for those who qualify, and REPAYE even offers interest subsidies that can significantly reduce the amount of interest you pay4.