Uncover the Secret Best Income Driven Repayment Plan

Are you struggling to manage your student loan payments and eager to discover a solution that could ease your financial burden? Dive into the world of income-driven repayment plans, where you can browse options that align with your financial situation and potentially lower your monthly payments.

Understanding Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more affordable by adjusting the monthly payment amount based on your income and family size. These plans are particularly beneficial for borrowers with high debt relative to their income, offering a way to manage payments without financial strain. The primary goal is to prevent default and provide a manageable path to loan forgiveness.

Types of Income-Driven Repayment Plans

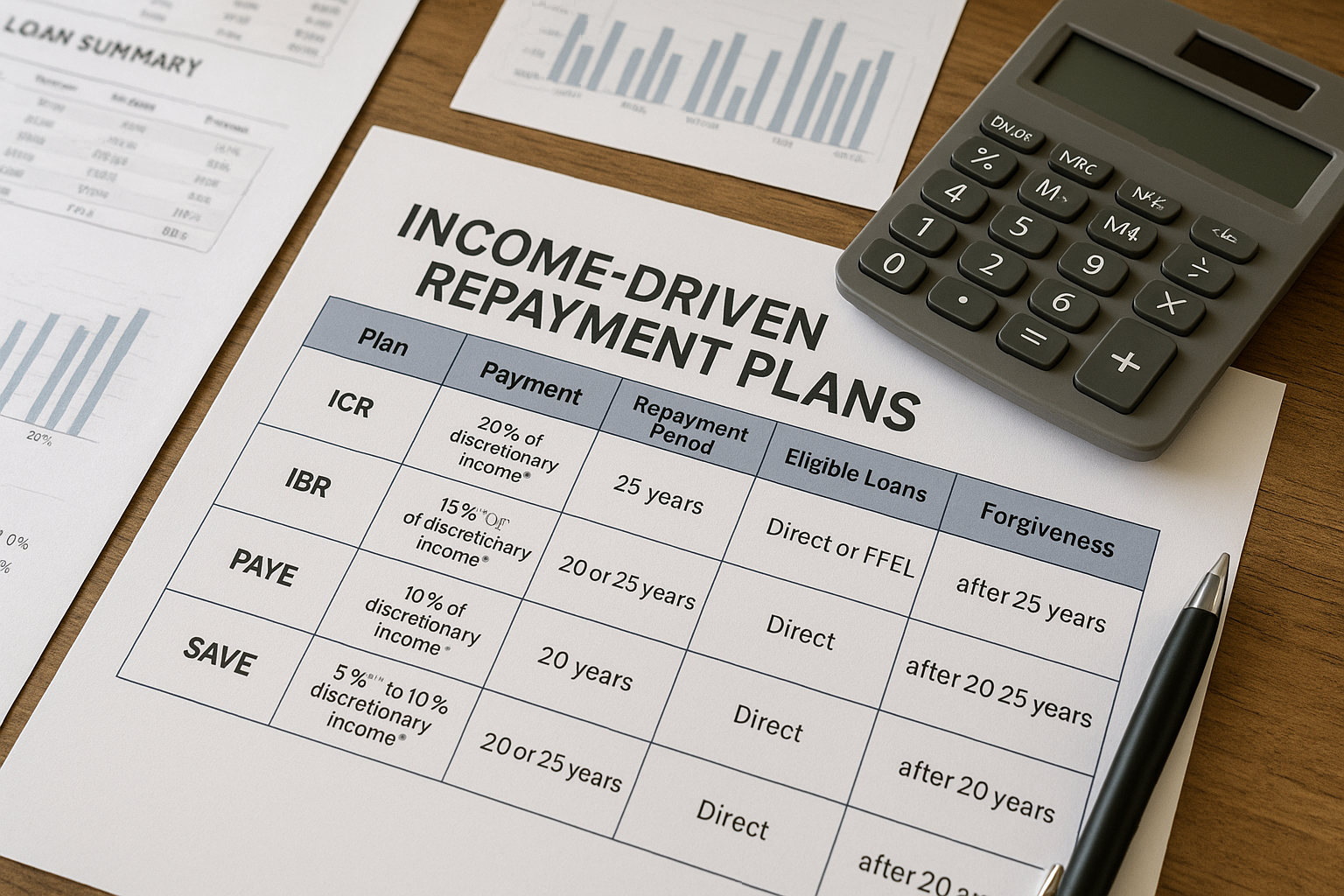

There are four main types of IDR plans:

- Revised Pay As You Earn (REPAYE) Plan: This plan caps your monthly payments at 10% of your discretionary income and offers loan forgiveness after 20 to 25 years, depending on whether the loans were for undergraduate or graduate studies.

- Pay As You Earn (PAYE) Plan: Similar to REPAYE, this plan also sets payments at 10% of discretionary income but requires that you show a partial financial hardship to qualify. Loan forgiveness occurs after 20 years.

- Income-Based Repayment (IBR) Plan: For new borrowers, this plan caps payments at 10% of discretionary income, while older loans might require 15%. Loan forgiveness is available after 20 or 25 years, respectively.

- Income-Contingent Repayment (ICR) Plan: This plan sets payments at the lesser of 20% of discretionary income or the amount you would pay on a fixed 12-year plan, adjusted according to income. Loan forgiveness applies after 25 years.