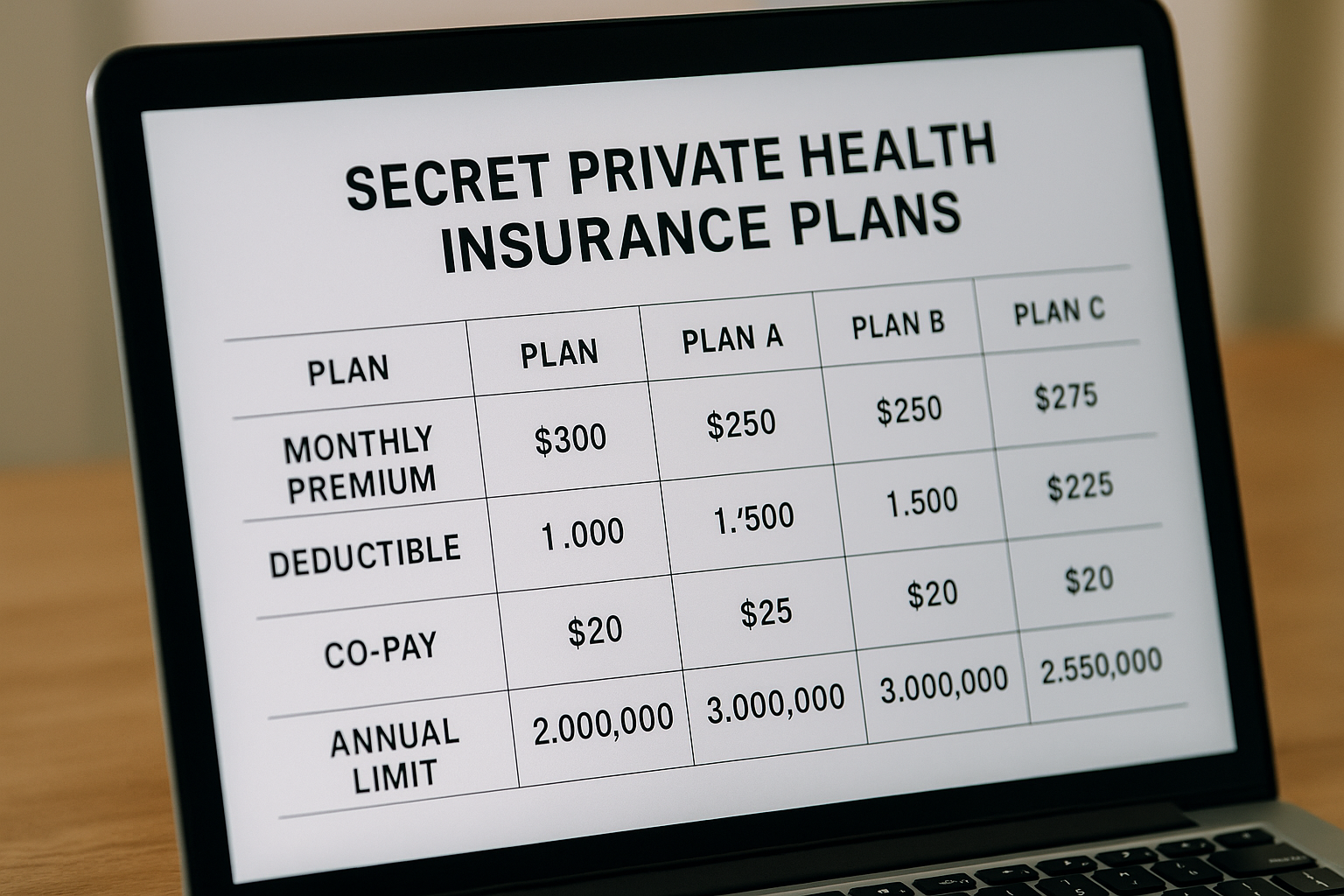

Access Secret Private Health Insurance Plans Today

If you're seeking to unlock exclusive health insurance benefits that could transform your healthcare experience, now is the time to browse options and see these opportunities that might be just what you need.

Understanding Private Health Insurance Plans

Private health insurance plans offer a range of benefits that can significantly enhance your healthcare coverage beyond what public plans typically provide. These plans are designed to cater to individual needs, offering flexibility in terms of coverage options and provider networks. Unlike public insurance, private plans often allow you to choose from a wider array of doctors and specialists, ensuring that you receive the best possible care tailored to your health requirements.

Types of Private Health Insurance Plans

Private health insurance plans come in various forms, each with unique features and benefits. The most common types include:

- Health Maintenance Organizations (HMOs): These plans require members to choose a primary care physician and obtain referrals for specialist care. They often have lower premiums and out-of-pocket costs.

- Preferred Provider Organizations (PPOs): Offering more flexibility, PPOs allow you to see any healthcare provider but offer better rates for using in-network professionals. They typically have higher premiums but provide broader access to specialists.

- Exclusive Provider Organizations (EPOs): Similar to PPOs but with a more limited network of doctors and hospitals. EPOs usually require members to use in-network providers for all non-emergency care.

- Point of Service (POS) Plans: Combining features of HMOs and PPOs, POS plans require a primary care physician referral for specialist services but offer some out-of-network coverage at a higher cost.