Auto Loan Refinance Rates Slashed for Savvy Drivers

As a savvy driver eager to reduce your monthly expenses, exploring the current trend of slashed auto loan refinance rates can unlock significant savings, so why not browse options now to see how you can benefit?

Understanding Auto Loan Refinancing

Auto loan refinancing involves replacing your existing car loan with a new one, typically at a lower interest rate. This financial strategy can lead to reduced monthly payments, decreased interest over the loan term, and even a shorter payoff period. For many, refinancing is a practical way to improve cash flow and manage finances more effectively.

Why Refinance Now?

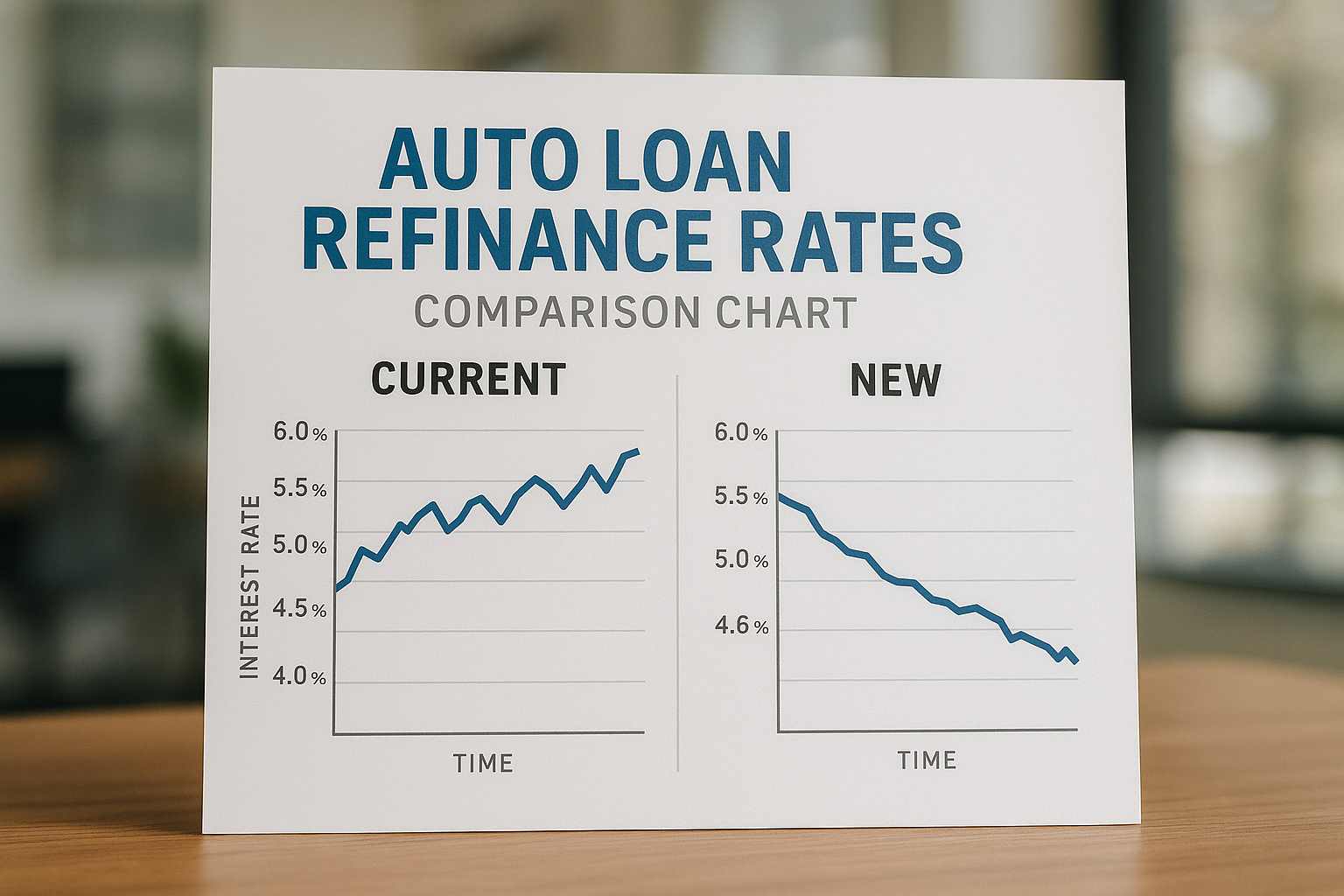

The current economic climate has seen a shift in interest rates, with many lenders offering competitive refinancing options to attract new customers. By taking advantage of these lower rates, you can reduce your overall loan cost. For instance, if your original loan was secured when rates were higher, refinancing now could significantly lower your monthly payments and total interest paid over the life of the loan.