Dental Groups Save Big Compare D&O Insurance Quotes

As a dental professional, you understand the importance of protecting your practice, and by taking the time to compare D&O insurance quotes, you can uncover significant savings and ensure your business is safeguarded against potential liabilities—so why not browse options and see these opportunities for yourself?

Understanding D&O Insurance for Dental Groups

Directors and Officers (D&O) insurance is a crucial component for dental groups seeking to protect their leadership and management from potential legal claims. This insurance covers the personal liabilities of directors and officers in the event of lawsuits related to their managerial decisions. For dental practices, this means safeguarding against claims that could arise from decisions impacting the business’s financial health, regulatory compliance, or employment practices.

Given the complex nature of running a dental group, D&O insurance provides peace of mind by covering legal defense costs, settlements, and judgments. This is particularly important as the healthcare sector faces increasing scrutiny and regulation, making dental practices more susceptible to legal challenges.

The Benefits of Comparing D&O Insurance Quotes

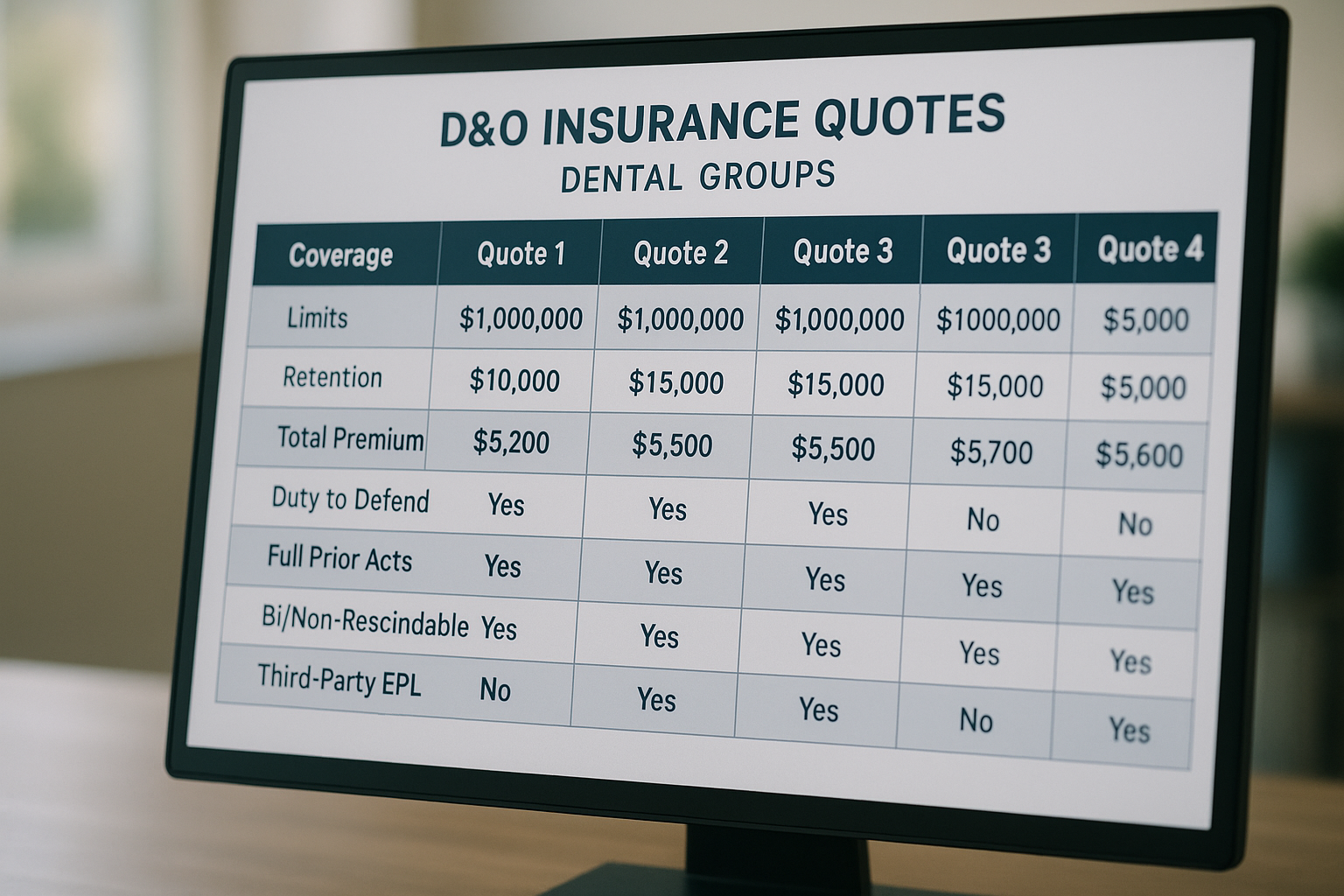

Comparing D&O insurance quotes can lead to substantial savings and better coverage options for your dental group. By evaluating different policies, you can identify the best fit for your specific needs, ensuring that your practice is adequately protected without overpaying. This process involves analyzing the scope of coverage, policy limits, deductibles, and premiums offered by various insurers.

Furthermore, exploring different insurance providers can reveal opportunities for discounts or special rates tailored to dental groups. Some insurers offer group discounts or loyalty programs that can significantly reduce the overall cost of coverage. By taking the time to search options and visit websites, you can uncover these potential savings and enhance your practice’s financial security.