Easiest Way Bank Mortgages Even Without W-2 Forms

If you're looking to secure a bank mortgage without the traditional W-2 forms, you're in the right place to discover how you can browse options and find solutions tailored to your unique financial situation.

Understanding Non-Traditional Mortgages

Securing a mortgage without W-2 forms might seem daunting, but it's entirely possible with the right approach and knowledge. Traditional mortgages often require proof of income through W-2 forms, which can be a hurdle for self-employed individuals, freelancers, or those with non-traditional income streams. Fortunately, there are mortgage options specifically designed for such scenarios.

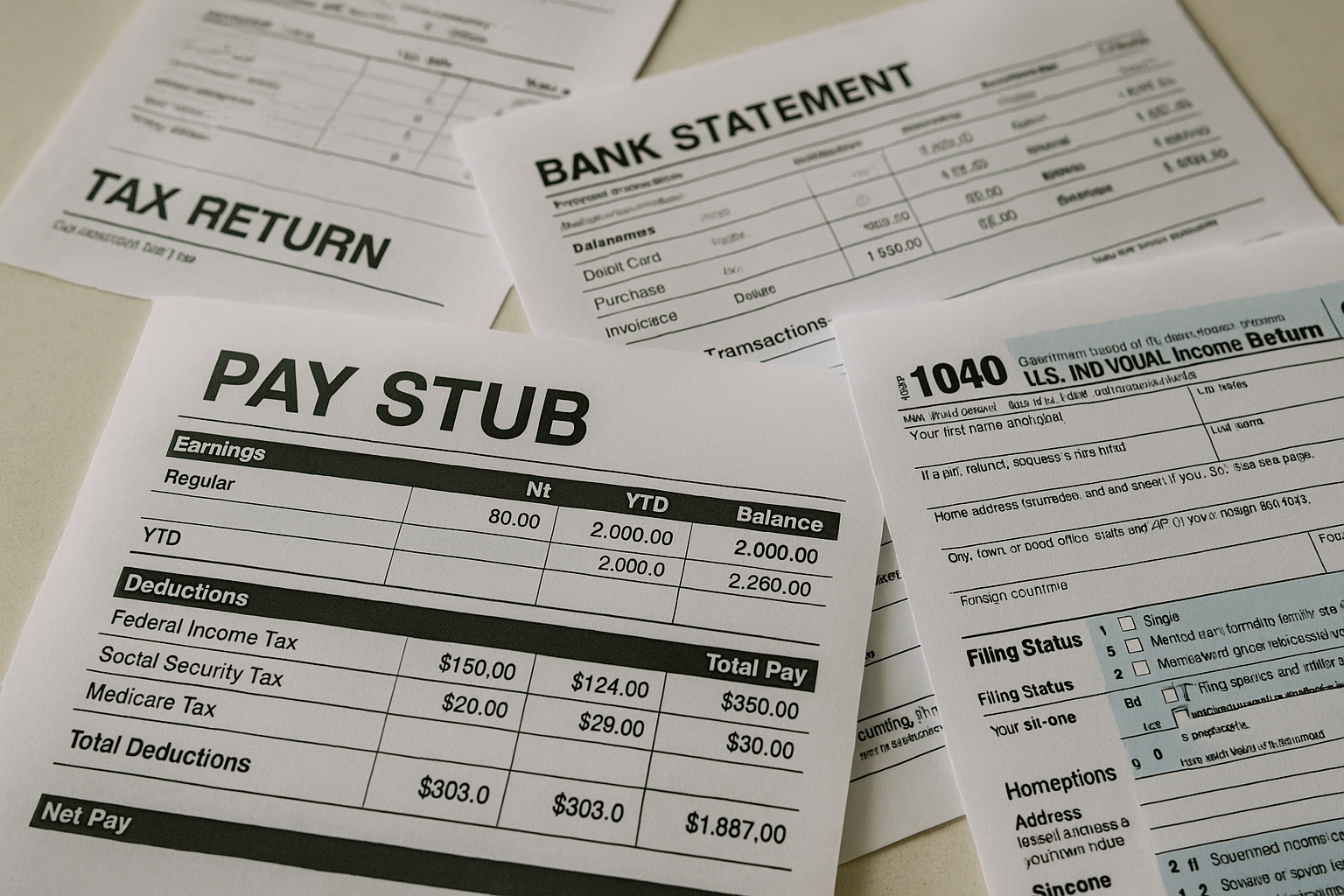

Bank Statement Loans

One of the most popular alternatives is a bank statement loan. These loans allow borrowers to use personal or business bank statements to verify income instead of W-2s or tax returns. Typically, lenders will review 12-24 months of bank statements to assess income stability and cash flow. This option is ideal for self-employed individuals or those with fluctuating incomes, as it provides a more accurate picture of their financial situation.