Ecommerce Brands Access Cash Solutions Same-Day Prequalification Available

Are you an ecommerce brand looking to unlock cash solutions quickly and efficiently? Discover how same-day prequalification can transform your business's financial agility and explore these options to find the best fit for your needs.

The Growing Need for Immediate Cash Solutions in Ecommerce

In the fast-paced world of ecommerce, having access to immediate cash solutions is not just a luxury—it's a necessity. With the dynamic nature of online markets, businesses often face unexpected expenses, inventory demands, or opportunities that require quick financial responses. Traditional loan processes can be slow and cumbersome, often taking weeks to approve and fund. This delay can hinder growth and limit a business's ability to capitalize on time-sensitive opportunities.

Understanding Same-Day Prequalification

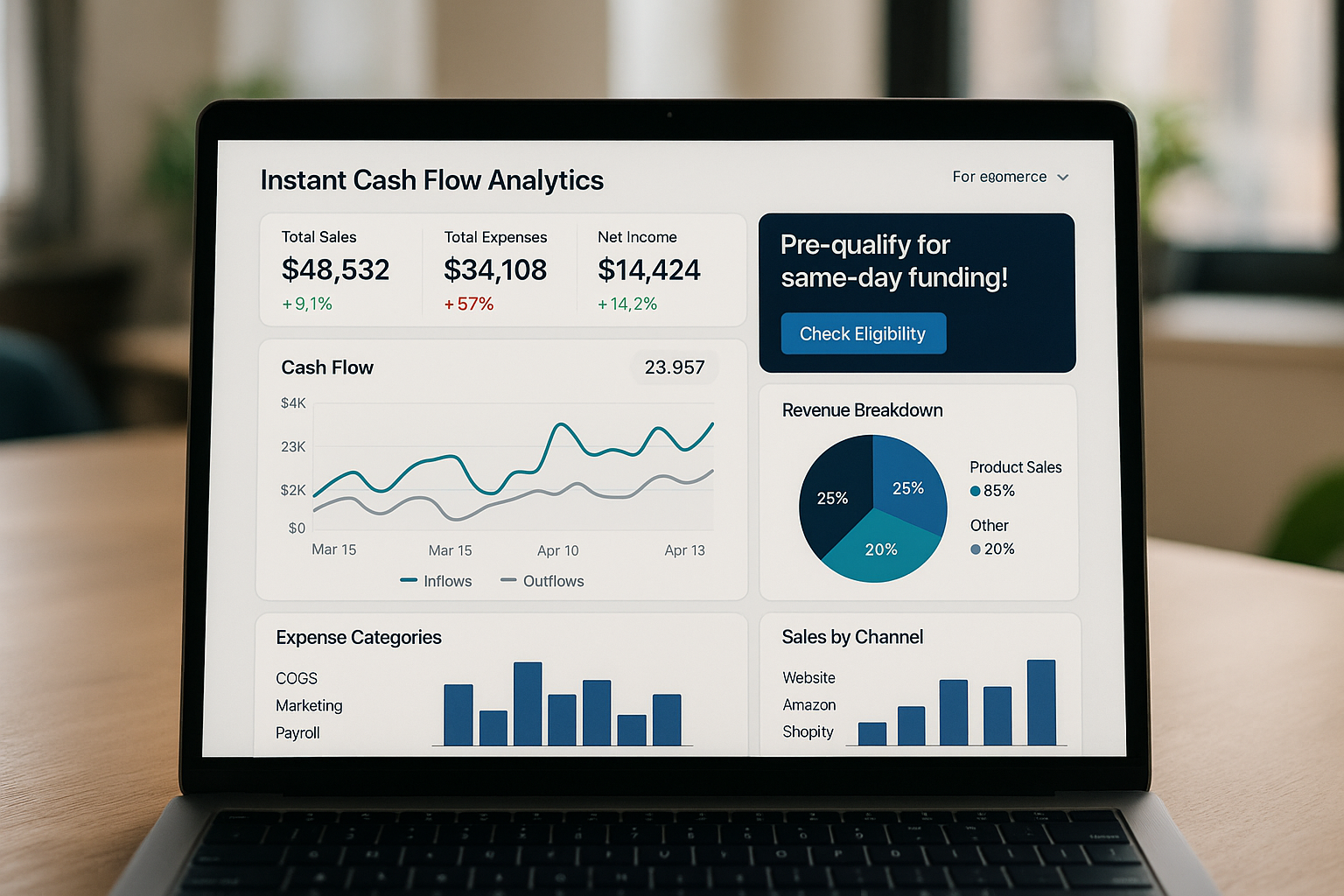

Same-day prequalification is a financial service designed to expedite the cash-access process for businesses. Unlike traditional loans, which require extensive documentation and lengthy approval times, same-day prequalification allows ecommerce brands to quickly determine their eligibility for funding. This process typically involves a streamlined application, often completed online, that evaluates key financial metrics to provide an immediate decision.

Once prequalified, businesses can access funds much faster, often within 24 to 48 hours. This rapid turnaround can be crucial for ecommerce brands needing to restock popular items, invest in marketing campaigns, or manage unexpected expenses.