Effortlessly Automate Fintech Crime Insurance Certificate Solutions

Effortlessly automating your fintech crime insurance certificate solutions can streamline your processes and save you valuable time, so why not browse options today to discover how these solutions can revolutionize your operations?

Understanding Fintech Crime Insurance Certificate Solutions

In the fast-evolving world of financial technology, the need for robust and efficient crime insurance solutions has never been more critical. Fintech companies are increasingly targeted by cybercriminals, necessitating comprehensive insurance coverage to mitigate risks. Automating the issuance and management of insurance certificates can significantly enhance operational efficiency, reduce manual errors, and ensure compliance with regulatory standards.

The Benefits of Automation in Fintech Insurance

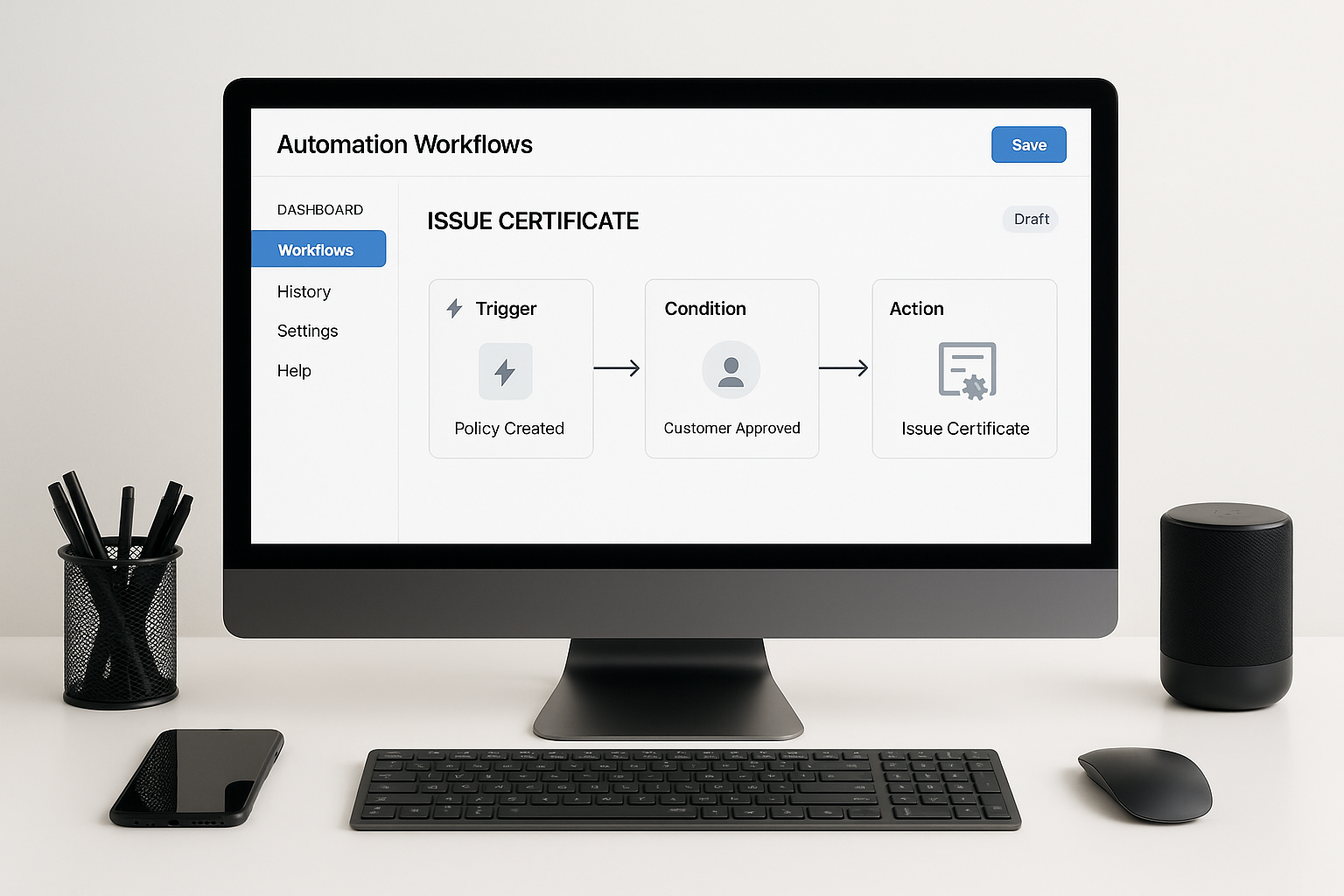

Automation in fintech crime insurance solutions offers numerous advantages. Firstly, it reduces the time and effort required to manage insurance certificates, allowing companies to focus on core business activities. Automated systems can handle repetitive tasks such as data entry, document generation, and compliance checks with greater accuracy and speed. This not only minimizes the risk of human error but also ensures that all necessary documentation is consistently up-to-date.

Moreover, automation facilitates seamless integration with existing systems, enabling real-time data sharing and improved coordination across different departments. This leads to enhanced transparency and better decision-making processes. By automating these services, fintech firms can also benefit from cost savings, as fewer resources are needed to manage insurance-related tasks.