Find Lowest Credit Union Auto Loan Rates Instantly

When you're ready to find the lowest credit union auto loan rates instantly, browse options that can save you money and simplify your car financing journey.

Understanding Credit Union Auto Loan Rates

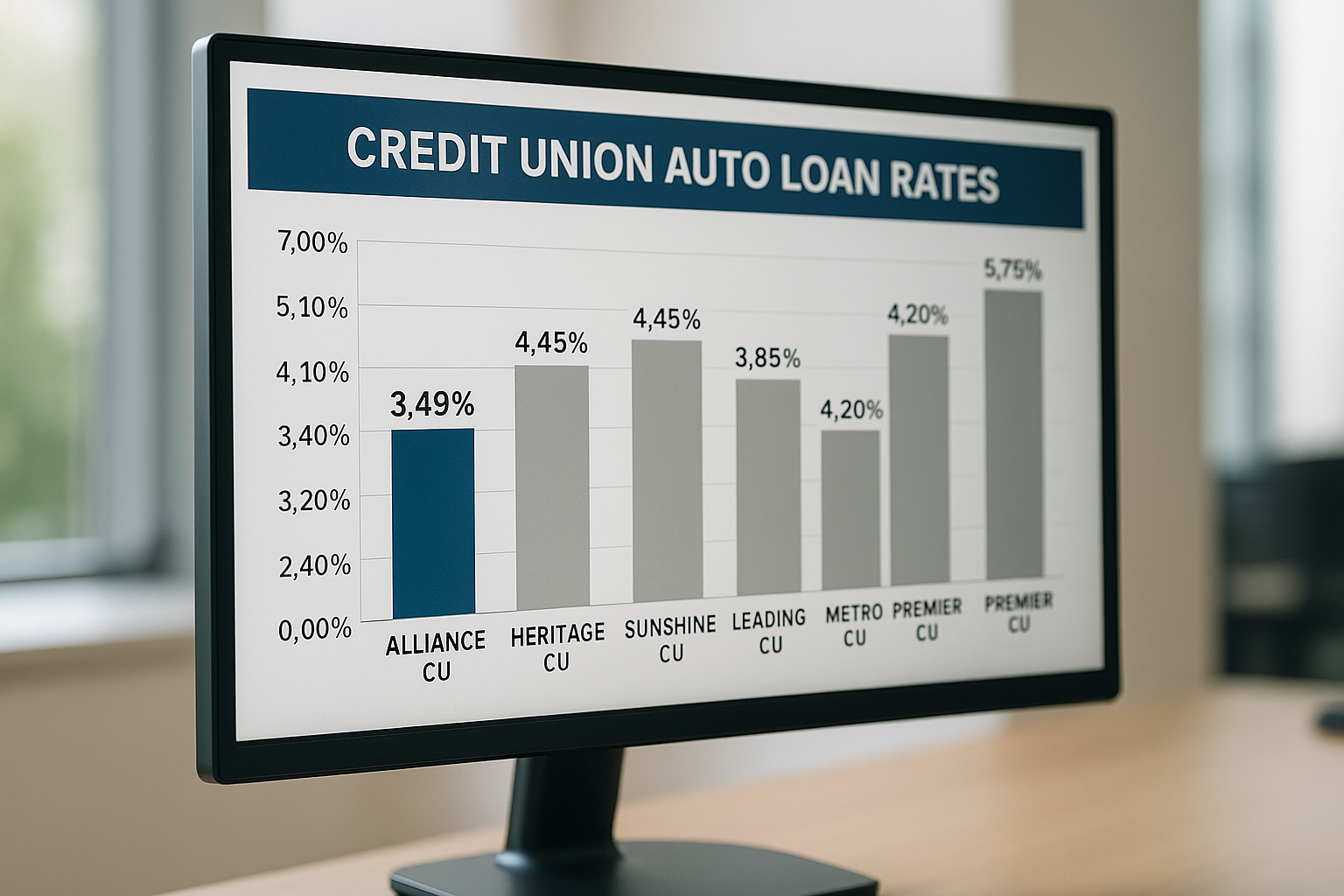

Credit unions often offer some of the most competitive auto loan rates available, primarily because they are member-owned, not-for-profit organizations. This structure allows them to provide lower interest rates compared to traditional banks. By searching options and visiting websites of various credit unions, you can unlock potential savings that make a significant difference in your monthly payments and the overall cost of your vehicle.

Why Choose a Credit Union for Your Auto Loan?

Choosing a credit union for your auto loan offers several advantages. Firstly, credit unions typically offer lower interest rates, which can save you hundreds or even thousands over the life of the loan. Additionally, credit unions often provide personalized service and a more flexible approach to lending, which can be beneficial if you have a less-than-perfect credit score. Moreover, many credit unions offer pre-approval, allowing you to shop for your car with confidence, knowing your financing is already in place.