Find Your Ideal Reverse Mortgage Purchase Lender Today

Are you ready to unlock the potential of your home equity and discover the perfect reverse mortgage purchase lender today? Browse options to find the most suitable financial partner that aligns with your needs and goals.

Understanding Reverse Mortgage Purchase Loans

Reverse mortgage purchase loans, known as Home Equity Conversion Mortgages for Purchase (H4P), offer seniors aged 62 and above the chance to buy a new primary residence without the burden of monthly mortgage payments. This financial tool allows you to leverage the equity from the sale of your previous home or other savings to fund the purchase of a new home, while the reverse mortgage covers the remaining cost. The primary benefit is the ability to move into a home that better suits your retirement lifestyle without depleting your savings.

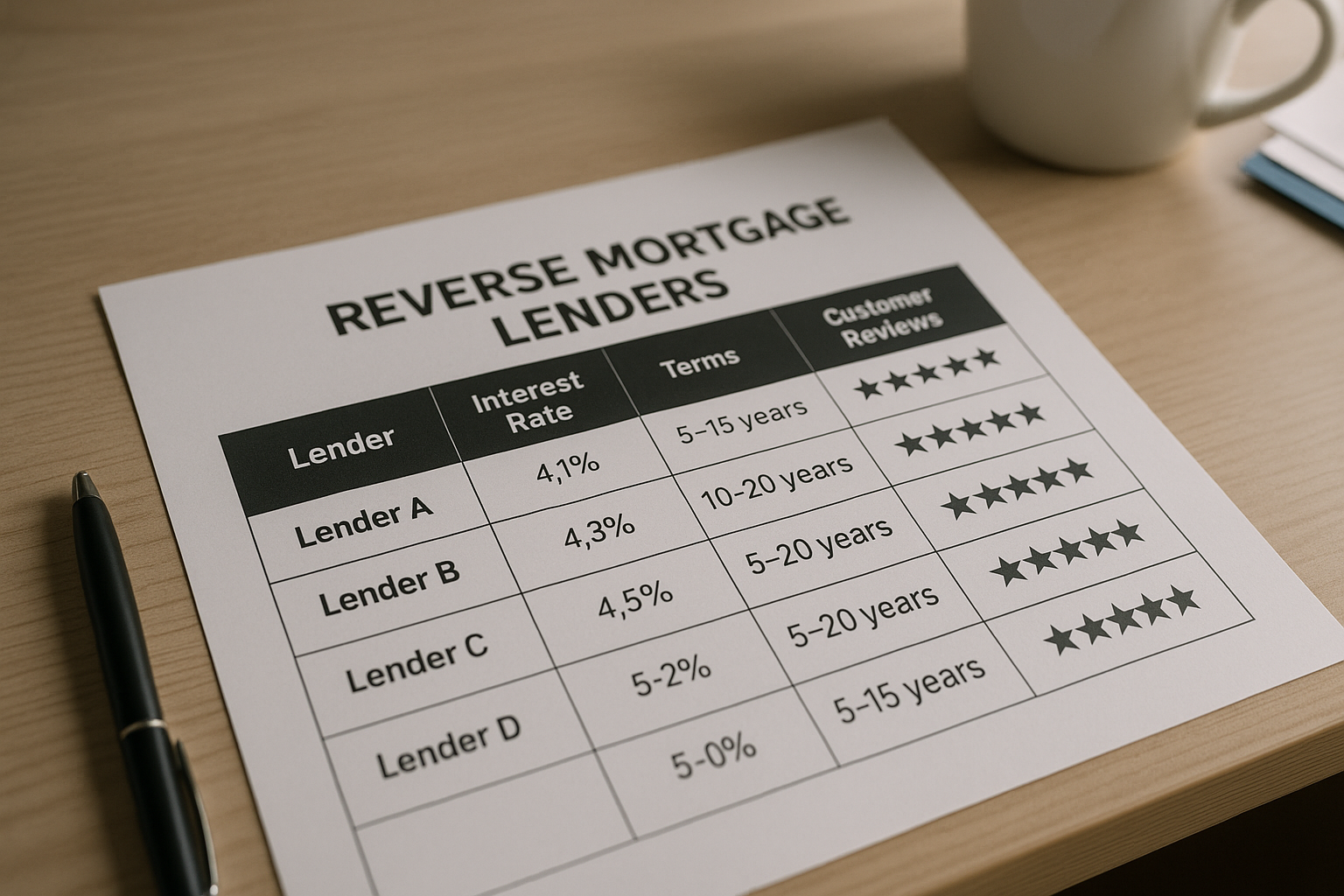

Benefits of Choosing the Right Lender

Finding the ideal lender for your reverse mortgage purchase can significantly impact your financial well-being. A reputable lender will offer competitive interest rates, transparent terms, and excellent customer service, ensuring a smooth and stress-free process. Additionally, the right lender can provide expert guidance, helping you understand the intricacies of reverse mortgages and assisting you in making informed decisions. By choosing wisely, you can maximize your financial flexibility and maintain a comfortable lifestyle in your new home.