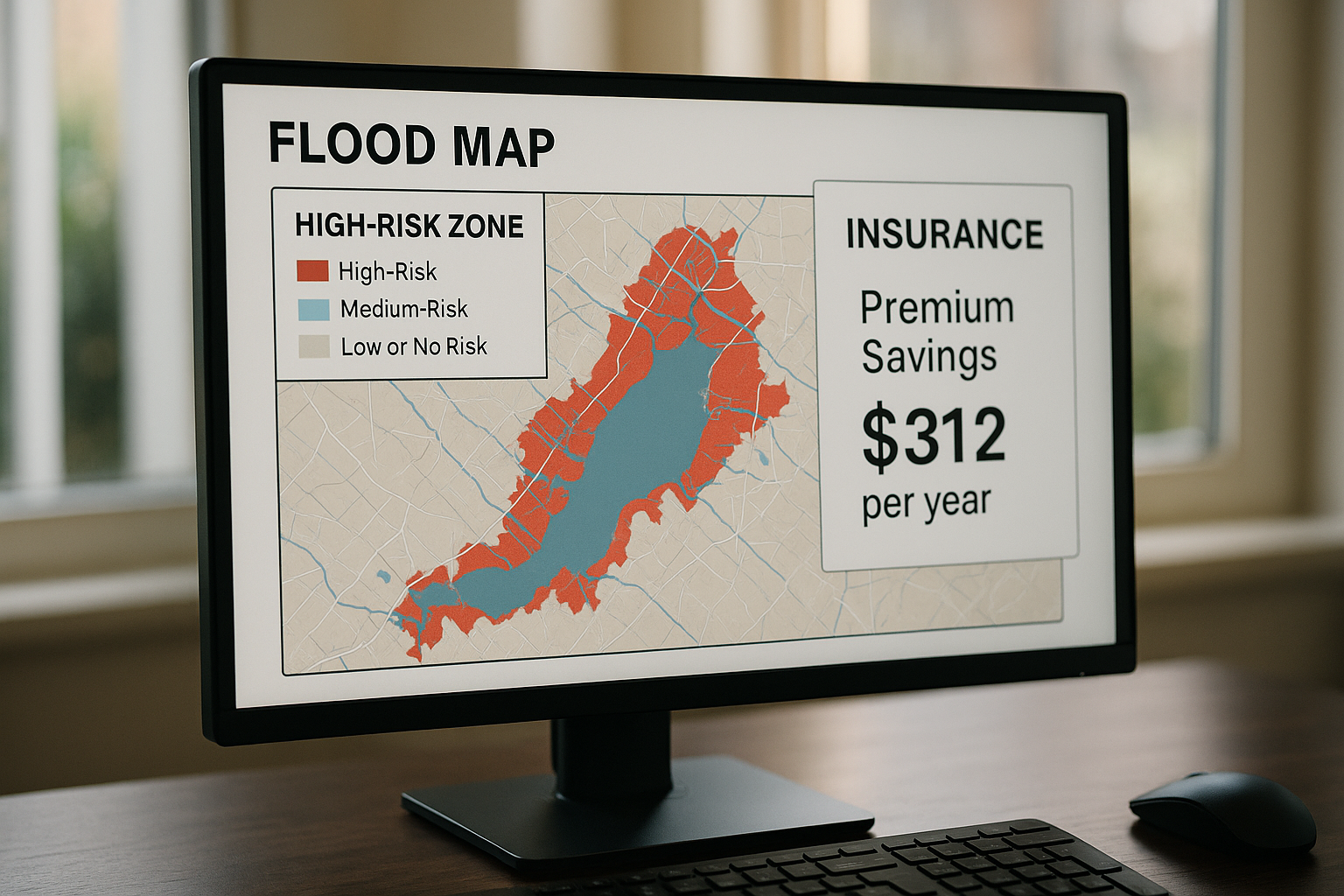

High-risk zones save big with this flood insurance quote

If you're living in a high-risk flood zone, you can save significantly on flood insurance by exploring the many options available online, helping you secure peace of mind while protecting your home and finances.

Understanding the Importance of Flood Insurance in High-Risk Zones

Flooding is one of the most common and costly natural disasters, particularly in high-risk zones where the likelihood of water damage to properties is significantly elevated. For homeowners in these areas, having adequate flood insurance is not just a wise precaution—it's often a necessity. The National Flood Insurance Program (NFIP) reports that just one inch of water can cause up to $25,000 in damage to a home1. This statistic underscores the critical need for homeowners to protect their investment with comprehensive flood insurance coverage.

How Flood Insurance Works

Flood insurance provides coverage for both the structure of your home and your personal belongings. Policies typically cover the cost of repairing or replacing damaged property, up to the policy limits. It's important to note that standard homeowners insurance policies do not cover flood damage, which is why a separate flood insurance policy is essential for those in high-risk areas. The NFIP offers flood insurance policies, but private insurers are also entering the market, providing more options and potentially better rates2.