Home Health Agency Insurance Policies That Save Thousands Instantly

Looking to protect your home health agency while saving thousands? Discover how the right insurance policies can provide you with peace of mind and significant financial benefits, and explore options that could transform your business today.

Understanding Home Health Agency Insurance

Running a home health agency involves numerous responsibilities, not least of which is ensuring you have the right insurance coverage. This is crucial not only for legal compliance but also for protecting your business from potential financial losses. Home health agency insurance typically includes several types of coverage, such as general liability, professional liability, and workers' compensation, each tailored to shield your agency from specific risks.

The Financial Benefits of Comprehensive Coverage

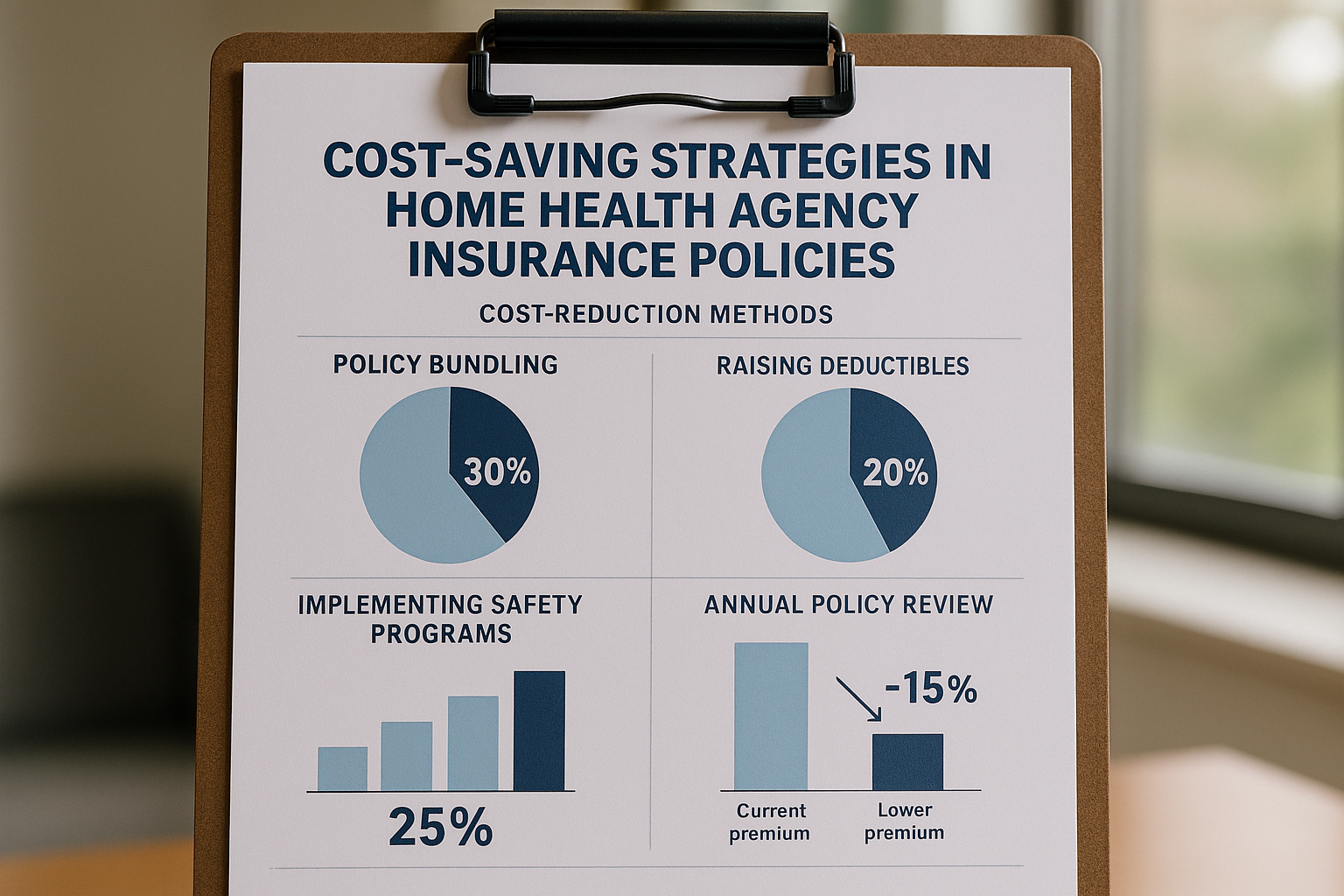

Investing in comprehensive insurance coverage for your home health agency can result in substantial savings over time. By mitigating risks associated with lawsuits, employee injuries, and property damage, you can avoid unexpected expenses that could otherwise drain your resources. Moreover, many insurance providers offer discounts for bundling multiple policies, which can further reduce your costs1.