Master Medicaid Long Term Care Secrets For Success

Unlocking the secrets to mastering Medicaid long-term care can transform how you plan for the future, offering you the chance to browse options, search options, and see these options that could lead to significant savings and peace of mind.

Understanding Medicaid Long-Term Care

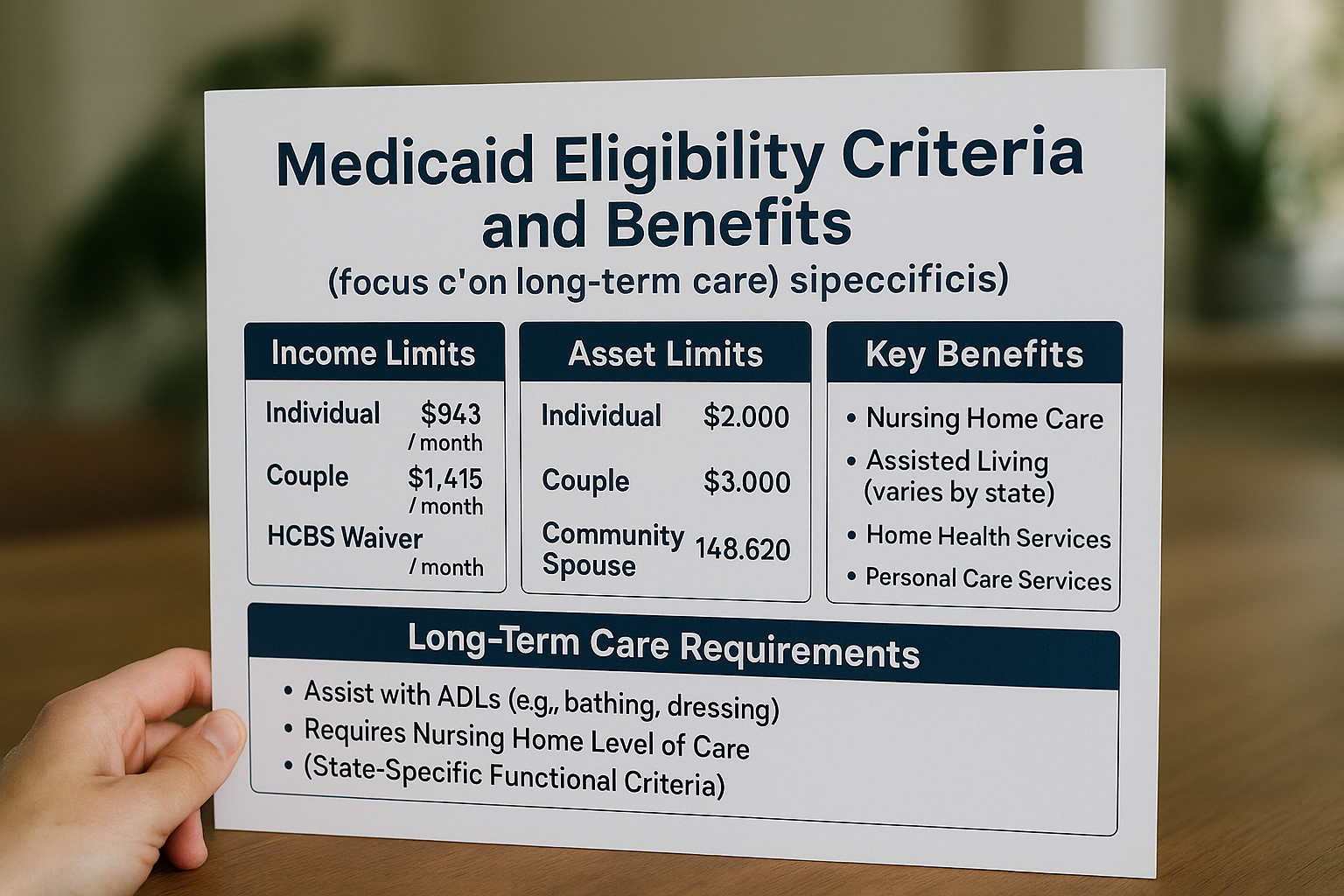

Medicaid long-term care is a critical component for many individuals and families when it comes to managing the costs associated with aging and health-related needs. This government-funded program provides essential financial assistance for those who require long-term care services, which can include nursing home care, assisted living facilities, and in-home care services. By understanding the intricacies of Medicaid, you can better navigate the options available and ensure that you or your loved ones receive the necessary care without financial strain.

Eligibility and Application Process

To qualify for Medicaid long-term care, applicants must meet specific income and asset requirements, which vary by state. Generally, individuals must have limited income and assets, but there are exceptions and planning strategies that can help. For example, some states allow for the "Medicaid spend down" process, where individuals can reduce their income or assets to qualify1. It's crucial to understand these rules and how they apply to your situation, as well as to explore the available resources for guidance.

When applying, it's essential to gather all necessary documentation, including proof of income, assets, and medical needs. The application process can be complex, and consulting with a Medicaid planner or elder law attorney can be beneficial. These professionals can help you navigate the system, ensuring that you meet all requirements and maximize your benefits.