Master Mortgage Rate Lock vs Float Secrets Today

Unlock the secrets of mortgage rate locks and floats today, and discover how strategic timing and informed choices can save you thousands, as you browse options and follow the best strategies for your financial future.

Understanding Mortgage Rate Locks and Floats

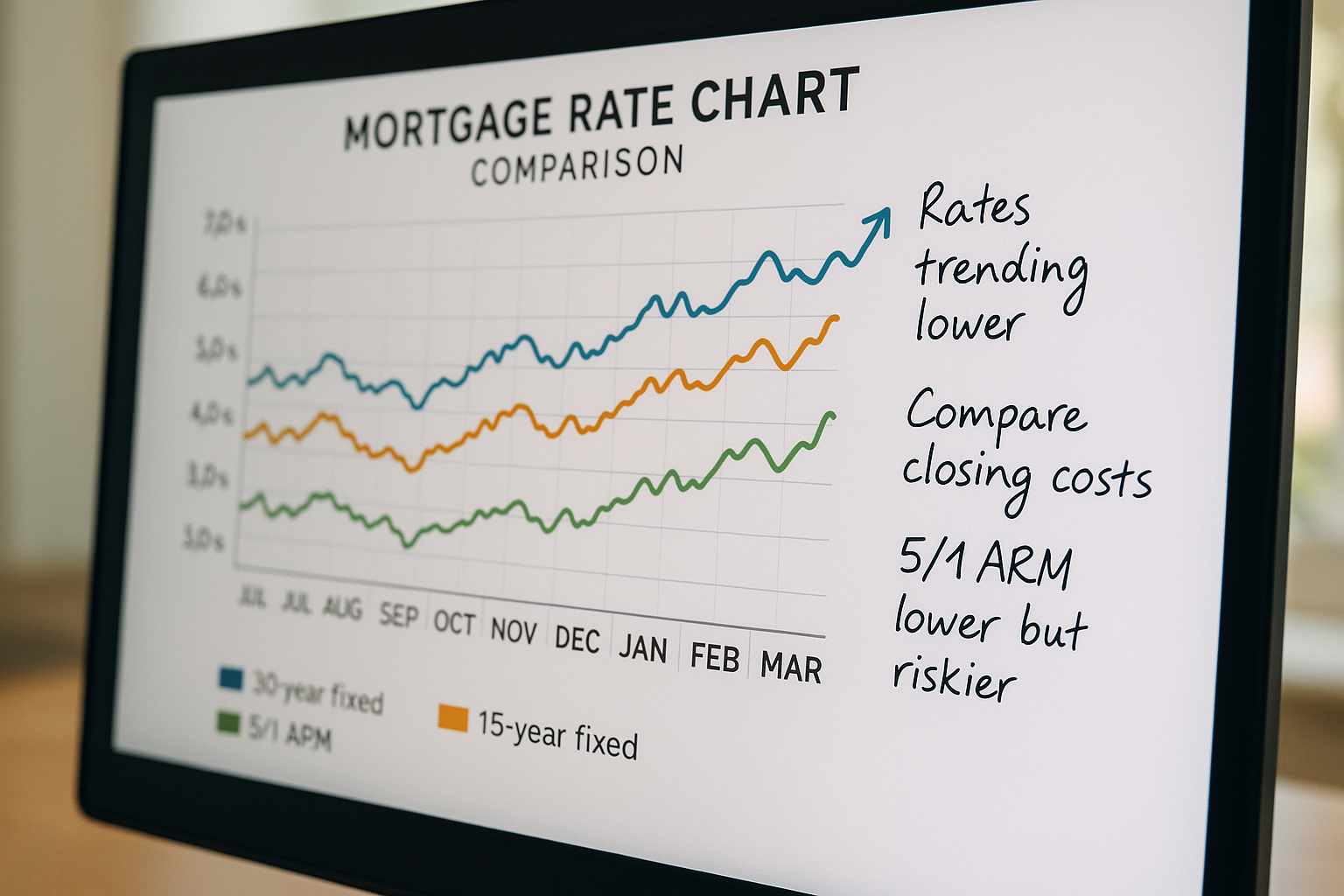

When you're in the market for a mortgage, one of the most critical decisions you'll face is whether to lock in your interest rate or let it float. A rate lock guarantees your interest rate for a set period, typically ranging from 30 to 60 days, protecting you from rate increases during that time. Conversely, a floating rate means your interest rate could change with market fluctuations until your loan closes.

The Benefits of Locking Your Rate

Locking your mortgage rate can provide peace of mind and financial predictability. By securing a rate, you shield yourself from potential rate hikes that could increase your monthly payments. This stability is particularly beneficial in a volatile market where rates are expected to rise. For instance, if you're planning to close on a home in a few months, locking in a low rate today could save you significant amounts over the life of your loan.