Master Real Estate DSCR Secrets Skyrocketing Investment Success

If you're ready to master the secrets of Real Estate Debt Service Coverage Ratio (DSCR) and transform your investment success, now is the time to explore these options and gain valuable insights that can elevate your financial portfolio.

Understanding DSCR in Real Estate Investment

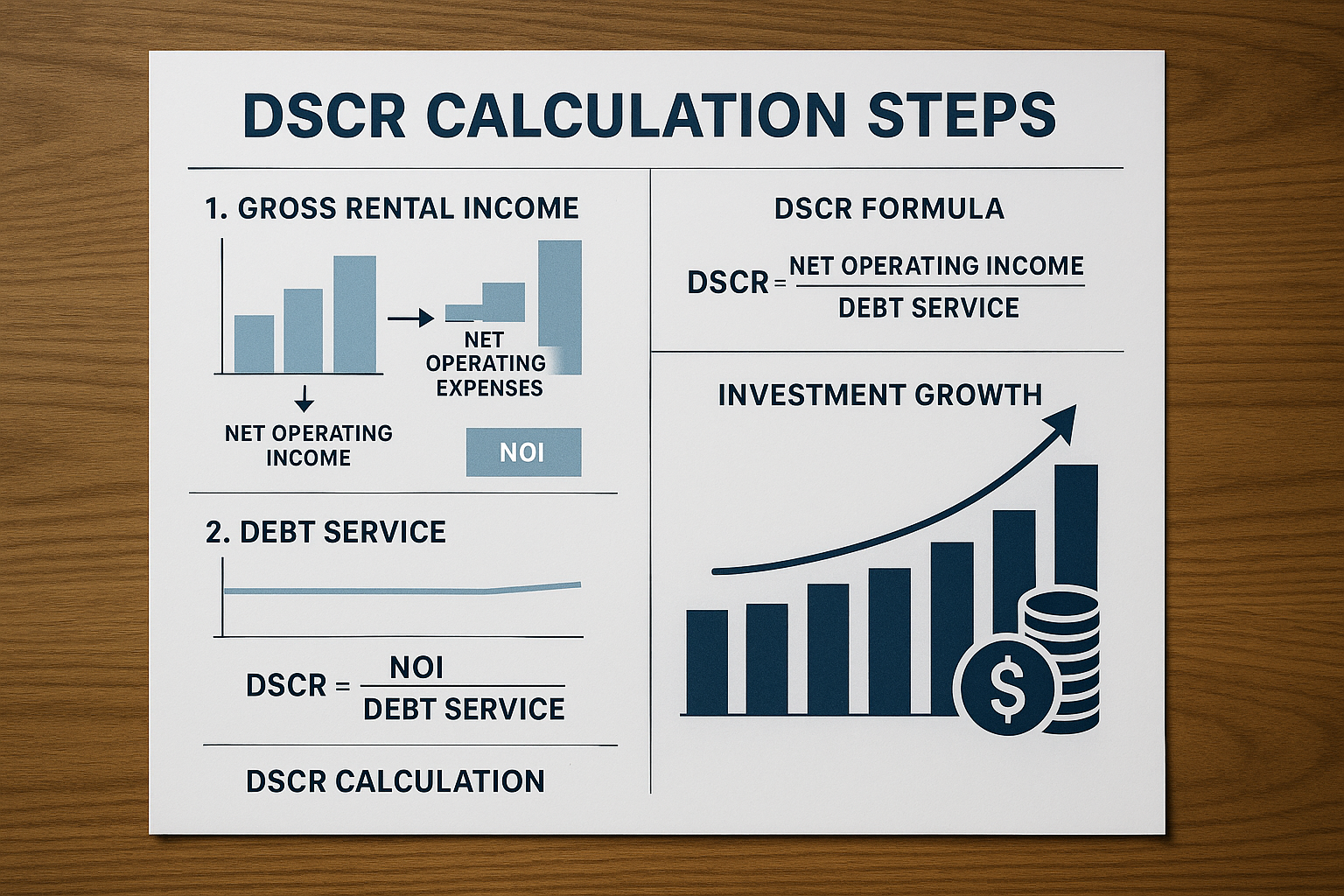

The Debt Service Coverage Ratio (DSCR) is a critical metric used by lenders to assess an investor's ability to service their debt. Essentially, it measures the cash flow available to pay current debt obligations. A DSCR greater than 1 indicates that the property generates sufficient income to cover its debt, while a ratio below 1 suggests potential financial strain. Understanding and optimizing DSCR can significantly enhance your investment strategy, making it a vital tool for both new and seasoned real estate investors.

Why DSCR Matters for Investors

For real estate investors, a strong DSCR can mean the difference between securing financing and missing out on lucrative deals. Lenders often use DSCR to determine loan eligibility and terms, making it an essential factor in investment planning. A high DSCR not only increases your chances of loan approval but can also lead to more favorable interest rates and loan conditions. This means you can potentially maximize your returns while minimizing risks, a crucial consideration in today's competitive real estate market.