Master Strategies Revealed for Hottest SBA Acquisition Financing

Unlock the potential of SBA acquisition financing to expand your business portfolio by exploring strategic options and valuable insights that await you when you browse options and visit websites for more details.

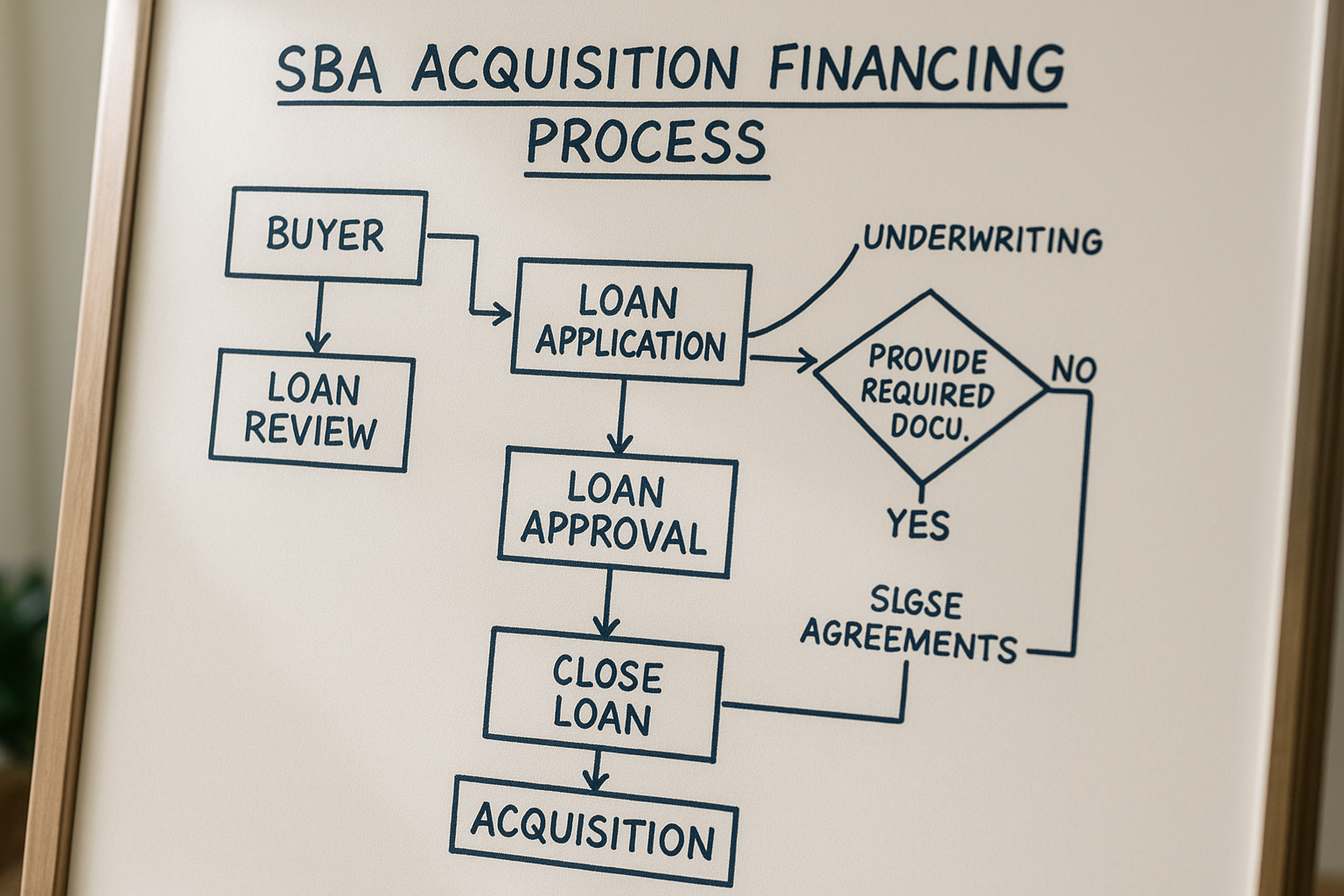

Understanding SBA Acquisition Financing

SBA acquisition financing is a powerful tool for entrepreneurs looking to purchase existing businesses. The Small Business Administration (SBA) offers loan programs that provide favorable terms, lower down payments, and longer repayment periods compared to conventional loans. This makes it an attractive option for those seeking to expand their business holdings without the burden of excessive financial strain.

Types of SBA Loans for Acquisition

The most common SBA loan used for business acquisitions is the SBA 7(a) loan. This versatile loan program allows for a wide range of uses, including purchasing a business, real estate, or equipment. The maximum loan amount is $5 million, and the SBA guarantees up to 85% for loans up to $150,000 and 75% for loans greater than that amount1.

Another option is the SBA 504 loan, which is specifically designed for purchasing fixed assets like real estate and equipment. While not primarily used for business acquisitions, it can be part of a financing package that includes a 7(a) loan for a comprehensive acquisition strategy2.