Master Wealth Secrets with Owner Occupied Commercial Real Estate

Unlock the potential of owner occupied commercial real estate to build wealth and financial security by exploring lucrative opportunities and browsing options that align with your investment goals.

Understanding Owner Occupied Commercial Real Estate

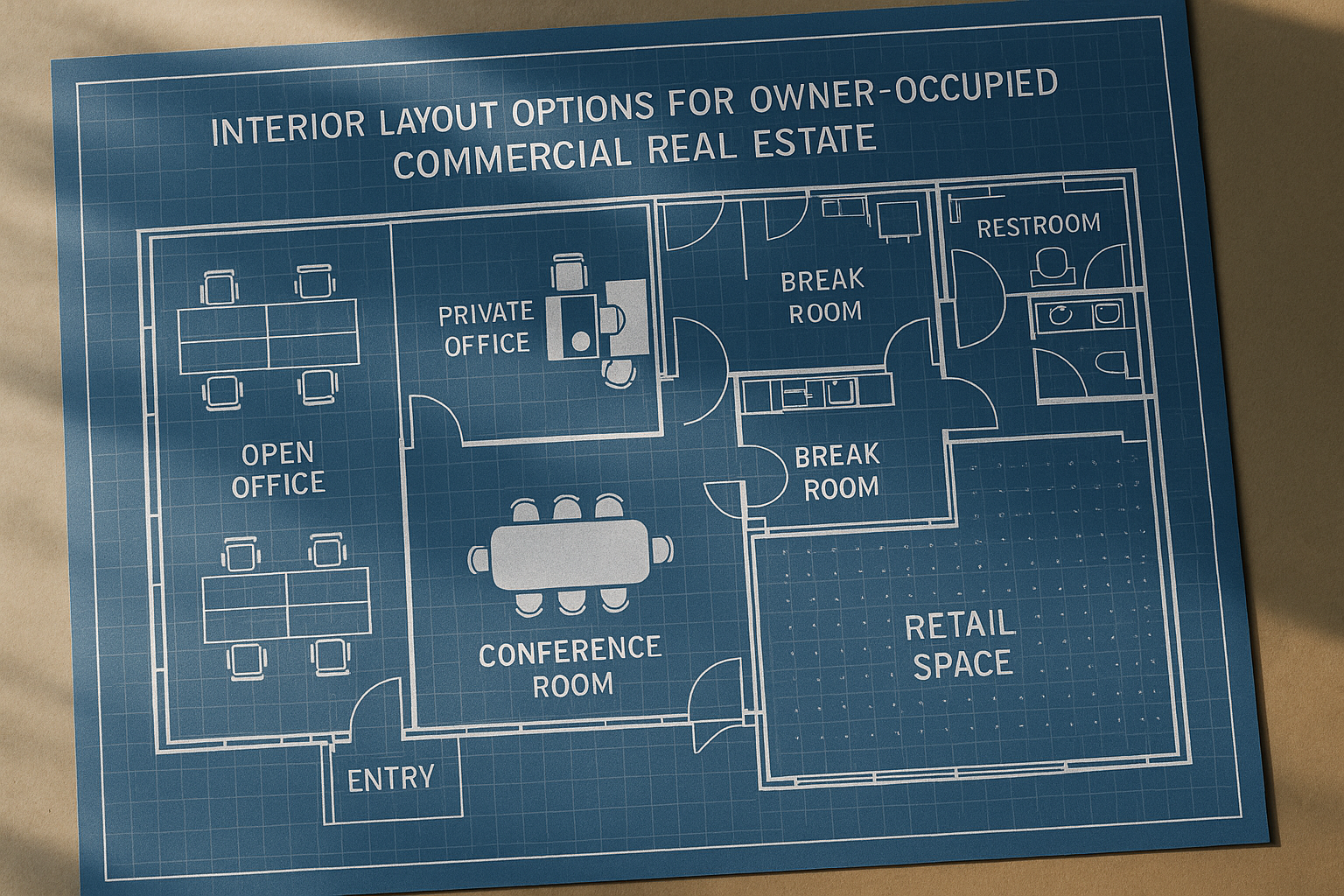

Owner occupied commercial real estate refers to properties where the owner runs their business operations, occupying at least 51% of the space. This form of investment provides dual benefits: a place to conduct business and a tangible asset that appreciates over time. For business owners, investing in owner occupied real estate can lead to significant financial advantages, including stable operating costs and potential tax benefits.

Financial Benefits of Owner Occupied Real Estate

One of the primary advantages of owner occupied commercial real estate is the ability to stabilize operating costs. By owning the property, businesses can avoid unpredictable rent increases and gain control over the space. Additionally, business owners can benefit from tax deductions on mortgage interest and property taxes, which can significantly reduce taxable income1.

Moreover, building equity in a commercial property can be a powerful wealth-building tool. As the property appreciates, the owner can leverage this equity to finance business expansion or other investments. Historically, commercial real estate has shown consistent appreciation, making it a reliable long-term investment2.