Maximize Rental Profits with DSCR Refinance Magic Secrets

Maximize your rental profits by unlocking the secrets of DSCR refinance, where you can browse options to enhance your income potential and explore valuable insights that could transform your real estate investments.

Understanding DSCR Refinance

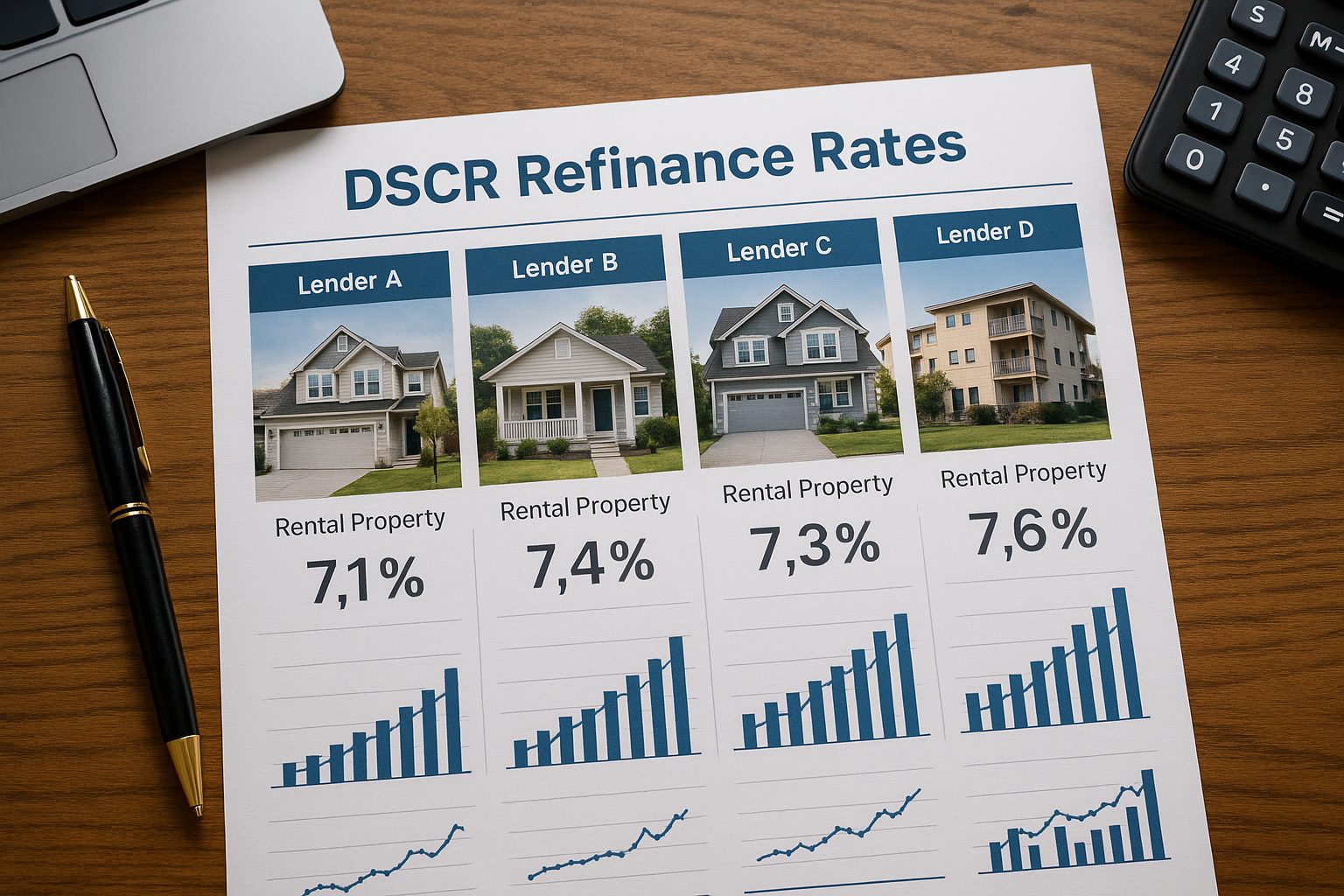

Debt Service Coverage Ratio (DSCR) refinance is a powerful financial tool that can help property owners maximize their rental income by leveraging the equity in their properties. This type of refinancing focuses on the property's income-generating ability rather than the owner's personal income, making it an attractive option for investors with multiple rental properties. By refinancing through a DSCR loan, you can potentially lower your interest rates, reduce monthly payments, and free up cash flow for further investments.

How DSCR Refinance Works

DSCR is a measure used by lenders to determine a property's ability to cover its debt obligations. It is calculated by dividing the property's net operating income (NOI) by its total debt service. A DSCR of 1.25, for example, indicates that the property generates 25% more income than is needed to cover its debt payments. Lenders typically look for a DSCR of at least 1.2 to 1.5 to ensure the property can comfortably service its debt1.

When you refinance a property using a DSCR loan, the focus is on the property's cash flow rather than your personal financial situation. This allows investors with high-performing rental properties to secure favorable loan terms even if their personal credit scores are less than stellar.