Multiple Rental Property Insurance Maximizes Your Profit Effortlessly

If you're looking to maximize your rental income effortlessly, exploring multiple rental property insurance options can provide you with the peace of mind and financial security needed to boost your profits—browse options now to find the best fit for your needs.

Understanding Multiple Rental Property Insurance

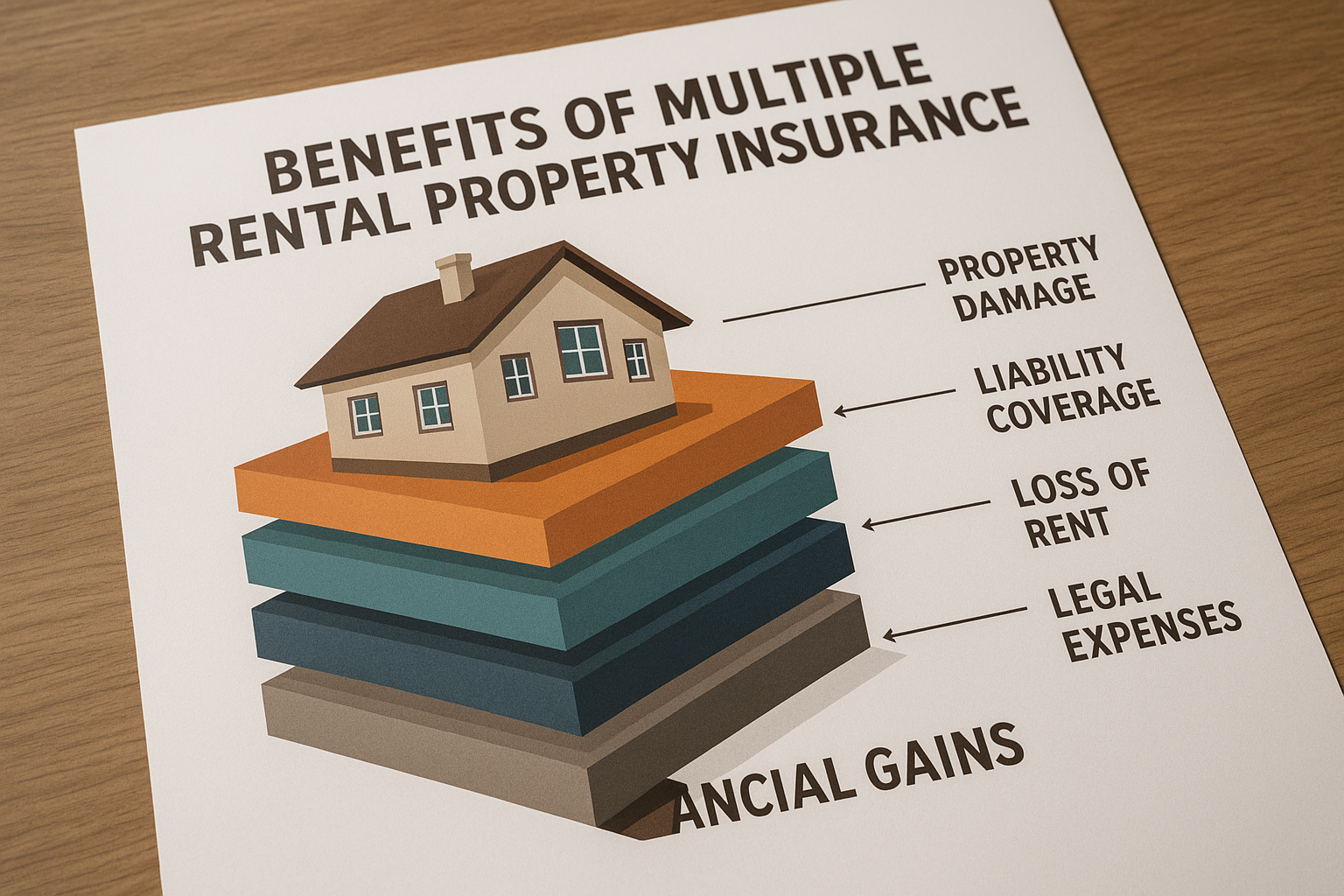

Owning rental properties can be a lucrative investment, but it comes with its own set of risks and responsibilities. Multiple rental property insurance, often referred to as a landlord insurance policy, is designed to protect your investment by covering potential damages to your property, loss of rental income, and liability claims. Unlike standard homeowner’s insurance, landlord policies are tailored specifically for properties that are rented out to tenants, ensuring that you receive coverage for the unique risks associated with rental properties.

Financial Benefits of Multiple Rental Property Insurance

One of the primary benefits of multiple rental property insurance is the potential to maximize your profits by minimizing unexpected expenses. For instance, if a fire or natural disaster damages your property, the insurance can cover repair costs, preventing you from dipping into your savings. Additionally, if your property becomes uninhabitable due to covered damages, the policy can reimburse you for lost rental income1. This financial protection allows you to maintain a steady cash flow, even in the face of unforeseen events.