Prequalify instantly manage property finances effortlessly now

Prequalifying instantly to manage your property finances effortlessly can transform how you handle real estate investments, and by exploring these options, you can discover streamlined solutions that save time and maximize profitability.

Understanding Prequalification in Property Finance

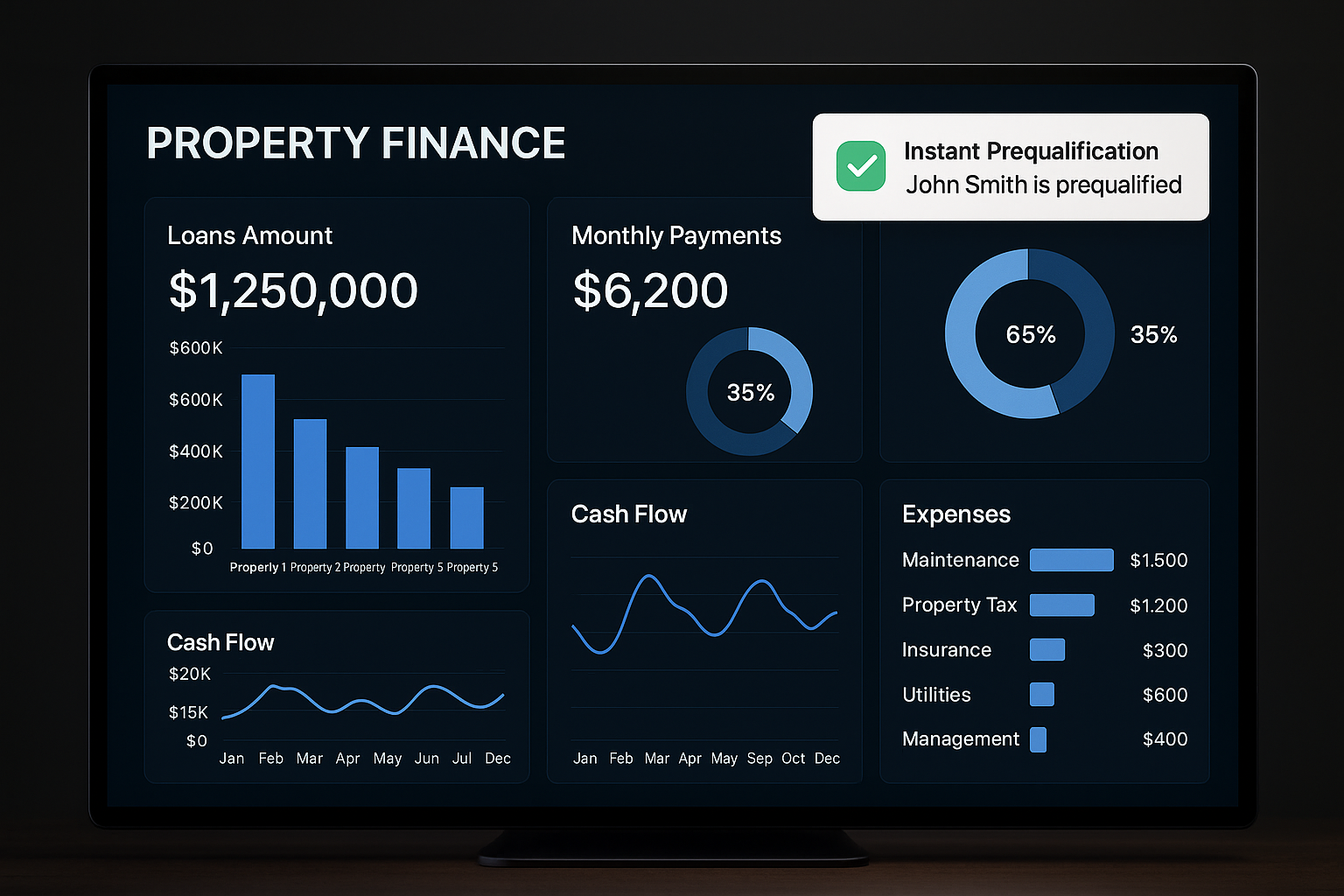

Prequalification is a preliminary step in the property financing process where potential borrowers provide financial information to a lender to estimate how much they can borrow. This step is crucial for property investors and homeowners alike, as it provides a clear picture of purchasing power without impacting credit scores. By prequalifying instantly, you gain a competitive edge in the fast-paced real estate market, allowing you to act swiftly when the right opportunity arises.

The Benefits of Instant Prequalification

Instant prequalification offers numerous advantages. Firstly, it simplifies the financial planning process by giving you a realistic budget. This allows you to narrow your search options and focus on properties within your financial reach. Secondly, it enhances your negotiating power with sellers, as it demonstrates serious intent and financial readiness. Lastly, it can save time by streamlining the mortgage application process, allowing you to secure financing more efficiently1.