Reveal Personal Line of Credit Rates Secretly Saving Us

Unlock the secrets of personal line of credit rates that could be quietly saving you money and explore these options to discover how you can benefit from financial flexibility and potential cost savings.

Understanding Personal Lines of Credit

A personal line of credit is a flexible financial tool that provides you with access to a predetermined amount of money that you can draw from as needed. Unlike traditional loans, you only pay interest on the amount you use, making it a cost-effective option for managing cash flow and unexpected expenses. This flexibility is one of the key reasons why many individuals prefer personal lines of credit over other forms of borrowing.

How Personal Line of Credit Rates Work

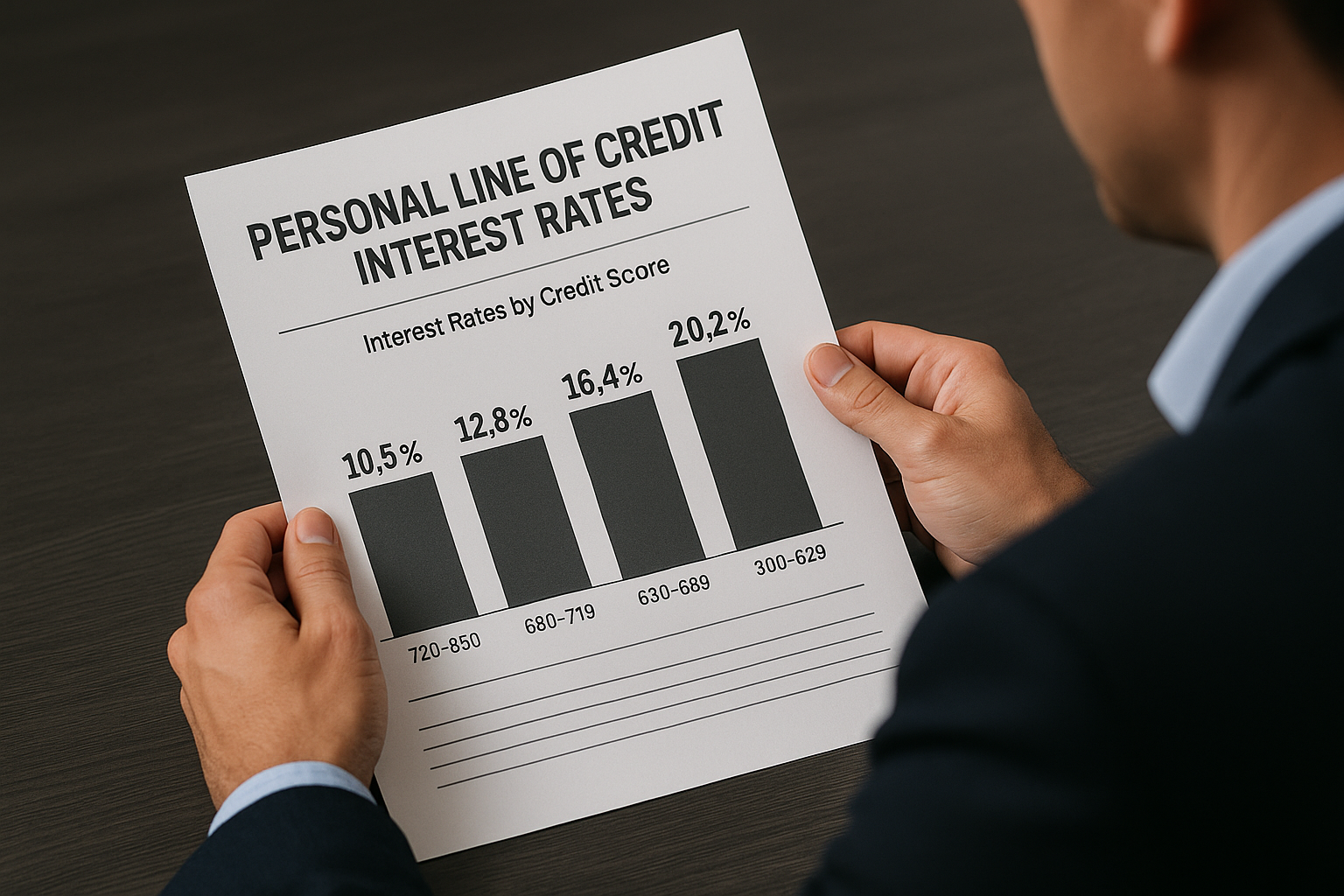

The interest rates on personal lines of credit can vary based on several factors, including your credit score, the lender's terms, and the economic environment. Typically, these rates are variable, meaning they can fluctuate over time. However, they often start lower than credit card rates, providing a more affordable borrowing option. According to recent data, personal line of credit rates can range from 5% to 15%1.