Revealed Latest Office Insurance Costs Saving Fortune

You could be saving a fortune on your office insurance costs by simply taking a moment to browse options and explore the latest industry insights.

Understanding Office Insurance: What It Covers

Office insurance is a crucial component of any business's risk management strategy, safeguarding against potential financial losses due to accidents, theft, or natural disasters. Typically, office insurance covers property damage, liability claims, and sometimes even business interruption. This means if your office equipment is damaged in a fire or a client sues for an injury on your premises, the insurance can help cover those expenses1.

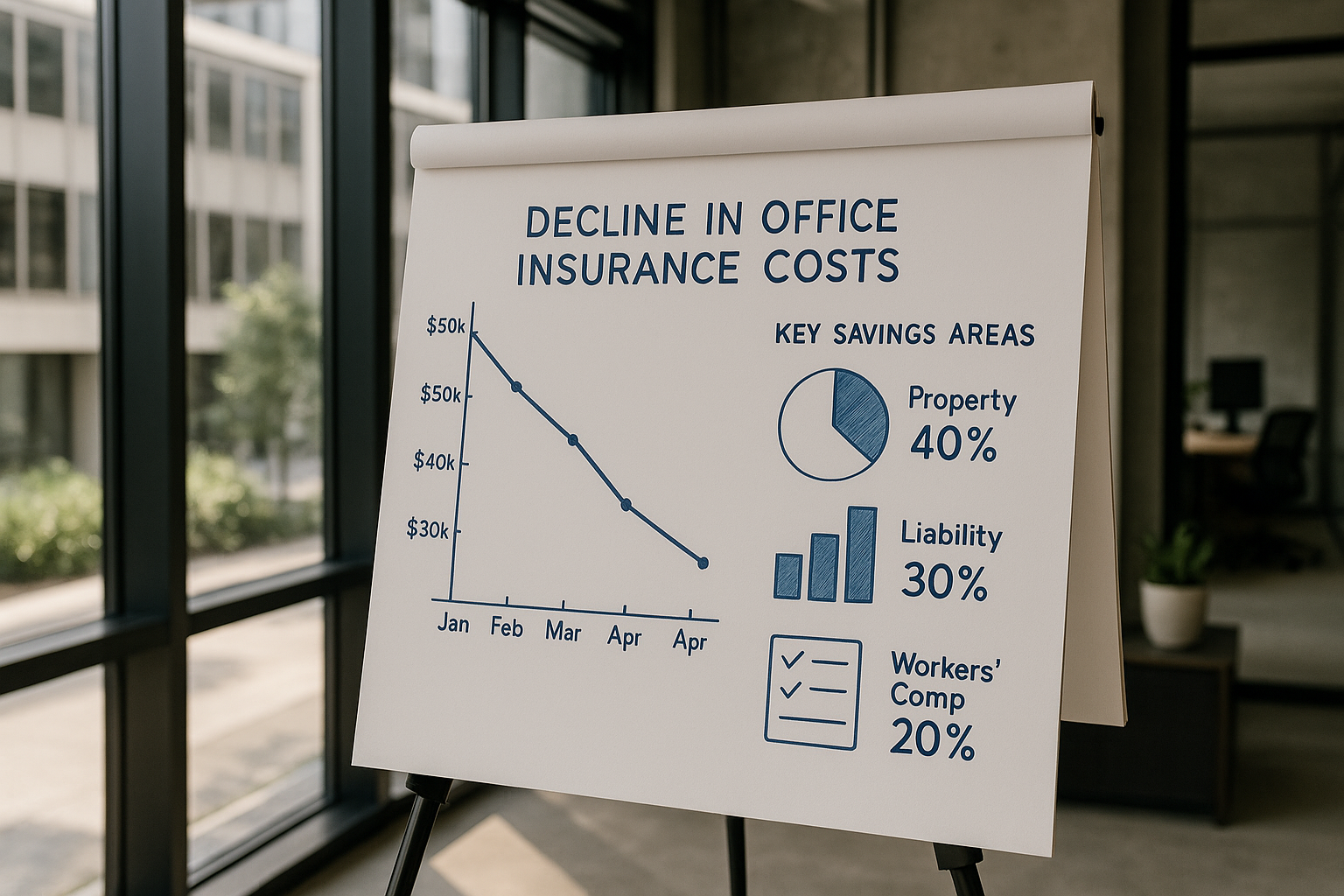

Current Trends in Office Insurance Costs

Recent trends indicate a shift towards more competitive pricing in the office insurance sector. As more providers enter the market, businesses have a broader range of options to choose from, often resulting in lower premiums. According to the National Association of Insurance Commissioners, the average cost of office insurance can vary significantly depending on the size of the business, location, and coverage specifics2.