Revolutionary Way to Slash Real Estate Closing Costs

If you're looking to significantly reduce your real estate closing costs, explore these innovative strategies to keep more money in your pocket while you browse options for your next property investment.

Understanding Real Estate Closing Costs

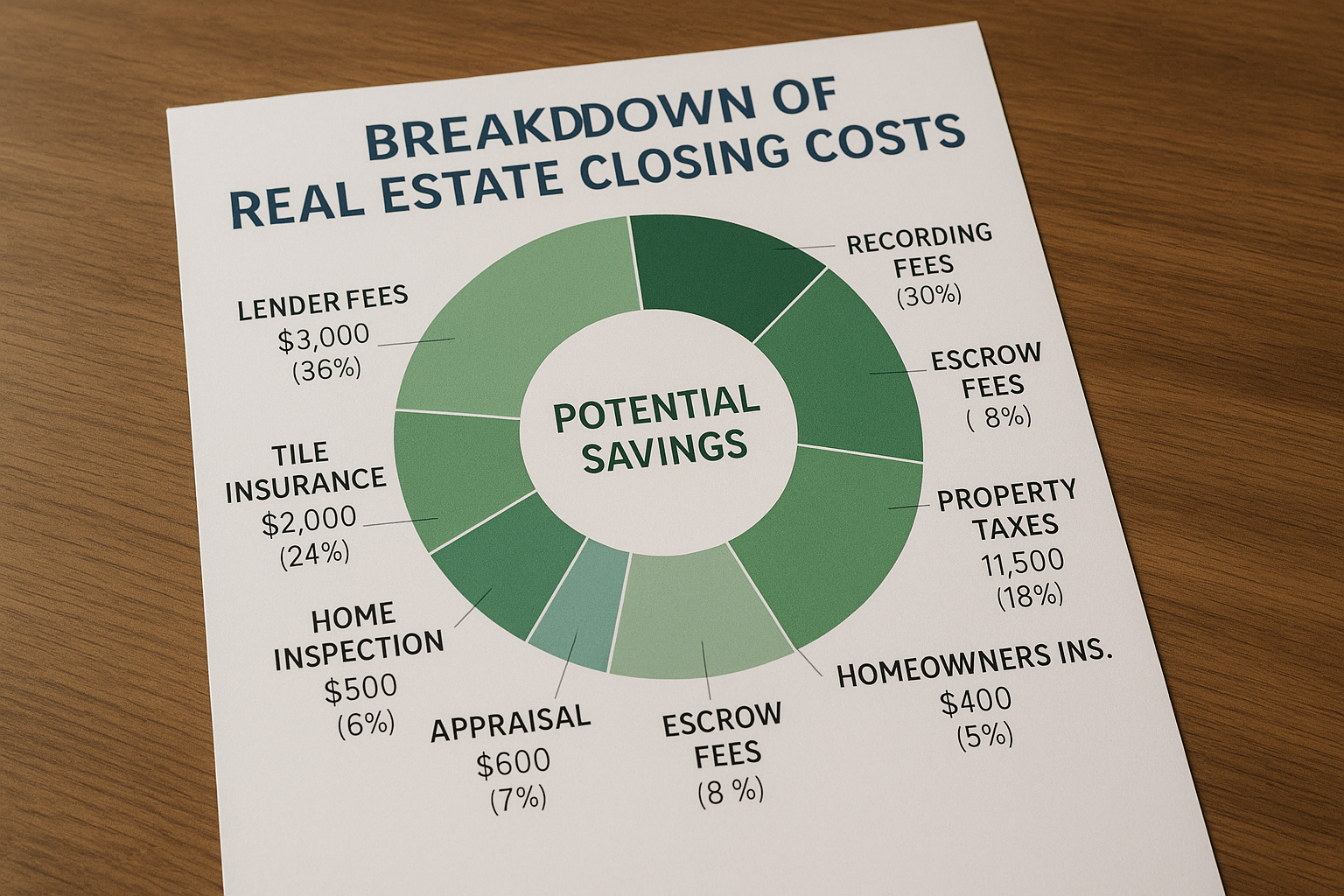

Closing costs are the various fees and charges that buyers and sellers incur during the finalization of a real estate transaction. These costs can include lender fees, title insurance, escrow fees, and taxes, and they typically amount to 2-5% of the property's purchase price1. For many homebuyers, these expenses can be a significant financial burden, making it crucial to explore ways to minimize them.

Negotiate with Your Lender

One of the most effective ways to lower your closing costs is by negotiating with your lender. Many lenders offer discounts or waive certain fees, such as application fees or origination fees, especially if you have a strong credit score or are a repeat customer2. By shopping around and comparing offers, you can find a lender willing to provide you with the best deal. Be sure to inquire about any available promotions or special programs that could further reduce your costs.