Revolutionize Commercial Safety with Parametric Wildfire Insurance Today

Are you ready to safeguard your commercial investments against the unpredictable threat of wildfires? Discover the transformative power of parametric wildfire insurance and browse options to protect your assets today.

Understanding Parametric Wildfire Insurance

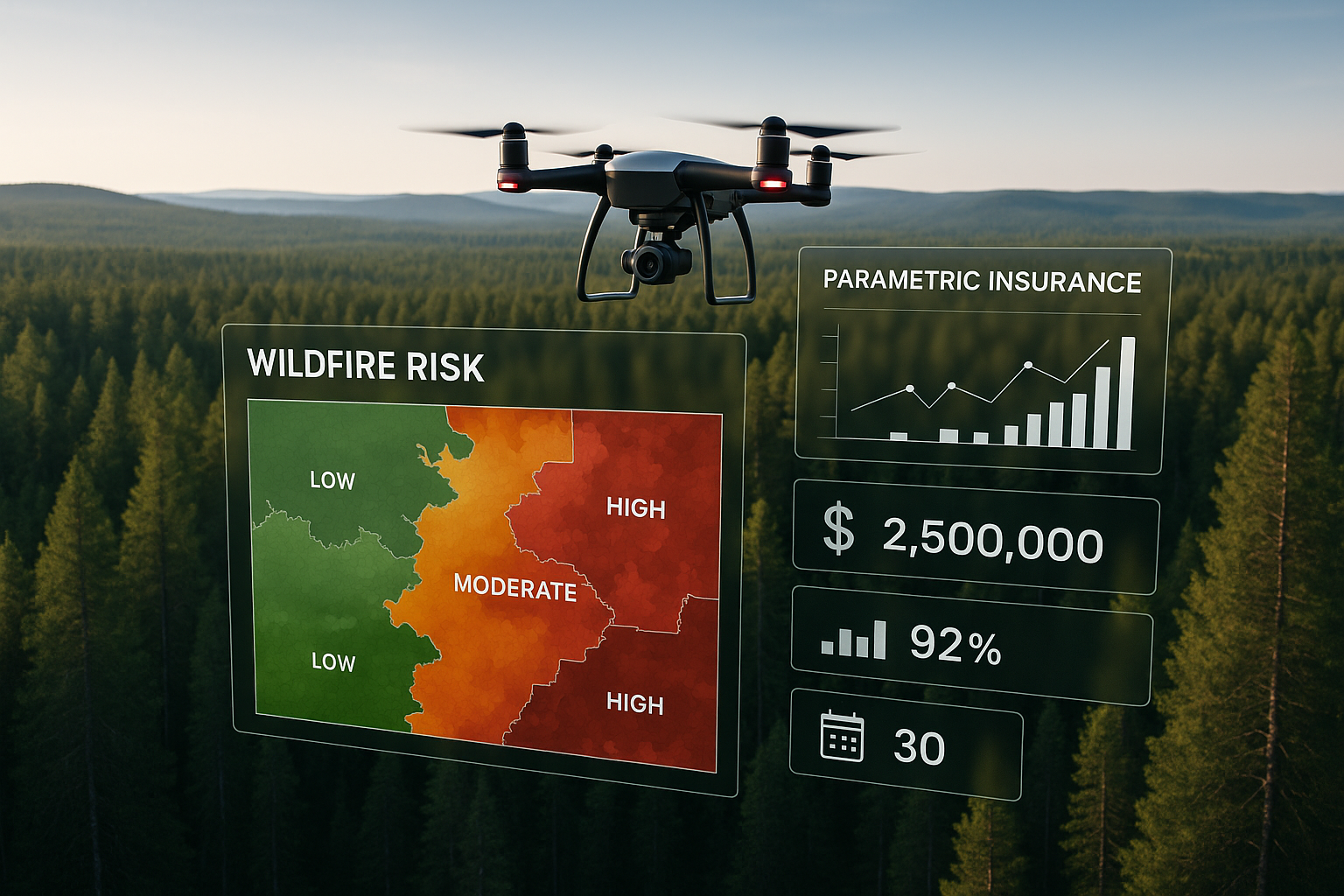

Parametric wildfire insurance represents a groundbreaking approach to managing the financial risks associated with wildfires. Unlike traditional insurance policies that require lengthy claims processes and damage assessments, parametric insurance offers a swift, predetermined payout once specific criteria or "triggers" are met. These triggers are typically based on measurable parameters such as the intensity of a wildfire or its proximity to insured properties1.

How It Works

The primary advantage of parametric insurance lies in its simplicity and speed. Once a trigger event occurs, such as a wildfire reaching a certain intensity level, the insurer automatically disburses the agreed-upon payout to the policyholder. This bypasses the traditional claims process, which can be time-consuming and often fraught with disputes over the extent of damage2.