Revolutionize Your Profits with Livery Service Insurance Secrets

Unlocking the hidden potential of your livery service profits begins with understanding the insurance secrets that can maximize your returns, and by browsing options, you can discover tailored solutions that fit your business needs.

Understanding Livery Service Insurance

Livery service insurance is an essential component for any business that offers transportation services for hire. Whether you operate a taxi, limousine, or rideshare service, having the right insurance coverage not only protects your assets but also enhances your business's credibility. This specialized insurance covers liability, physical damage, and medical expenses, which are crucial for safeguarding against unforeseen incidents. By exploring various insurance options, you can find policies that align with your operational requirements and financial capabilities.

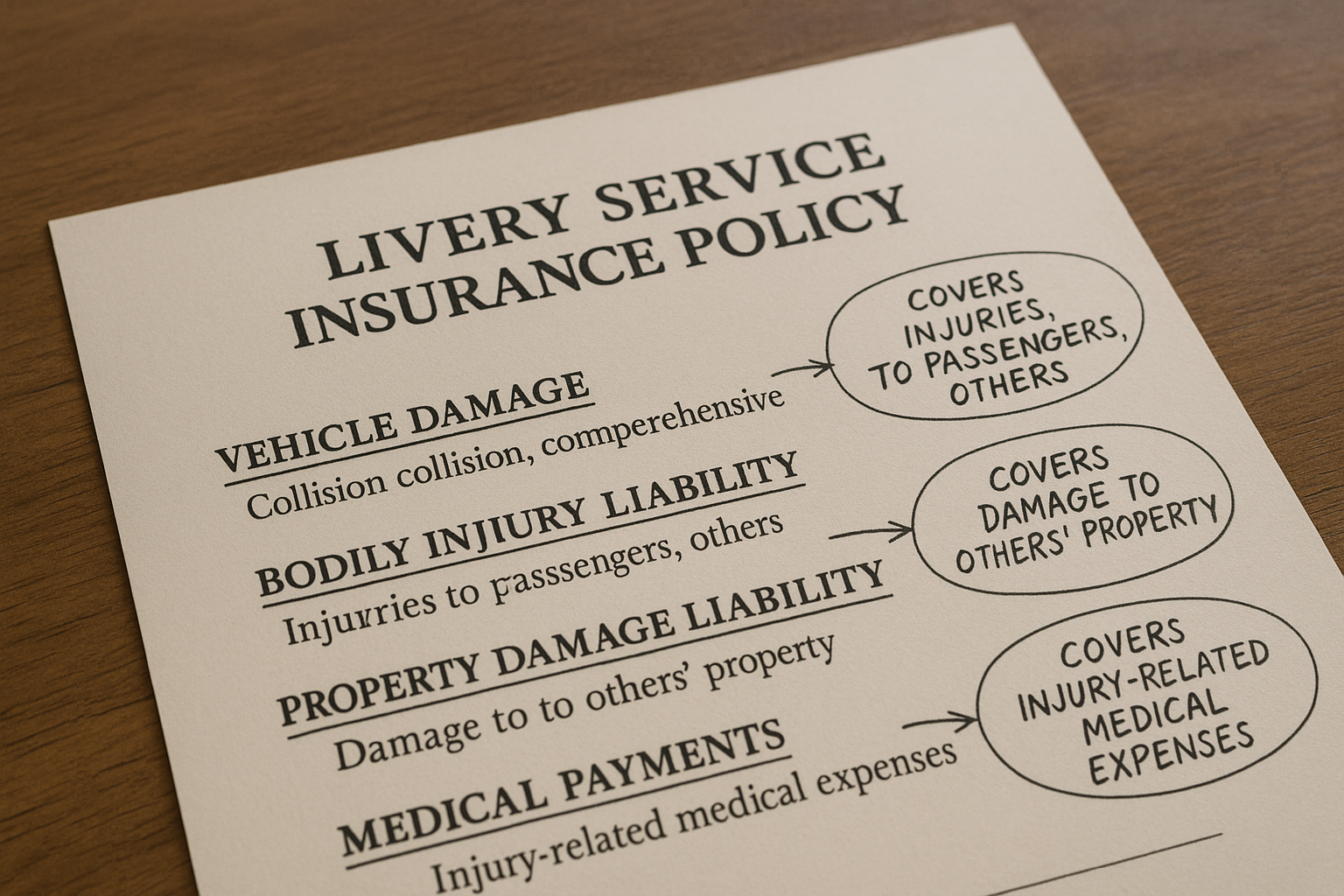

Types of Coverage Available

Livery insurance typically includes several types of coverage. Liability insurance is paramount, covering bodily injury and property damage that might occur during operations. Comprehensive and collision coverage protect against physical damage to your vehicles, whether from accidents or other incidents like theft or vandalism. Additionally, personal injury protection (PIP) or medical payments coverage ensures that medical expenses for drivers and passengers are addressed in the event of an accident. By searching options and comparing policies, you can customize your coverage to fit your specific needs.