Rideshare Driver Insurance Ends Money-Wasting Risks Instantly

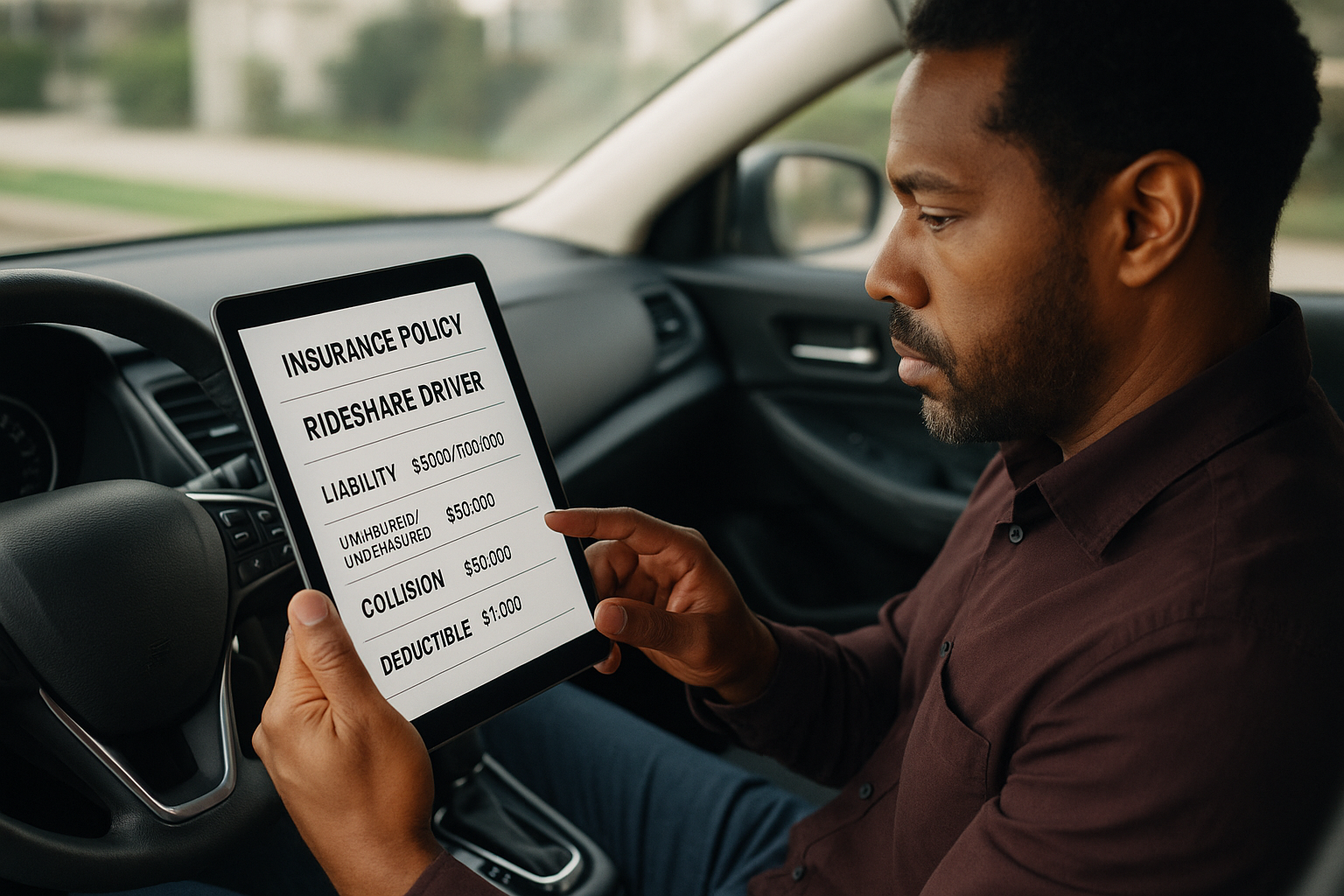

As a rideshare driver, protecting yourself from unforeseen costs is crucial, and by exploring rideshare driver insurance options, you can instantly eliminate money-wasting risks—browse options to secure your financial peace of mind today.

Understanding Rideshare Driver Insurance

Rideshare driving has become a popular way to earn extra income, but it comes with unique challenges, particularly when it comes to insurance. Traditional personal auto insurance policies often do not cover incidents that occur while driving for rideshare services like Uber or Lyft. This gap can leave drivers vulnerable to significant financial loss in the event of an accident. Rideshare driver insurance bridges this gap, ensuring you are covered during all phases of your ride-sharing activities.

The Phases of Rideshare Coverage

Rideshare insurance typically covers three distinct phases:

- Offline: When you are not using the rideshare app, your personal auto insurance applies.

- App On, No Passenger: When you have the app on but have not yet accepted a ride, you have limited coverage. Rideshare insurance fills gaps left by the rideshare company's insurance, which may only offer minimal liability coverage.

- App On, Passenger Onboard: During this phase, rideshare companies usually provide more comprehensive coverage, but rideshare insurance can offer additional protection against deductibles and other out-of-pocket expenses.

By understanding these phases and securing appropriate insurance, you can ensure that you are fully protected at all times while driving.