Safeguard Coastal Homes with Secret Windstorm Insurance Tactics

When it comes to protecting your coastal home from the unpredictable wrath of windstorms, discovering secret insurance tactics can offer you peace of mind and financial security, so why not browse options that could shield your investment today?

Understanding the Importance of Windstorm Insurance

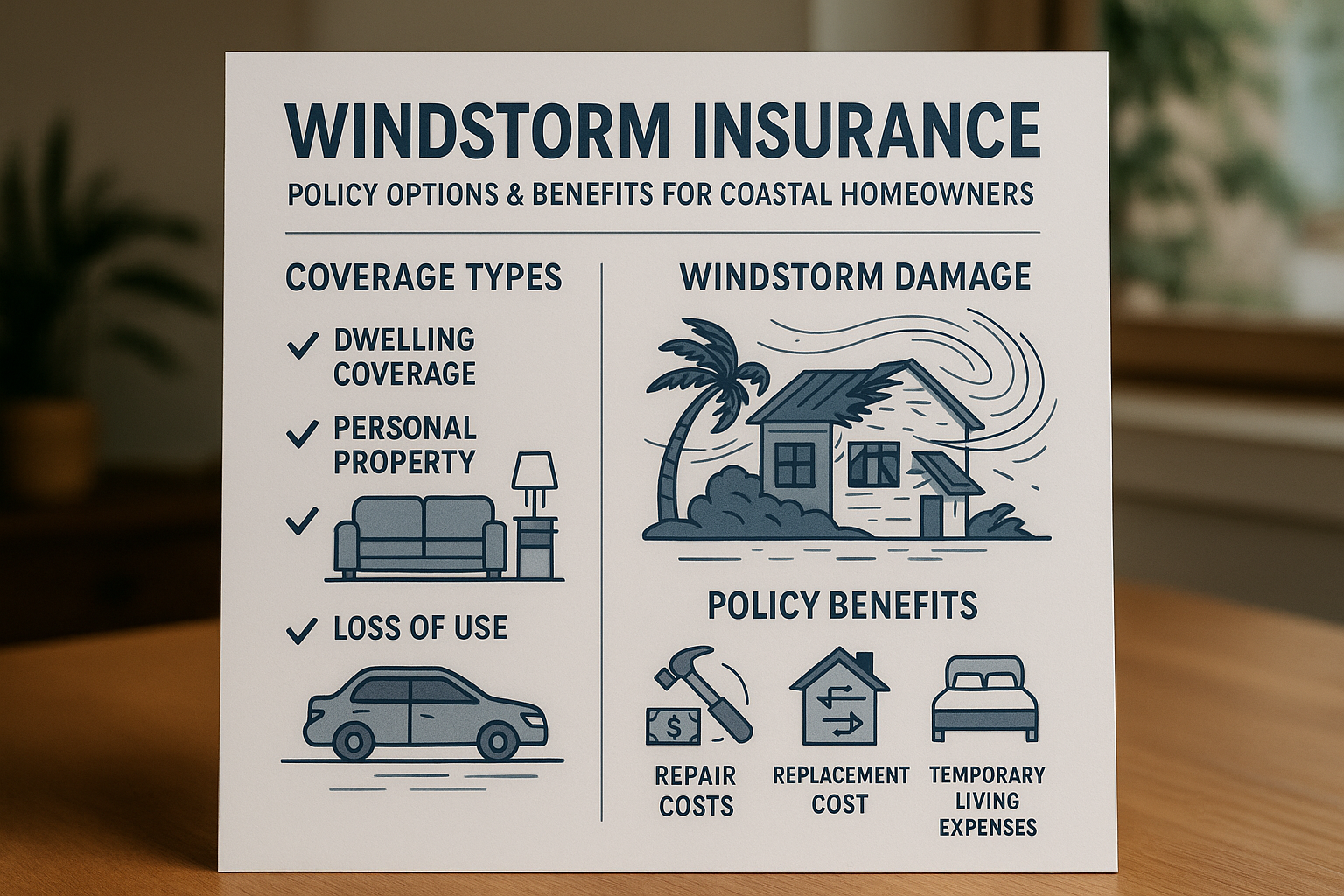

Living in a coastal area comes with its unique set of challenges, especially the threat of windstorms that can cause extensive damage to properties. Windstorm insurance is a critical component for homeowners in these regions, offering a safety net against financial losses caused by high winds, hurricanes, and other related perils. This specialized insurance helps cover the cost of repairs, replacements, and even living expenses if your home becomes uninhabitable due to storm damage.

Exploring Secret Tactics for Better Coverage

While standard homeowner policies might include some wind coverage, they often fall short in areas prone to severe storms. Here are some lesser-known tactics to enhance your windstorm insurance:

- Separate Windstorm Policy: In high-risk areas, insurers may exclude wind damage from standard policies. Purchasing a standalone windstorm policy ensures comprehensive coverage tailored to your needs1.

- Mitigation Discounts: Implementing home improvements, such as storm shutters or reinforced roofing, can not only protect your home but also qualify you for discounts on premiums2.

- State-Backed Insurance Pools: Some states offer insurance pools for residents who struggle to find coverage in the private market. These programs can provide essential coverage at competitive rates3.