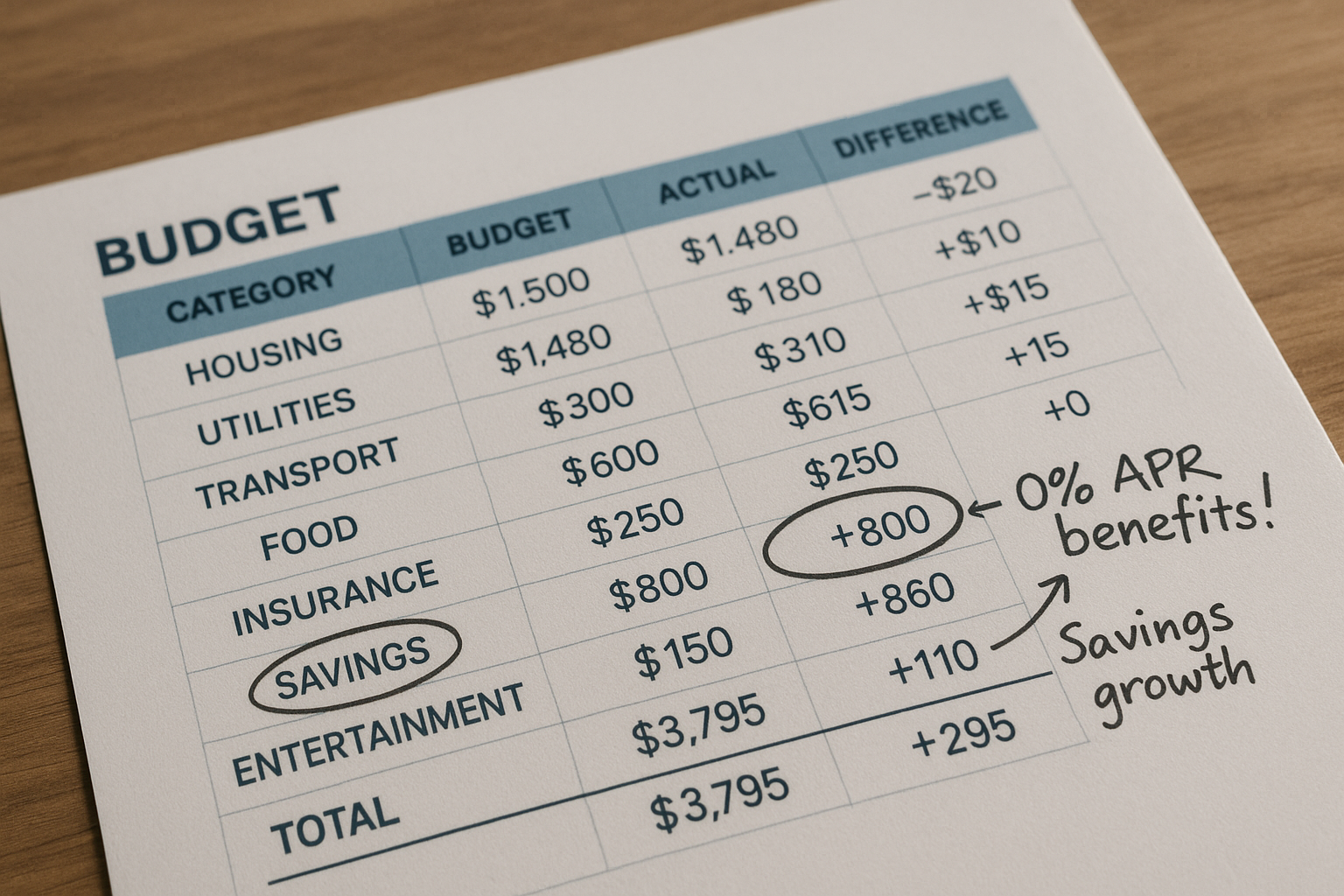

Secret Hack to Maximize 0 Percent APR Savings

Unlock the secret to maximizing your 0 percent APR savings and seize the opportunity to browse options that could transform your financial strategy into a powerhouse of interest-free growth.

Understanding 0 Percent APR Offers

Zero percent APR (Annual Percentage Rate) offers can be a financial game-changer, allowing you to make significant purchases or consolidate debt without the burden of interest for a specified period. These offers are commonly found in credit card promotions, auto loans, and even some personal loans. The allure of 0 percent APR lies in the potential to save money on interest payments, but to truly benefit, it's crucial to understand the terms and conditions that accompany these deals.

The Mechanics of 0 Percent APR

When a financial institution offers a 0 percent APR, they essentially allow you to borrow money without paying interest for a promotional period, which typically ranges from 6 to 24 months. During this time, every dollar you pay goes directly towards the principal, allowing you to reduce your debt more quickly. However, it's important to note that these offers often come with specific requirements, such as making minimum monthly payments and avoiding late fees to maintain the interest-free status1.