Secrets Bankruptcy Attorney Chapter 13 Payment Plan Reveals

If you're navigating the complexities of Chapter 13 bankruptcy, discovering the secrets of a well-crafted payment plan can be your key to financial stability, and as you browse options, you'll find valuable insights that can transform your economic future.

Understanding Chapter 13 Bankruptcy

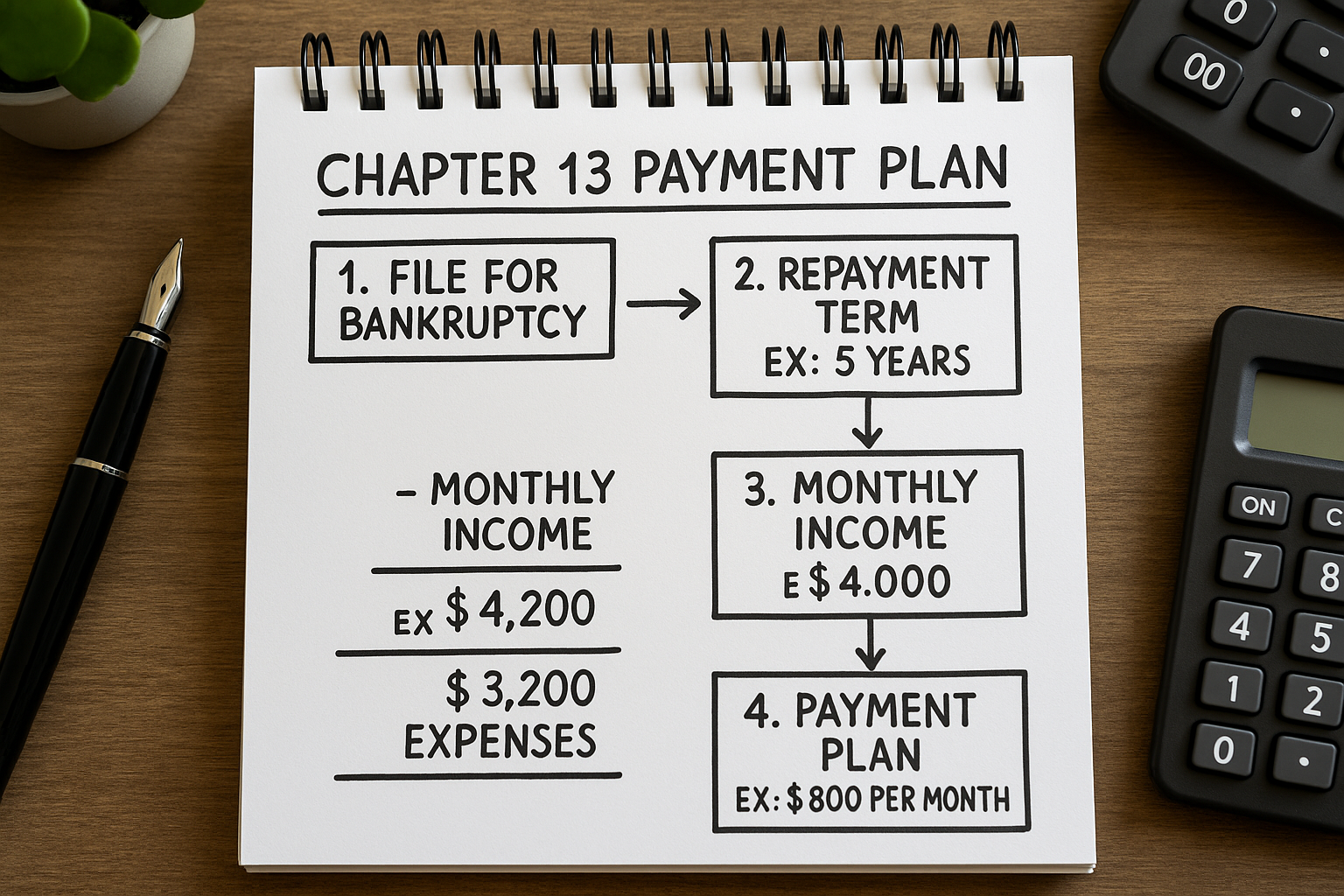

Chapter 13 bankruptcy, often referred to as a wage earner's plan, allows individuals with a regular income to develop a plan to repay all or part of their debts. Unlike Chapter 7, which involves liquidating assets to discharge debts, Chapter 13 focuses on restructuring your financial obligations into manageable payments over a three to five-year period. This approach can be particularly beneficial for those who wish to retain their property, such as a home or car, while catching up on missed payments over time.

The Role of a Bankruptcy Attorney

A bankruptcy attorney plays a critical role in guiding you through the Chapter 13 process. They help assess your financial situation, determine eligibility, and craft a feasible payment plan. Attorneys are adept at negotiating with creditors to reduce the total amount owed and can provide invaluable advice on maximizing exemptions to protect assets. By leveraging their expertise, you can ensure that your plan is both compliant with legal requirements and tailored to your specific financial circumstances.