Secrets Behind Crazy Low Truck Refinance Rates Unveiled

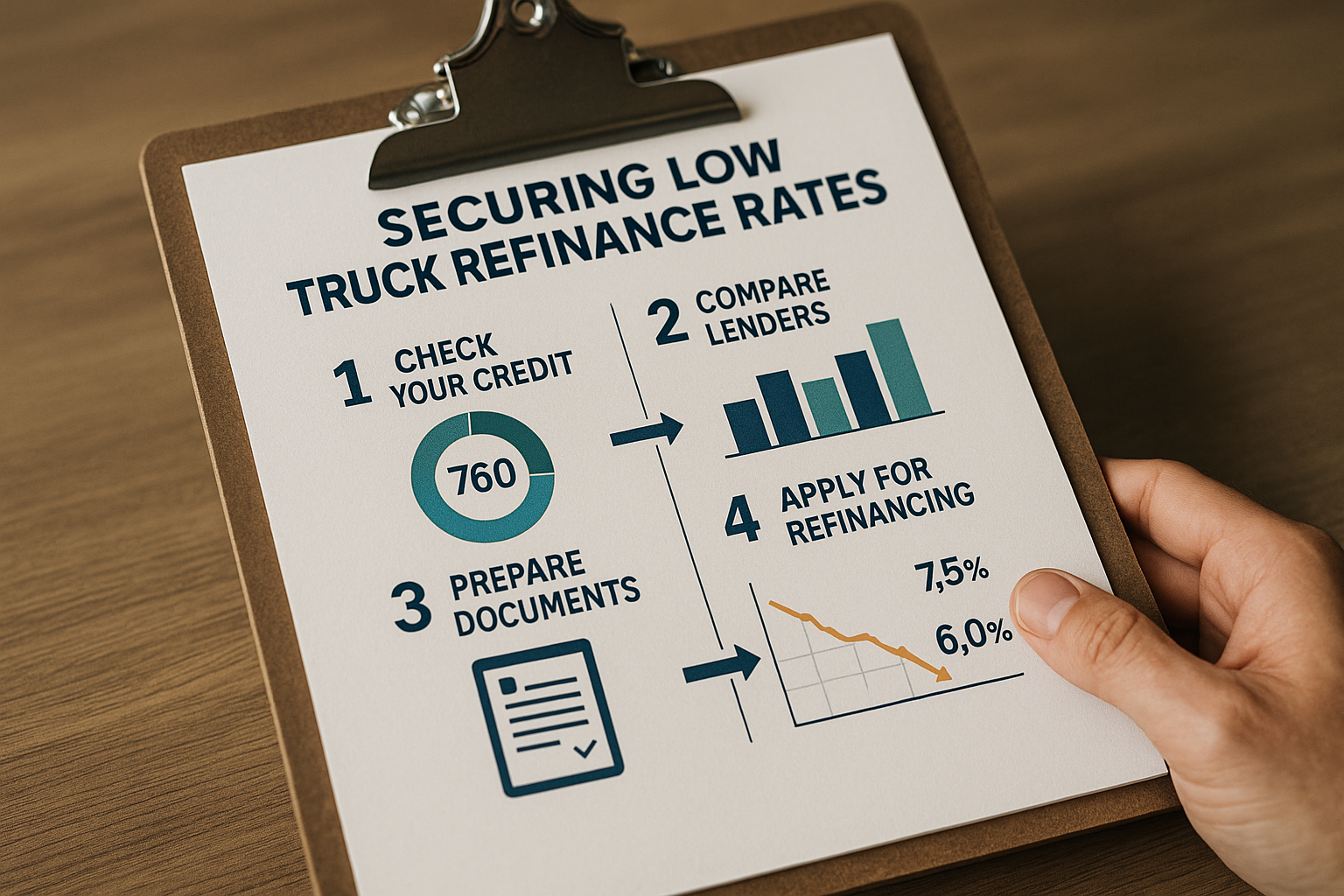

Unlocking the secrets behind crazy low truck refinance rates can empower you to save significantly on your monthly payments while optimizing your business cash flow, so why not browse options and see these opportunities for yourself?

Understanding Truck Refinance Rates

Refinancing your truck loan can be a strategic move to reduce your financial burden and improve your bottom line. The allure of low refinance rates is particularly appealing for businesses and individual truck owners looking to cut costs. But what exactly drives these rates down, and how can you take advantage of them?

Factors Influencing Low Refinance Rates

Truck refinance rates are influenced by a variety of factors, including market conditions, your credit score, and the overall loan amount. During periods of economic stability, lenders are often more willing to offer competitive rates to attract borrowers. Additionally, a strong credit score can position you as a low-risk borrower, enabling you to negotiate better terms. For those with less-than-perfect credit, there are still options available, as some lenders specialize in working with a wider range of credit profiles.