Secure Financial Stability Self-Employed Disability Insurance Secret

If you're self-employed, securing your financial stability with the right disability insurance can be a game-changer, and by exploring options now, you can protect your income and gain peace of mind.

Understanding Self-Employed Disability Insurance

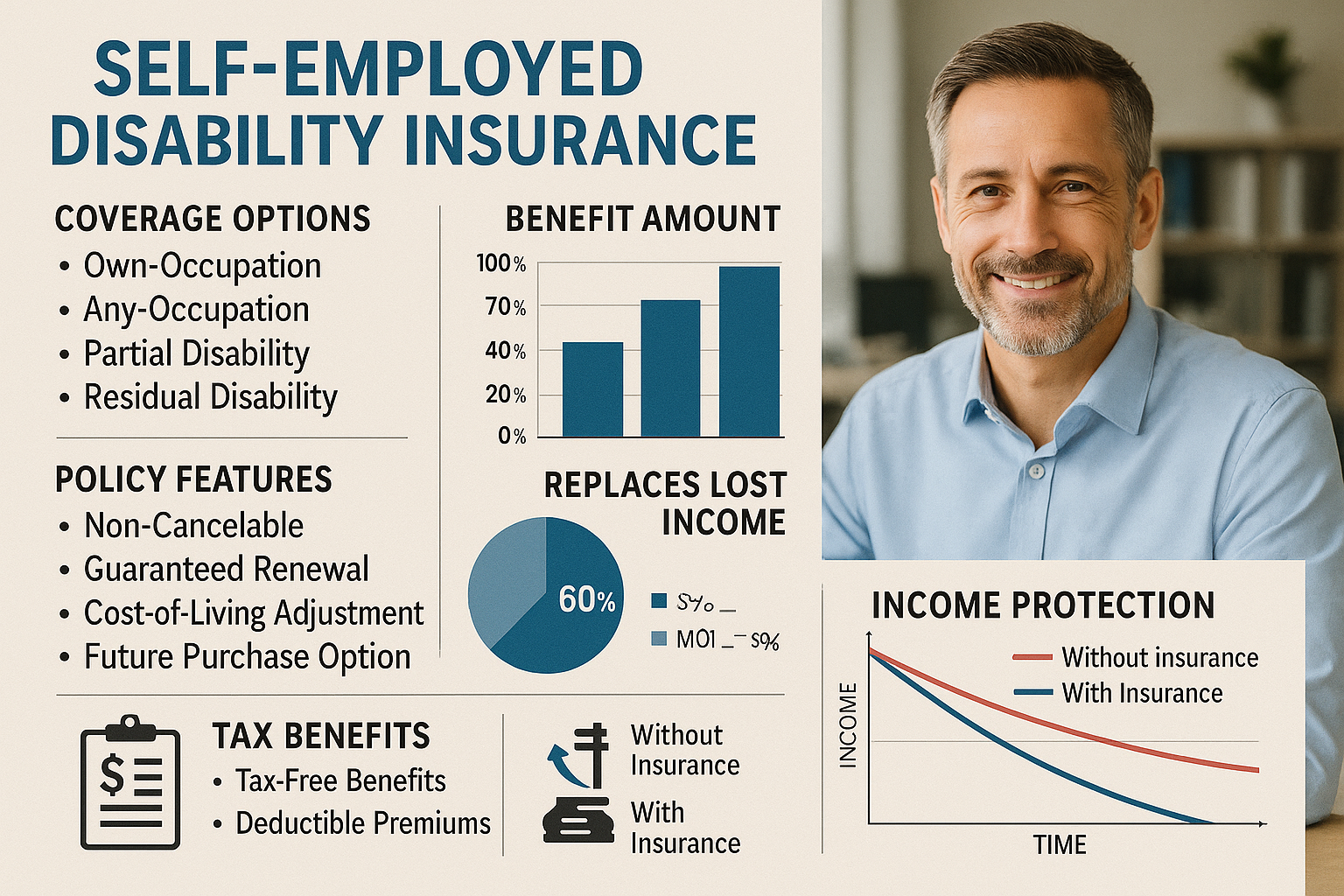

Self-employed individuals often enjoy the freedom and flexibility that come with running their own business, but this independence also brings unique financial risks. One of the most significant is the potential loss of income due to a disability. Disability insurance for the self-employed is designed to provide a safety net, ensuring you can maintain your lifestyle even if you're unable to work due to illness or injury.

Why Disability Insurance is Crucial for the Self-Employed

Unlike traditional employees, self-employed individuals typically do not have access to employer-sponsored disability insurance. This lack of coverage means that if you become disabled, your income could quickly dwindle, jeopardizing your financial security. Disability insurance offers a vital solution by replacing a portion of your income, allowing you to focus on recovery without the added stress of financial instability.