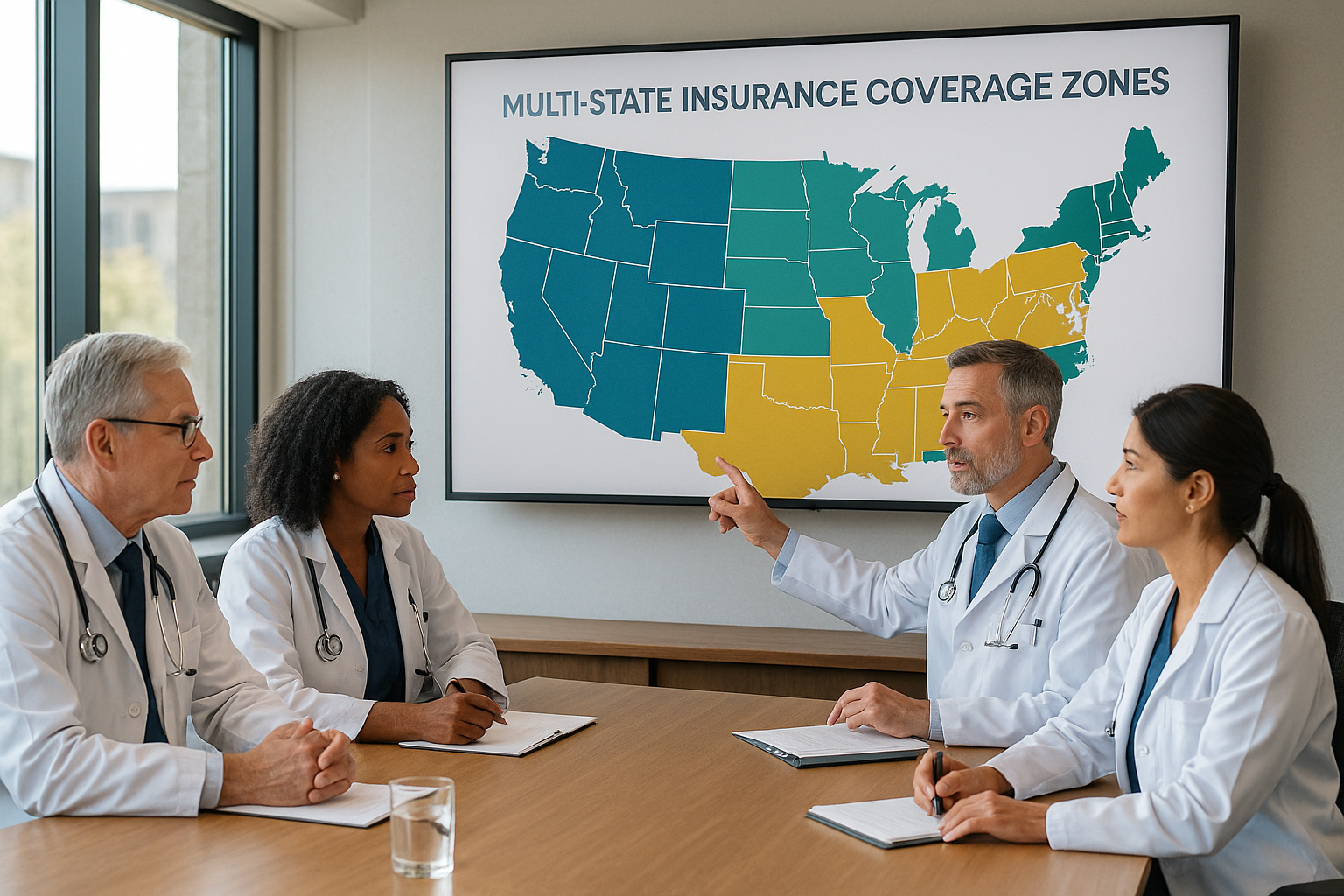

Secure Multi-State Coverage Simplifying Medical Practice Risks

As a medical practitioner aiming to mitigate risks while expanding your practice across multiple states, securing comprehensive multi-state coverage can be your game-changer, and by browsing the options available, you can find the perfect fit for your needs.

Understanding Multi-State Coverage

Multi-state coverage is essential for medical practices that operate in more than one state, as it provides a unified insurance solution that addresses the varying legal and regulatory requirements across state lines. This type of coverage simplifies the complexities of managing different policies for each state, ensuring that your practice remains compliant and protected against potential risks. By consolidating your insurance needs, you not only save time but also reduce administrative burdens, allowing you to focus more on patient care.

Benefits of Multi-State Coverage

One of the primary benefits of multi-state coverage is the streamlined risk management it offers. Instead of juggling multiple insurance policies, you have a single point of contact that understands the nuances of each state's regulations. This can lead to significant cost savings, as insurers may offer discounts for bundled coverage. Additionally, the comprehensive nature of this coverage means that you are protected against a wide range of risks, from malpractice claims to property damage, ensuring peace of mind as you expand your practice.