Self Funded Plans' Secret Stop Loss Insurance Wins

If you're looking to unlock the hidden advantages of self-funded plans with stop-loss insurance, now is the time to browse options and discover how these strategies can transform your approach to healthcare benefits.

Understanding Self-Funded Plans

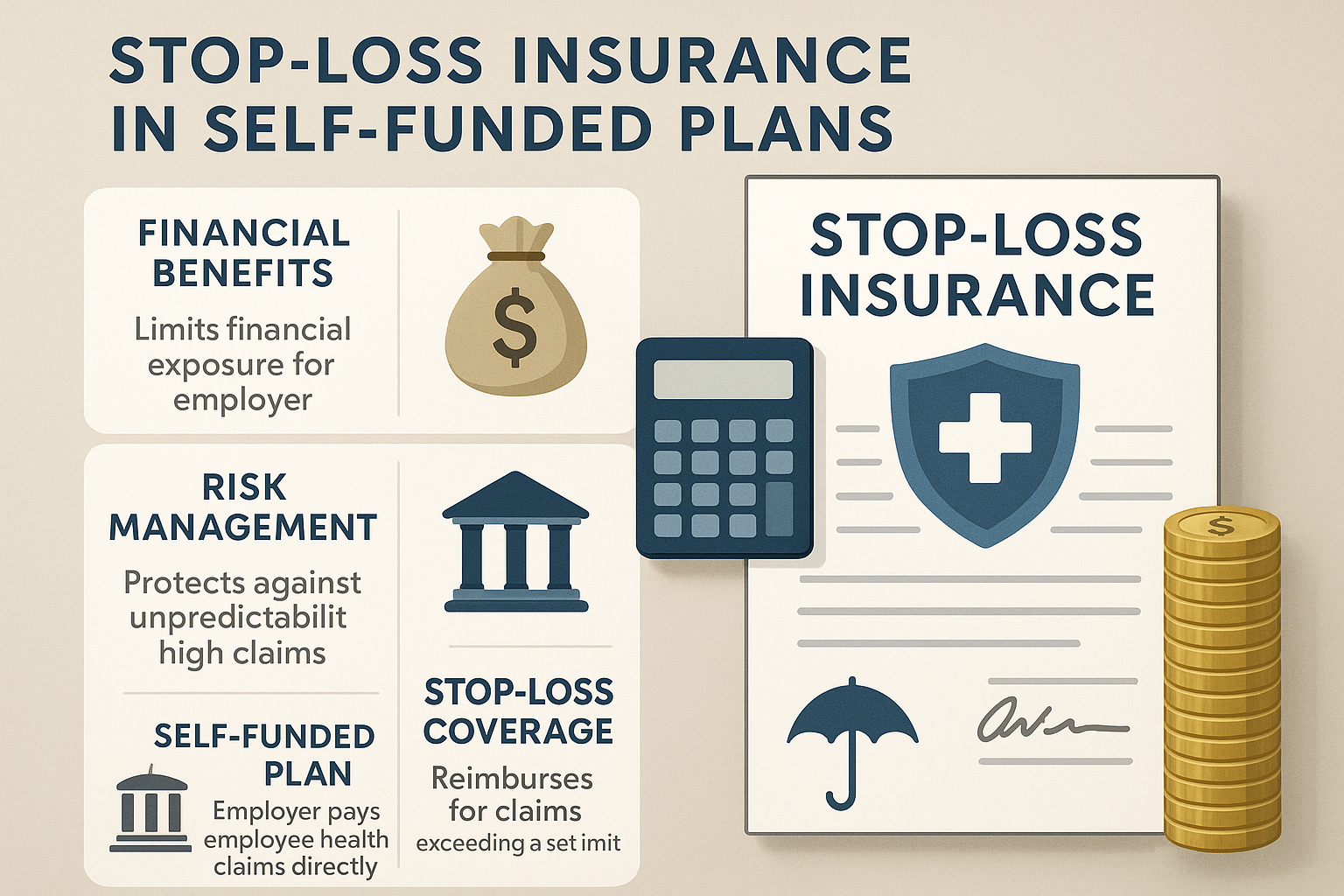

Self-funded health plans, also known as self-insured plans, offer employers a way to provide health benefits by paying for claims out of pocket rather than purchasing a traditional insurance policy. This approach allows companies to tailor their health benefits to the specific needs of their workforce, potentially reducing costs and increasing control over plan design. Employers assume the financial risk for providing healthcare benefits to their employees, but this risk is often mitigated by purchasing stop-loss insurance.

The Role of Stop-Loss Insurance

Stop-loss insurance is a crucial component for employers who opt for self-funded plans. It protects against catastrophic claims by capping the amount an employer would have to pay. There are two main types of stop-loss insurance: specific and aggregate. Specific stop-loss insurance covers claims that exceed a predetermined amount for an individual, while aggregate stop-loss insurance covers total claims that exceed a set threshold for the entire group. This dual protection ensures that employers are not overwhelmed by unexpected high-cost claims1.