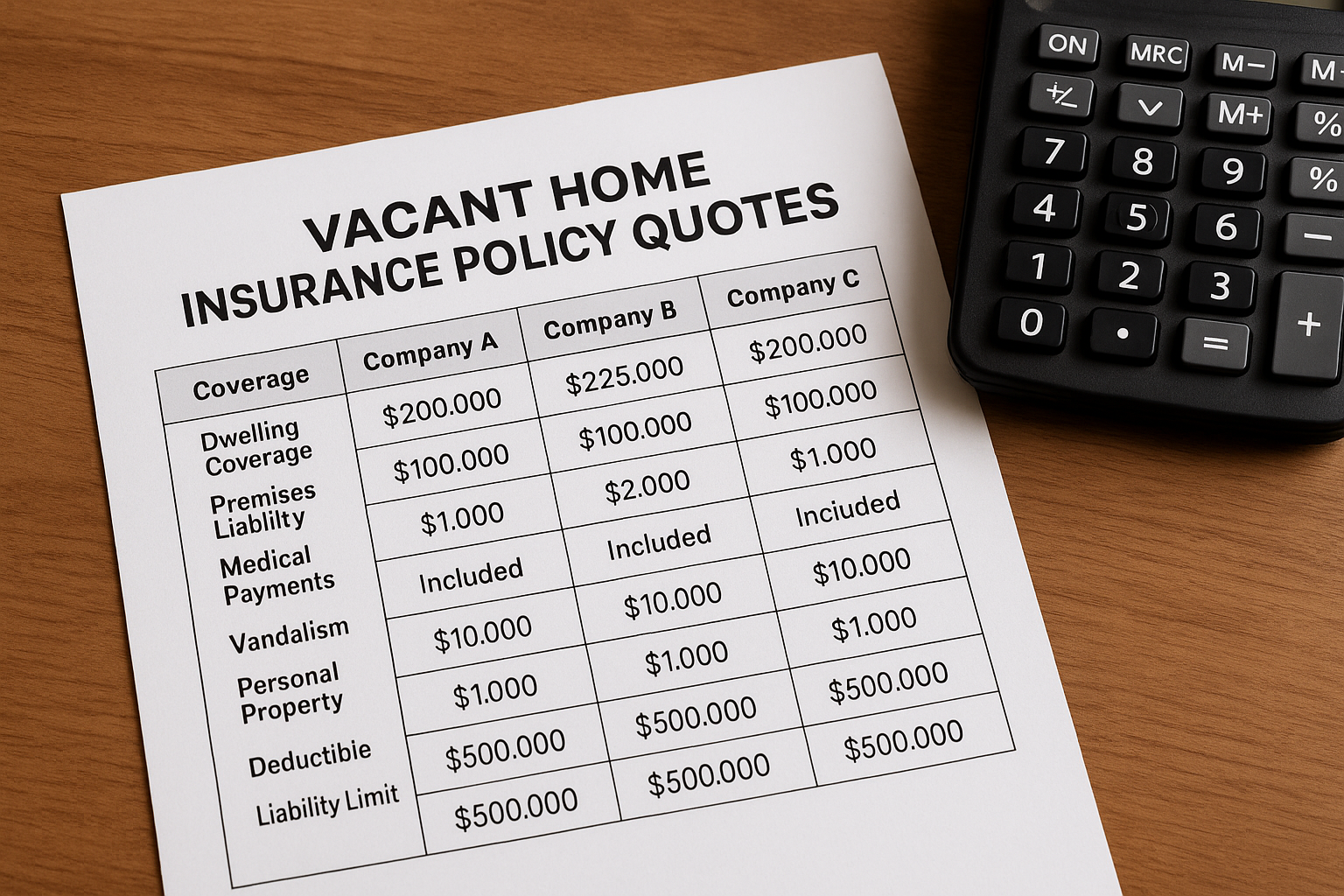

Slash Home Insurance with These Vacant Policy Quotes

Are you ready to slash your home insurance costs by exploring vacant policy quotes and uncovering valuable savings opportunities that await when you browse options and visit websites tailored to your needs?

Understanding Vacant Home Insurance

Vacant home insurance is a specialized type of coverage designed for properties that are unoccupied for an extended period, typically more than 30 days. Unlike standard homeowner's insurance, which may not cover certain risks if a home is left vacant, these policies provide protection against perils such as vandalism, theft, and weather-related damage. As a homeowner, you may need this coverage if you're selling your home, renovating, or if the property is a second home that remains unoccupied for long stretches.

Why Vacant Home Insurance is Crucial

When a home is left vacant, it becomes more susceptible to risks. For instance, vacant properties are more likely to be targeted by vandals or burglars. Additionally, maintenance issues such as leaks or electrical problems might go unnoticed, leading to significant damage. Standard homeowner's policies often include clauses that void coverage if a home is unoccupied for a specific period, making vacant home insurance a crucial consideration for safeguarding your investment.