Slash Medical Costs Short Term Health Insurance Secrets

If you're looking to slash your medical costs without compromising on essential coverage, exploring short-term health insurance options can offer you immediate savings and flexibility while you browse options that fit your needs.

Understanding Short-Term Health Insurance

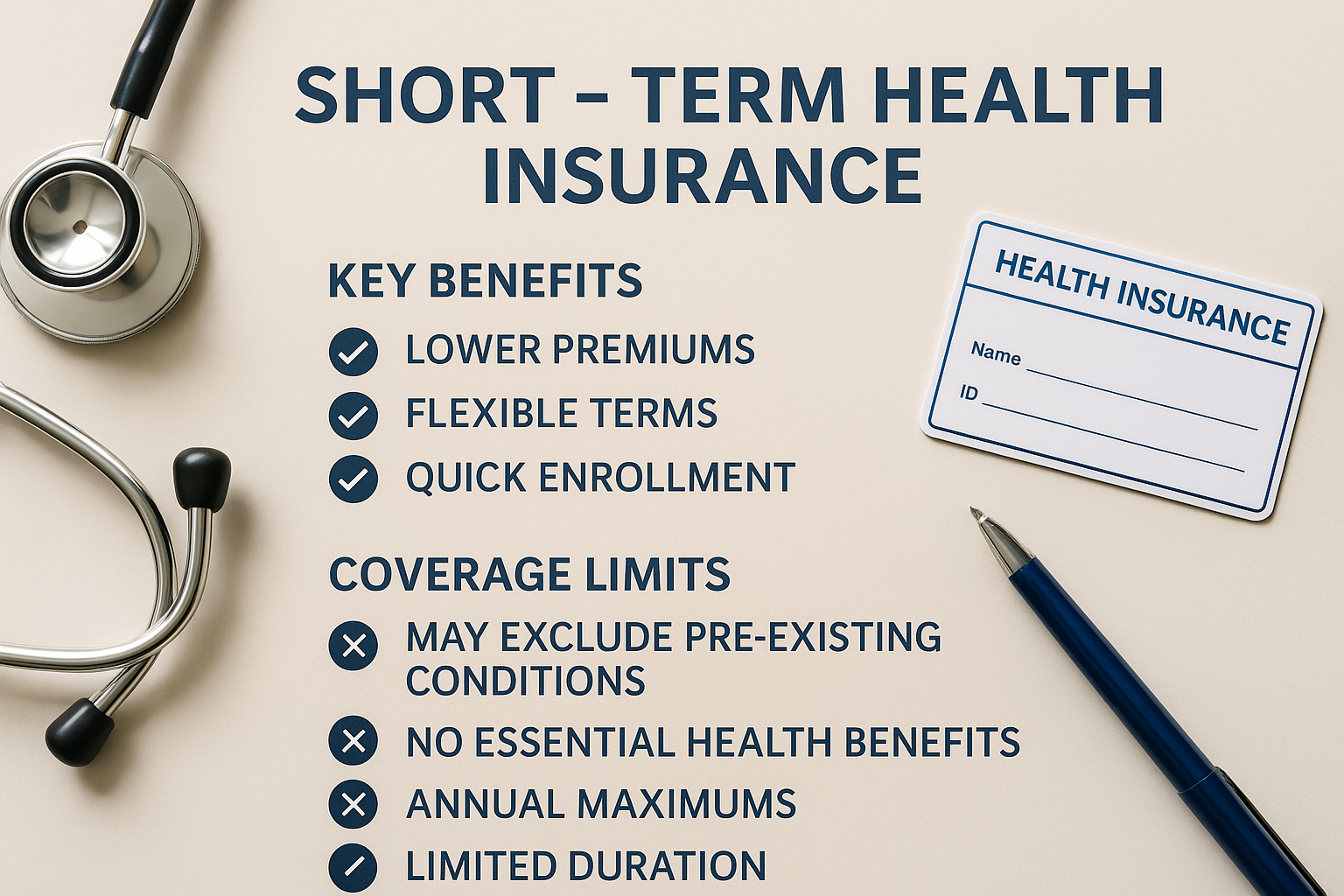

Short-term health insurance is designed to provide temporary coverage for individuals who are between permanent health plans. These plans typically cover a range of medical services, including doctor visits, emergency care, and hospital stays, but they may not cover pre-existing conditions or preventive care. The primary appeal of short-term health insurance lies in its affordability and flexibility, making it an attractive option for those in transition periods, such as recent graduates, individuals between jobs, or retirees not yet eligible for Medicare.

Benefits of Short-Term Health Insurance

One of the main benefits of short-term health insurance is cost savings. Premiums for these plans are generally lower than those for traditional health insurance plans, providing a more budget-friendly option for individuals seeking temporary coverage. Additionally, short-term plans offer quick enrollment processes and can be activated within a few days, allowing you to gain coverage almost immediately. This can be particularly advantageous if you're waiting for a new employer's health benefits to kick in or need coverage during a gap period.