Smart Choice Vision Insurance Plan Comparison Insights

If you're looking for a vision insurance plan that perfectly aligns with your needs and budget, exploring the variety of smart choice options available can lead you to significant savings and better coverage—so take a moment to browse these options and see which one fits you best.

Understanding Vision Insurance Plans

Vision insurance is a specialized health insurance product designed to reduce your costs for routine eye care, eyewear, and other vision-related expenses. Unlike comprehensive health insurance, vision insurance is typically supplemental and focuses on preventive care and corrective measures. The primary components of vision insurance include coverage for eye exams, prescription lenses, frames, and contact lenses. Some plans may also offer discounts on elective vision correction surgeries like LASIK.

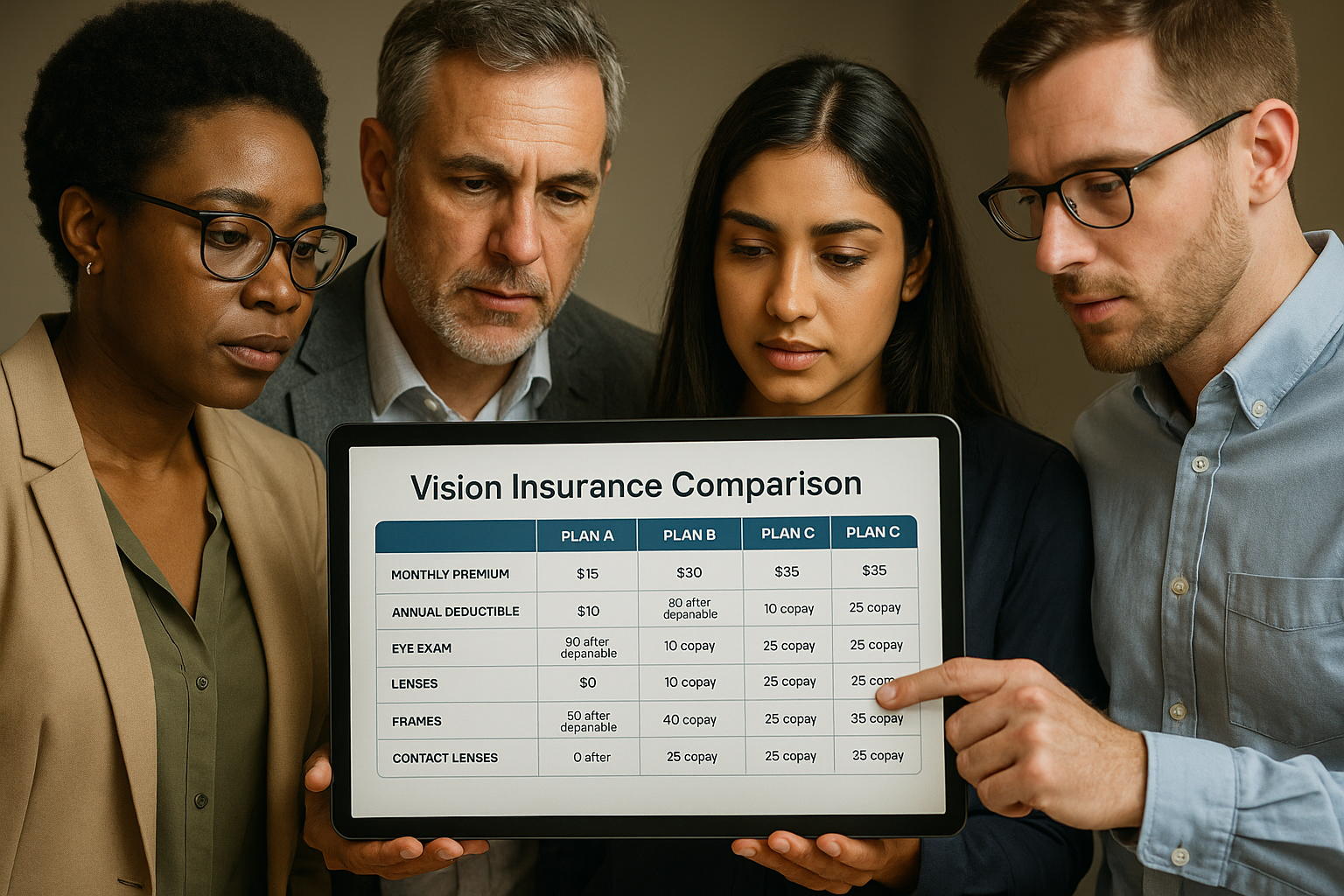

The Importance of Comparing Vision Insurance Plans

Choosing the right vision insurance plan involves a careful comparison of available options to ensure you get the best value for your money. When comparing plans, consider factors such as coverage limits, premiums, copayments, and network restrictions. Some plans might offer lower premiums but higher out-of-pocket costs, while others might have higher premiums with more comprehensive coverage. By evaluating these aspects, you can identify a plan that meets your specific needs and financial situation.