Stock Options Tax Tricks Top Advisors Swear By

Unlocking the potential tax benefits of stock options could significantly enhance your financial strategy, so why not browse options and see these opportunities for yourself?

Understanding Stock Options and Their Tax Implications

Stock options are a popular form of compensation that can provide substantial financial rewards. However, they also come with complex tax implications that can significantly impact your net earnings. Stock options generally fall into two categories: Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NSOs). Each type has different tax treatments, and understanding these differences is crucial for optimizing your financial outcomes.

ISOs offer favorable tax treatment, allowing you to defer taxes until you sell the stock. If you meet certain holding period requirements, the profits are taxed at the capital gains rate rather than as ordinary income. On the other hand, NSOs are taxed as ordinary income at the time of exercise, which can lead to a higher tax bill1.

Strategies to Minimize Tax Liabilities

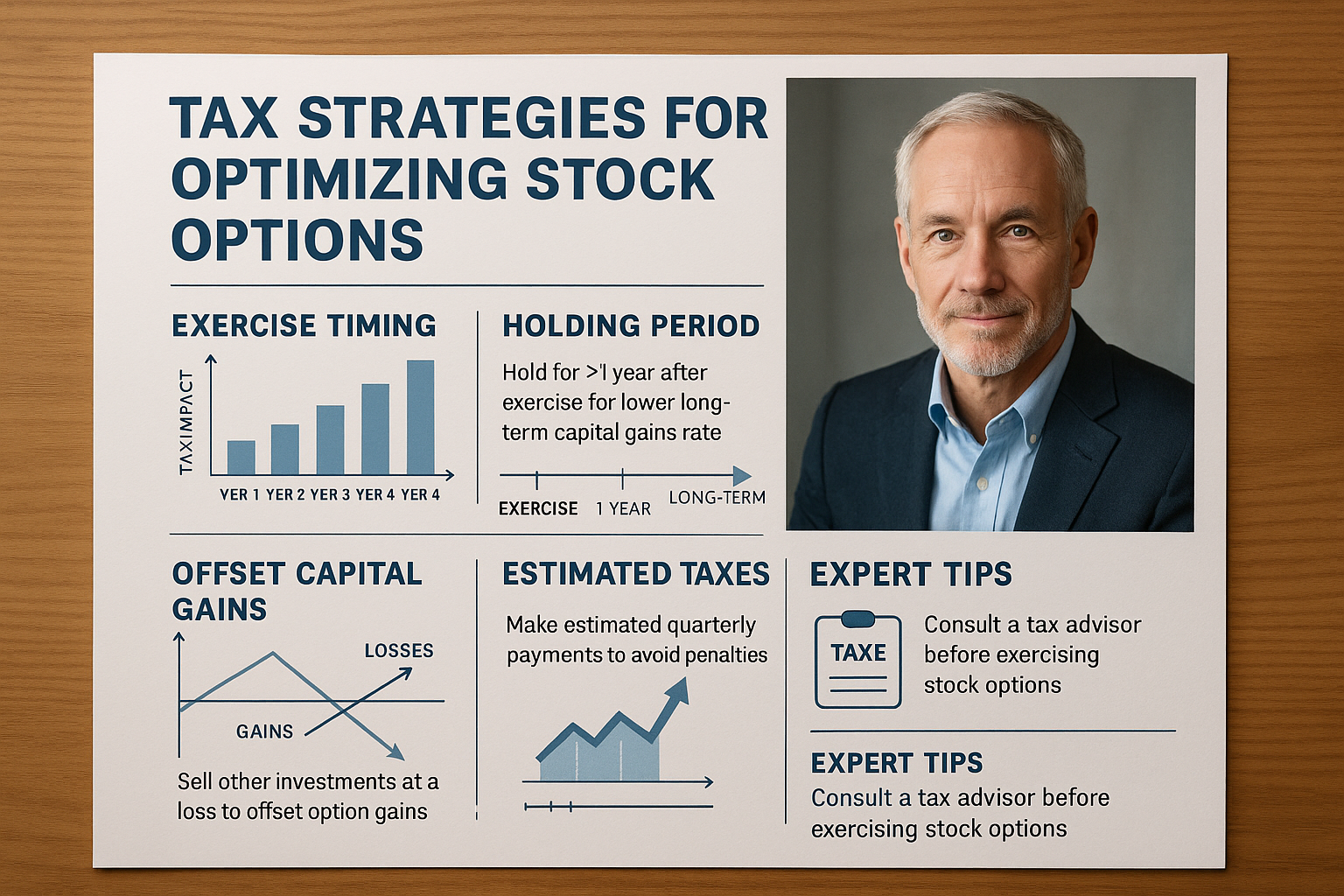

To make the most of stock options, it’s essential to employ strategies that minimize tax liabilities. One effective approach is to exercise ISOs early in the year. This strategy allows you to hold the stock for over a year, qualifying for long-term capital gains tax rates if you sell after two years from the grant date. Additionally, you can consider exercising options in a year when your income is lower, which could reduce the overall tax impact2.

Another tactic involves timing the sale of your shares. By strategically planning when to sell, you can manage your tax bracket and potentially reduce your tax burden. For instance, spreading sales over multiple tax years can help manage the impact on your income tax rate.