Today's Refinance Rates Could Save You Thousands Instantly

Imagine instantly saving thousands of dollars on your mortgage by simply exploring today's refinance rates with a quick search of available options.

Understanding Today's Refinance Rates

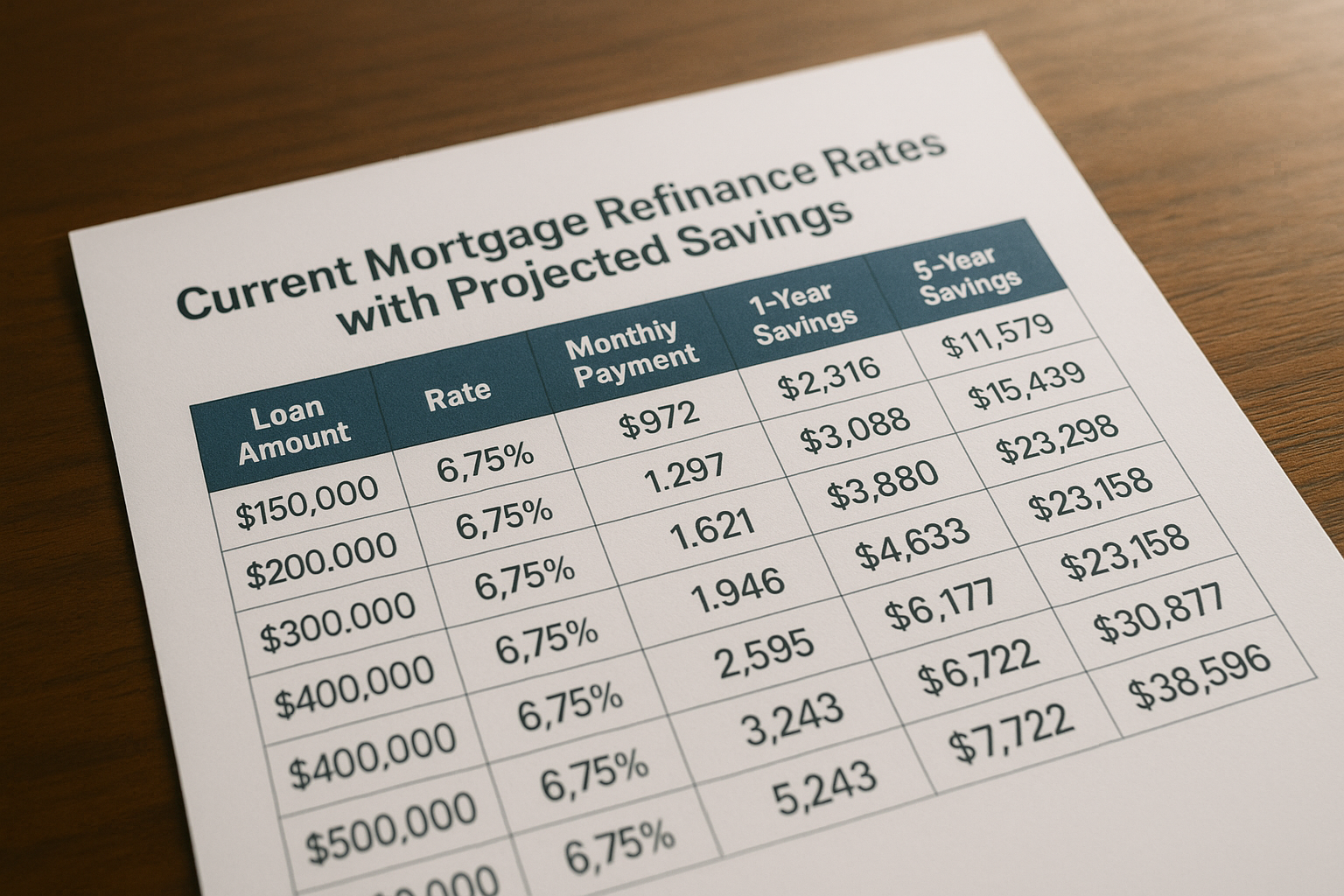

Refinancing your mortgage can be a strategic financial move, offering the potential to lower your monthly payments, reduce the total interest paid over the life of the loan, or even access cash from your home’s equity. Today's refinance rates are particularly attractive due to the current economic climate, where interest rates have remained relatively low compared to historical averages1. By taking advantage of these rates, homeowners can significantly cut down their mortgage costs and free up funds for other financial goals.

How Refinancing Can Save You Money

The primary benefit of refinancing is the potential for saving money. For instance, if you can reduce your interest rate by even one percentage point, the savings can be substantial. For a $300,000 mortgage, this could translate to over $3,000 in savings annually2. Additionally, refinancing to a shorter-term loan can reduce the amount of interest paid over time, although it may increase your monthly payments. This option is particularly appealing for those who are nearing retirement and want to pay off their mortgage sooner.