Transform D&O insurance renewal into multifamily savings bonanza

If you're looking to transform your D&O insurance renewal into a multifamily savings bonanza, you're in the right place to explore options that can significantly reduce costs and enhance your financial strategy.

Understanding D&O Insurance for Multifamily Properties

Directors and Officers (D&O) insurance is a critical component for multifamily property owners and managers, providing protection against claims made for alleged wrongful acts in managing the company. This type of coverage is essential as it safeguards the personal assets of your directors and officers, as well as the financial well-being of the organization itself. With the multifamily sector witnessing growth, the need for comprehensive D&O insurance has become more pronounced.

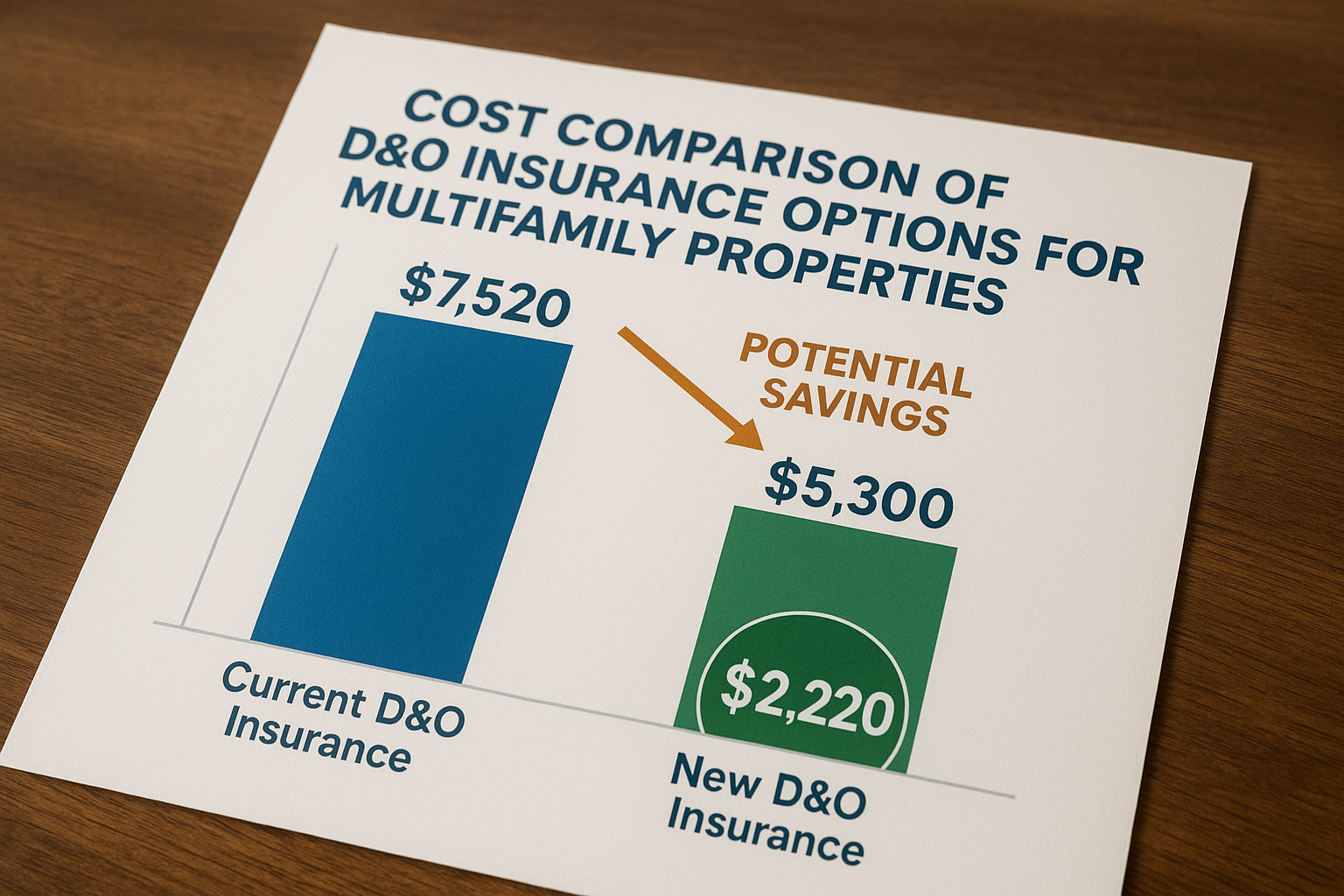

Opportunities for Cost Savings

Renewing your D&O insurance doesn't have to be a routine expense. By strategically approaching your renewal process, you can uncover significant savings. Start by reviewing your current policy to identify areas where you might be over-insured or where coverage can be optimized. Consider bundling your D&O policy with other insurance products like property or liability insurance for potential discounts. Many insurers offer attractive packages that can lead to substantial savings.