Transform Your Coverage With Flood Insurance NFIP vs Private

If you're looking to safeguard your property from the unpredictable wrath of nature, exploring flood insurance options can offer peace of mind and financial security—browse options to find the best fit for your needs.

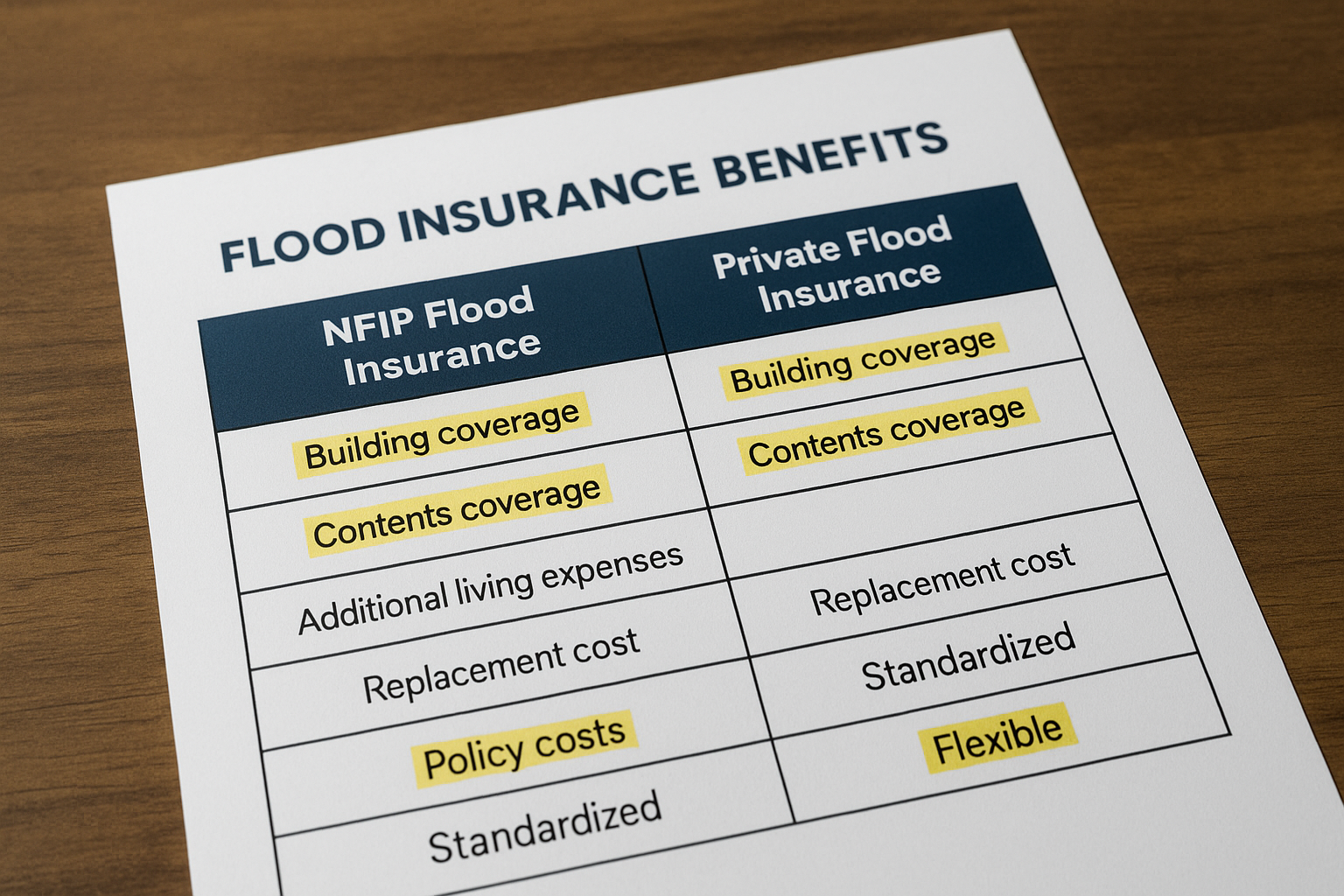

Understanding Flood Insurance: NFIP vs. Private

Flood insurance is a critical component for homeowners, especially those residing in flood-prone areas. The National Flood Insurance Program (NFIP) and private flood insurance are two primary avenues available for securing coverage. Each option has unique benefits and limitations, and understanding these can help you make an informed decision.

The National Flood Insurance Program (NFIP)

The NFIP, managed by the Federal Emergency Management Agency (FEMA), offers standardized flood insurance policies to homeowners, renters, and businesses in participating communities. This program is designed to reduce the socio-economic impact of floods by providing affordable insurance. NFIP policies cover up to $250,000 for residential buildings and $100,000 for contents1.

One of the significant advantages of the NFIP is its widespread availability and government backing, ensuring stability and reliability. However, NFIP policies often have limitations, such as coverage caps that might not fully protect high-value properties. Additionally, the NFIP requires a 30-day waiting period before coverage takes effect, which could be a disadvantage in urgent situations2.