Transform Your Finances with 0 Intro APR Magic

If you're looking to take control of your financial future and explore powerful tools to manage debt, reduce interest costs, and maximize savings, browse options like 0 Intro APR credit cards that can transform your financial landscape.

Understanding 0 Intro APR Credit Cards

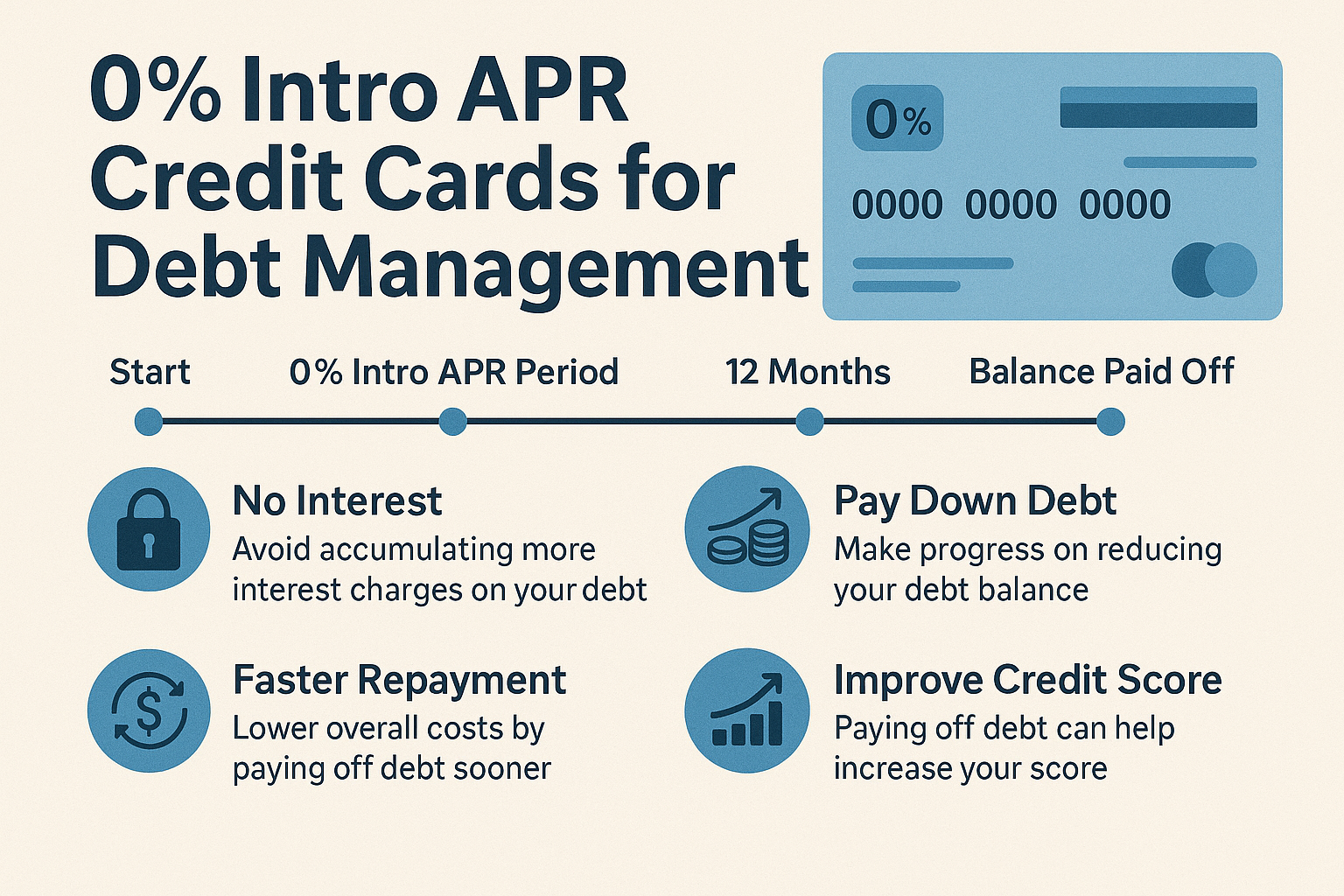

Zero Introductory Annual Percentage Rate (APR) credit cards offer a period during which no interest is charged on purchases or balance transfers. This can be a valuable tool for managing high-interest debt, making significant purchases, or simply easing cash flow without the burden of accruing interest. Typically, these promotional periods range from six to 21 months, providing ample time to pay down balances without the added financial stress of interest charges.

The Financial Benefits of 0 Intro APR

One of the most significant advantages of a 0 Intro APR card is the potential for substantial savings on interest payments. For example, if you have a credit card balance of $5,000 with an APR of 18%, you'd pay approximately $900 in interest over a year. By transferring this balance to a card with a 0 Intro APR, you can eliminate these interest costs during the promotional period, allowing you to focus on reducing the principal amount.

Moreover, these cards can be particularly beneficial for financing large purchases. Whether you're planning a home renovation or buying new appliances, spreading the cost over several months without interest can help you maintain budget stability and avoid financial strain.