Find Commercial Real Estate Investment Entry Secrets Now

Are you ready to uncover the hidden strategies that can propel your commercial real estate investment journey to new heights, while you browse options and explore the vast opportunities in this lucrative market?

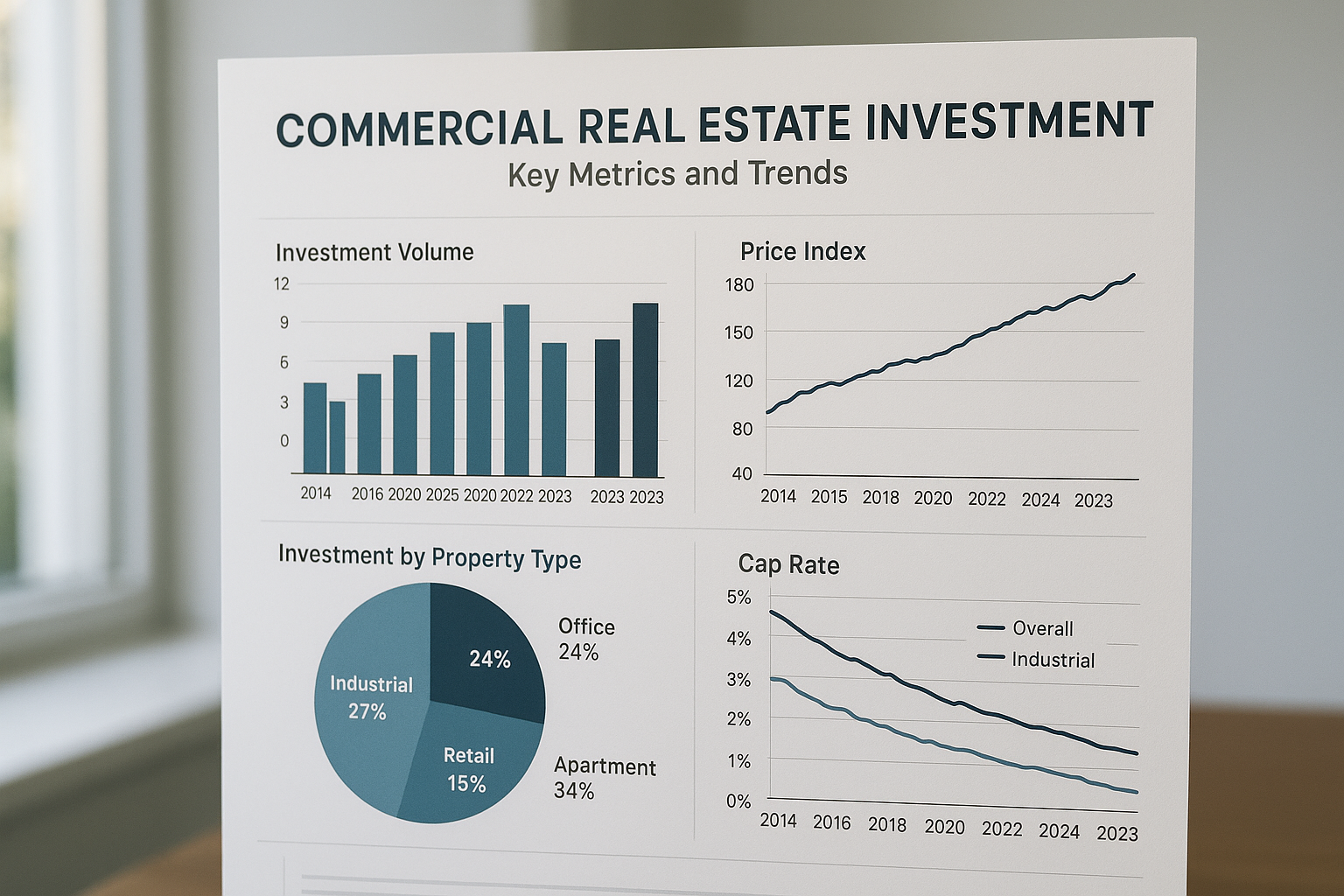

Commercial real estate investment is a dynamic and potentially lucrative field that offers significant opportunities for those willing to delve into its complexities. Unlike residential real estate, commercial properties are primarily used for business purposes, including office buildings, retail spaces, warehouses, and industrial properties. These investments can yield substantial returns, but they require a strategic approach, thorough research, and a keen understanding of market trends.

Understanding the Commercial Real Estate Market

The commercial real estate market is influenced by a myriad of factors, including economic conditions, interest rates, and demographic trends. Investors must keep a close eye on these variables to make informed decisions. For instance, rising interest rates can increase borrowing costs, impacting the overall profitability of an investment1. Conversely, a growing population in a specific area can boost demand for commercial spaces, leading to higher rental yields.

Types of Commercial Real Estate Investments

Commercial real estate encompasses various property types, each with its own set of benefits and challenges:

- Office Buildings: These properties are leased to businesses and can range from small office spaces to large skyscrapers. The demand for office spaces is often tied to employment rates and business growth in the area.

- Retail Spaces: This category includes shopping malls, strip malls, and standalone stores. The rise of e-commerce has impacted retail spaces, but strategic locations and unique offerings can still attract tenants.

- Industrial Properties: Warehouses and distribution centers fall under this category. As e-commerce continues to grow, the demand for industrial spaces near major transportation hubs has increased significantly.

- Multifamily Properties: Although often considered residential, large apartment complexes are treated as commercial investments. These properties provide stable cash flow and are less susceptible to economic downturns.

Maximizing Returns and Mitigating Risks

To succeed in commercial real estate investment, it's crucial to balance potential returns with associated risks. Investors should conduct comprehensive due diligence, which includes analyzing property location, tenant quality, lease terms, and maintenance costs. Diversification is another key strategy, as it helps spread risk across different property types and geographic regions2.

Moreover, understanding financing options is vital. Many investors leverage commercial mortgages to fund their purchases, and it's essential to compare interest rates and loan terms. Additionally, some investors explore Real Estate Investment Trusts (REITs) as an alternative to direct property ownership, offering liquidity and diversification3.

Current Market Trends and Opportunities

Recent trends in commercial real estate highlight the growing importance of sustainability and technology. Green buildings and energy-efficient systems are increasingly attractive to tenants and investors alike, often resulting in lower operating costs and higher property values4. Additionally, the integration of smart technology in commercial properties can enhance security, improve energy management, and provide valuable data insights.

Investors should also consider emerging markets and secondary cities, where lower entry costs and potential for growth present exciting opportunities. As remote work continues to shape the future of office spaces, flexible and co-working environments are gaining traction, catering to evolving business needs.

In summary, commercial real estate investment offers a wealth of opportunities for those equipped with the right knowledge and strategies. By understanding market dynamics, diversifying investments, and embracing new trends, you can position yourself for success in this ever-evolving field. As you explore the various options available, remember that thorough research and strategic planning are your best allies in achieving long-term financial growth.