Navigate Epic Savings Comparing Home Equity Loan Products

Unlocking the potential of your home’s equity can lead to epic savings, and by taking the time to compare home equity loan products, you can find the best deals tailored to your financial needs—browse options, search options, and visit websites to make informed decisions.

Understanding Home Equity Loans

Home equity loans are a popular choice for homeowners looking to leverage the value built into their property. Essentially, these loans allow you to borrow against the equity in your home, providing a lump sum of money that can be used for various purposes such as home improvements, debt consolidation, or major purchases. The interest rates on home equity loans are generally lower than those on personal loans or credit cards, making them an attractive option for many borrowers.

Types of Home Equity Loans

There are primarily two types of home equity loans: fixed-rate loans and home equity lines of credit (HELOCs). A fixed-rate home equity loan offers a one-time lump sum with a fixed interest rate and repayment schedule, which can be ideal for those who prefer predictable monthly payments. On the other hand, a HELOC provides a revolving credit line with a variable interest rate, giving you the flexibility to borrow and repay as needed, similar to a credit card. This option is suitable for ongoing expenses or projects with uncertain costs.

Benefits of Home Equity Loans

One of the primary benefits of home equity loans is their relatively low interest rates compared to other forms of credit. Additionally, the interest paid on these loans may be tax-deductible, though it's important to consult with a tax advisor to understand the specifics of your situation1. Home equity loans also provide access to significant funds, often up to 85% of your home's appraised value, minus any outstanding mortgage balance2.

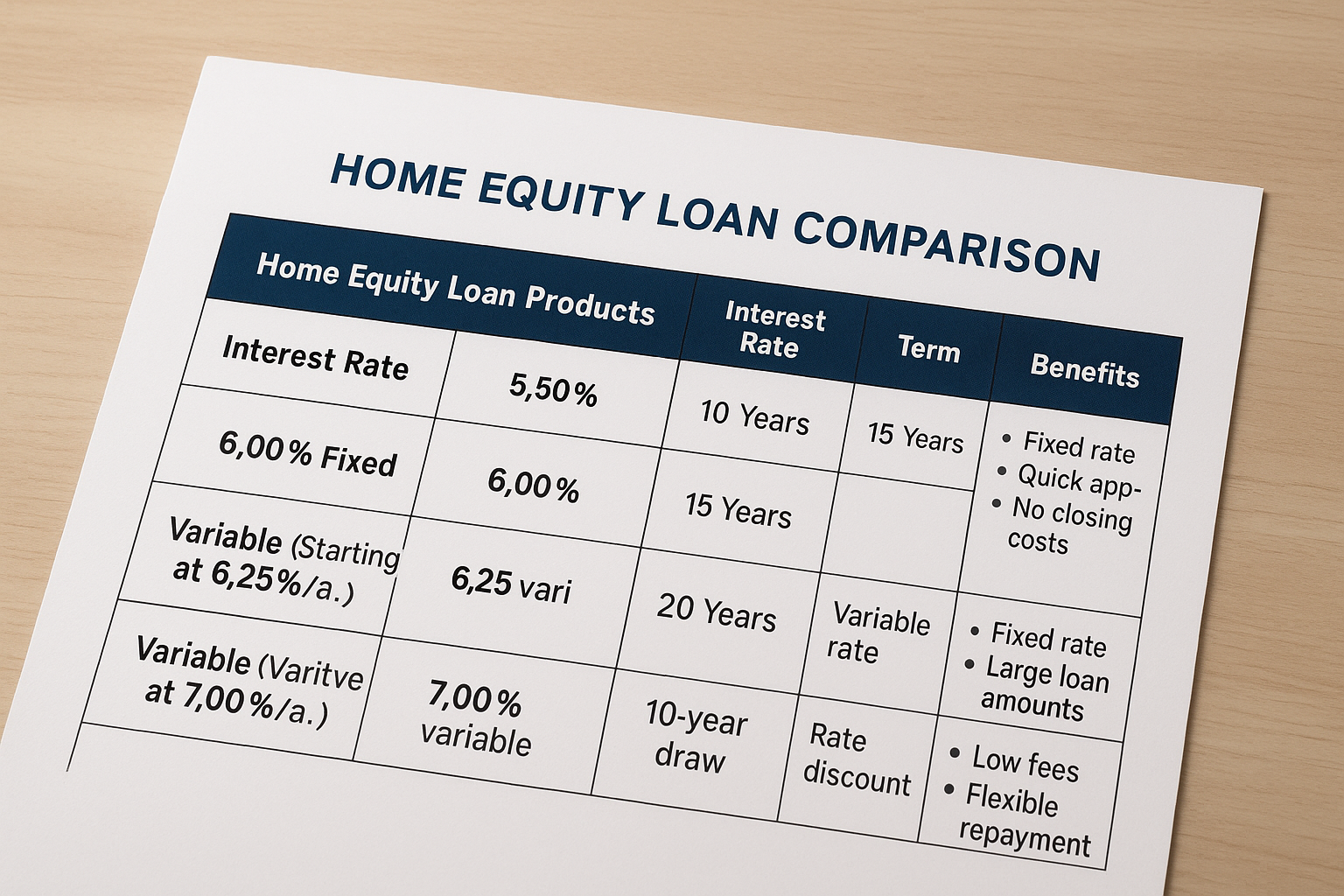

Comparing Home Equity Loan Products

To navigate epic savings, it's crucial to compare different home equity loan products thoroughly. Consider factors such as interest rates, loan terms, fees, and the lender's reputation. Many financial institutions offer competitive rates, and some even provide discounts for existing customers or those with excellent credit scores. It's also wise to examine the flexibility of repayment options and any potential penalties for early repayment.

Utilizing online tools and calculators can help you estimate monthly payments and total loan costs, allowing you to compare offers from multiple lenders easily. By doing so, you can identify the most cost-effective solution that aligns with your financial goals and circumstances.

Real-World Examples and Savings Opportunities

For instance, a homeowner with $100,000 in equity might secure a home equity loan with a fixed interest rate of 4.5% over 15 years. Compared to a personal loan with an interest rate of 10%, the homeowner could save thousands in interest over the life of the loan. Additionally, some lenders offer promotions such as reduced closing costs or waived application fees, which can further enhance your savings3.

Additional Resources and Specialized Services

For those seeking specialized solutions, many financial institutions offer personalized consultations to help you understand your options better. These services can provide deeper insights into the terms and conditions of different loan products, enabling you to make more informed decisions. Furthermore, exploring online platforms and financial forums can offer valuable peer insights and recommendations.

By taking the time to carefully compare home equity loan products, you can unlock substantial savings and make the most of your home’s value. Whether you're planning a major renovation, consolidating debt, or simply looking for financial flexibility, understanding your options and leveraging the right tools can lead to smart financial decisions. Remember to browse options, search options, and visit websites to stay informed and empowered in your financial journey.