Medicare's Secret Coverage Tips Everyone Should Know

Unlock the hidden secrets of Medicare coverage and discover how you can maximize your benefits while saving money by browsing options, visiting websites, and following the options available to you.

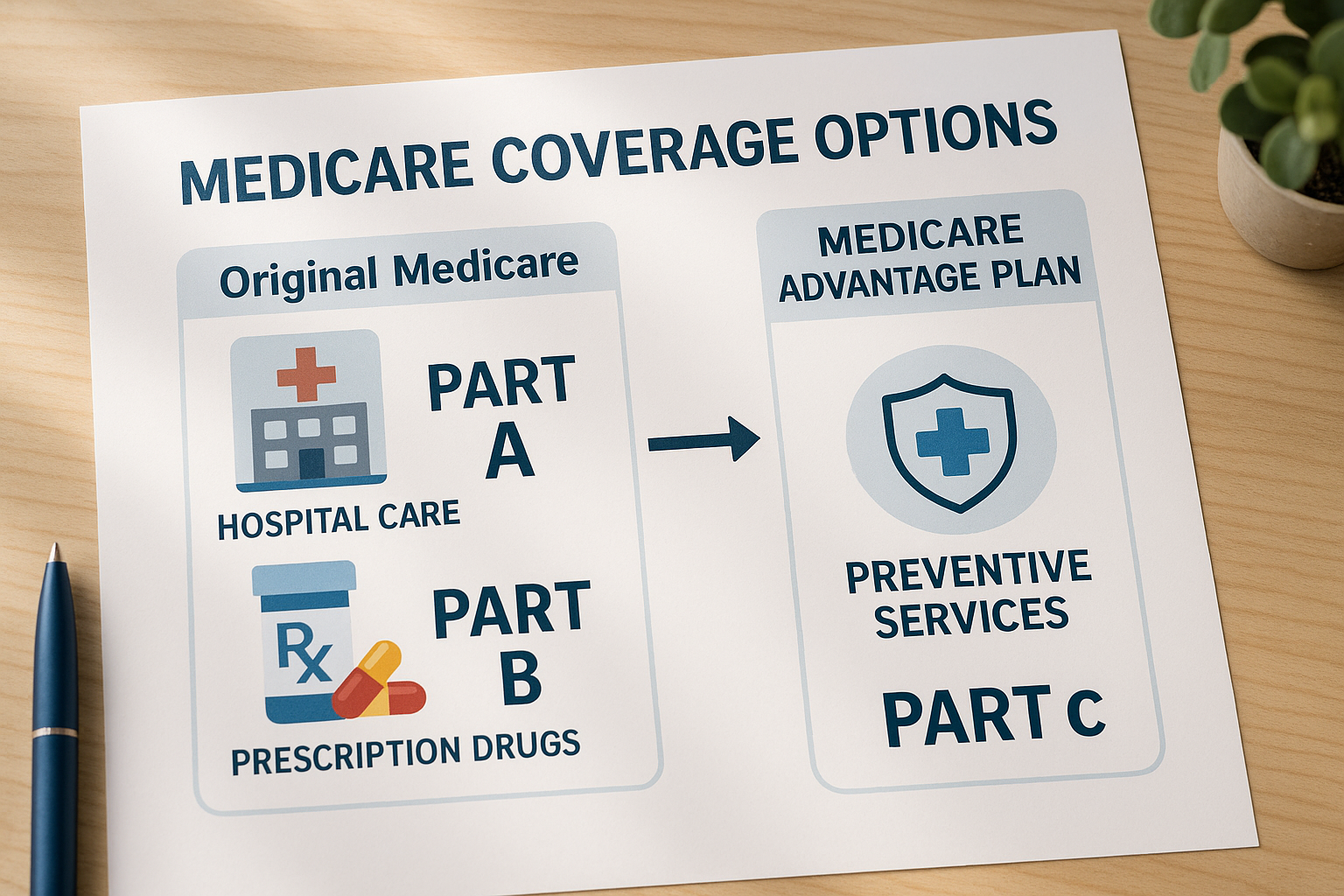

Understanding Medicare Coverage

Medicare, the federal health insurance program for people aged 65 and older, as well as certain younger individuals with disabilities, offers a range of coverage options that can be complex to navigate. Understanding the nuances of Medicare can lead to significant benefits, including cost savings and enhanced healthcare coverage. By exploring the various parts of Medicare—Parts A, B, C, and D—you can tailor your plan to better suit your individual health needs and financial situation.

Part A: Hospital Insurance

Medicare Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes while working. However, there can be deductibles and coinsurance costs, so it's important to understand these potential expenses and how they might impact your budget1.

Part B: Medical Insurance

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Unlike Part A, Part B requires a monthly premium, which can vary based on your income. For 2023, the standard premium is $164.90, but it can be higher for individuals with higher income levels2. Understanding these costs and the coverage provided can help you make informed decisions about your healthcare needs.

Part C: Medicare Advantage

Medicare Advantage (Part C) plans are offered by private companies approved by Medicare. These plans provide all of your Part A and Part B coverage and usually include additional benefits like vision, hearing, and dental. Some plans also include Medicare prescription drug coverage (Part D). The key benefit of Medicare Advantage plans is the potential for lower out-of-pocket costs and additional benefits that traditional Medicare does not cover3. When considering these plans, it's crucial to compare the options available in your area to find a plan that fits your healthcare needs and budget.

Part D: Prescription Drug Coverage

Medicare Part D adds prescription drug coverage to Original Medicare and some Medicare Cost Plans, Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. Each plan can vary in cost and drugs covered, so it's important to review the specifics of each plan to ensure it meets your medication needs. Many beneficiaries find that Part D plans offer significant savings on prescription medications by reducing out-of-pocket costs4.

Medicare Supplement Insurance (Medigap)

Medigap policies, sold by private companies, can help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles. These plans can offer peace of mind by limiting out-of-pocket expenses, but they come with their own premiums. It's essential to compare Medigap policies to find one that offers the coverage you need at a price you can afford5.

Maximizing Your Medicare Benefits

To fully leverage the benefits of Medicare, it's important to review your coverage annually and during the Medicare Open Enrollment Period (October 15 to December 7). This is an opportunity to make changes to your health and prescription drug plans for the following year. By staying informed and proactive, you can ensure that your Medicare plan continues to meet your evolving healthcare needs while optimizing costs.

As you explore these options, consider visiting websites and browsing options to find the best plans and coverage for you. Understanding the intricacies of Medicare can lead to better healthcare outcomes and financial savings, making it worthwhile to invest time in researching and comparing plans.