Find Out Renters Insurance Michigan's Real Deal Rates

When you're navigating the world of renters insurance in Michigan, understanding the real deal rates can empower you to make informed decisions and secure the best coverage by browsing options, visiting websites, and exploring the wealth of choices available.

Understanding Renters Insurance in Michigan

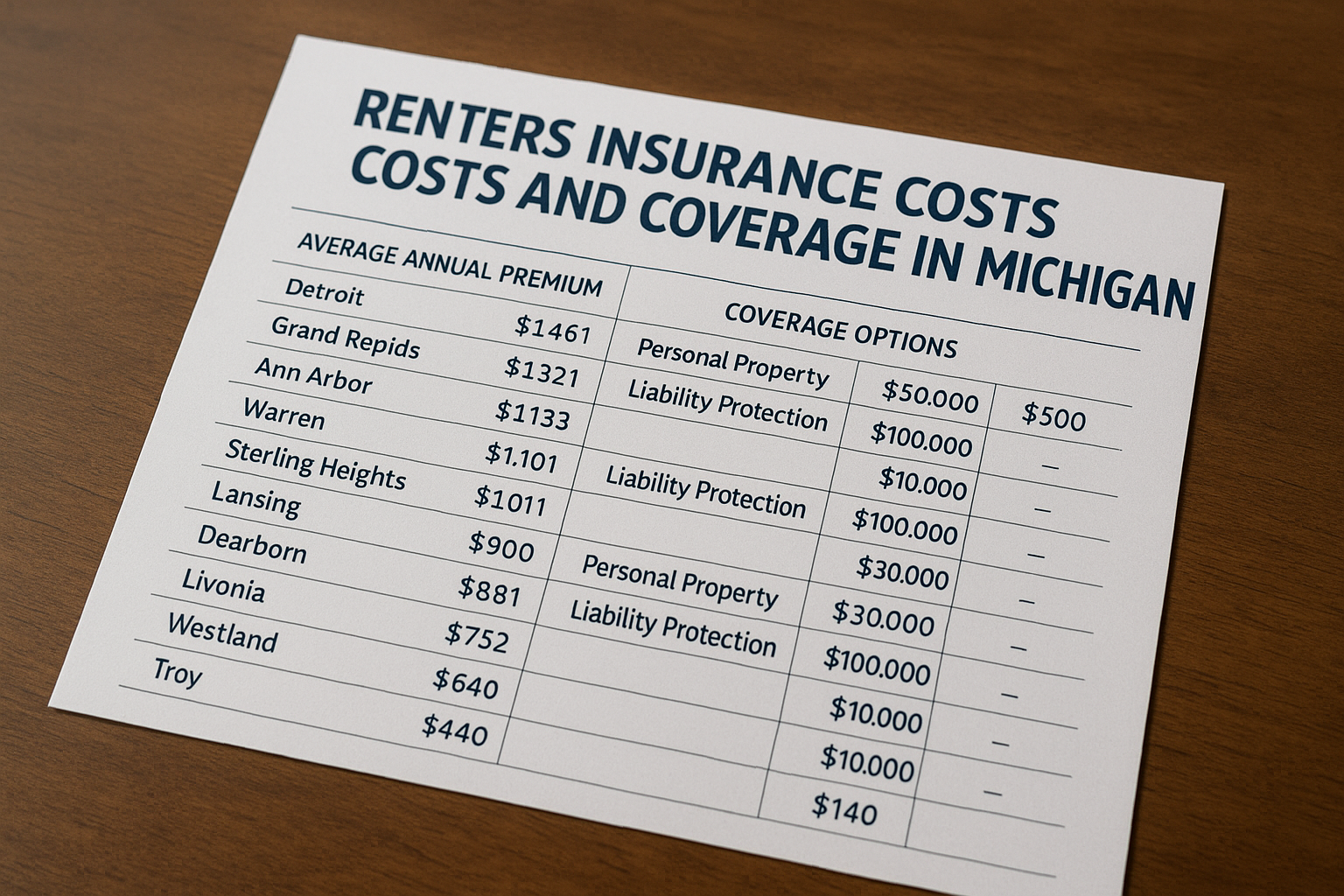

Renters insurance is an essential safeguard for tenants, providing coverage for personal belongings, liability protection, and additional living expenses in case of unforeseen events. In Michigan, the average cost of renters insurance is approximately $190 per year, which is slightly below the national average1. This affordability makes it an attractive option for renters looking to protect their assets without breaking the bank.

Factors Influencing Renters Insurance Rates

Several factors can influence the cost of renters insurance in Michigan. These include the location of your rental property, the value of your personal belongings, and your chosen coverage limits. Urban areas like Detroit may have higher premiums due to increased crime rates, while rural areas might offer more affordable options2. Additionally, opting for higher deductibles can lower your monthly premiums, although this means you'll pay more out-of-pocket in the event of a claim.

Types of Coverage Available

Renters insurance policies typically offer three main types of coverage: personal property, liability, and additional living expenses. Personal property coverage protects your belongings against risks like theft or fire, while liability coverage shields you from costs associated with accidents or injuries occurring in your rental unit. Additional living expenses coverage helps cover the cost of temporary housing if your rental becomes uninhabitable3.

How to Find the Best Rates

To find the best renters insurance rates in Michigan, it's crucial to shop around and compare quotes from different providers. Many companies offer discounts for bundling renters insurance with other policies, such as auto insurance. Additionally, having safety features like smoke detectors or security systems can lead to reduced premiums. Online tools and comparison websites can be invaluable resources for exploring these options and ensuring you get the most competitive rates4.

Real-World Examples and Statistics

Consider the case of a young professional renting an apartment in Ann Arbor. By choosing a policy with a $500 deductible and $20,000 in personal property coverage, they could expect to pay around $15 monthly. In contrast, a family renting a house in Grand Rapids might opt for a higher coverage limit due to more valuable possessions, resulting in a monthly premium closer to $255.

With the right approach, renters insurance can be a cost-effective way to protect your belongings and provide peace of mind. By following the options mentioned and conducting thorough research, you can secure a policy that meets your needs and budget, ensuring you're well-prepared for any unexpected events.