Secure Your Fortune with Rental Property Insurance Secrets

Unlock the secrets to safeguarding your rental property investment while maximizing your returns by exploring the diverse insurance options available, and see these options today to secure your financial future.

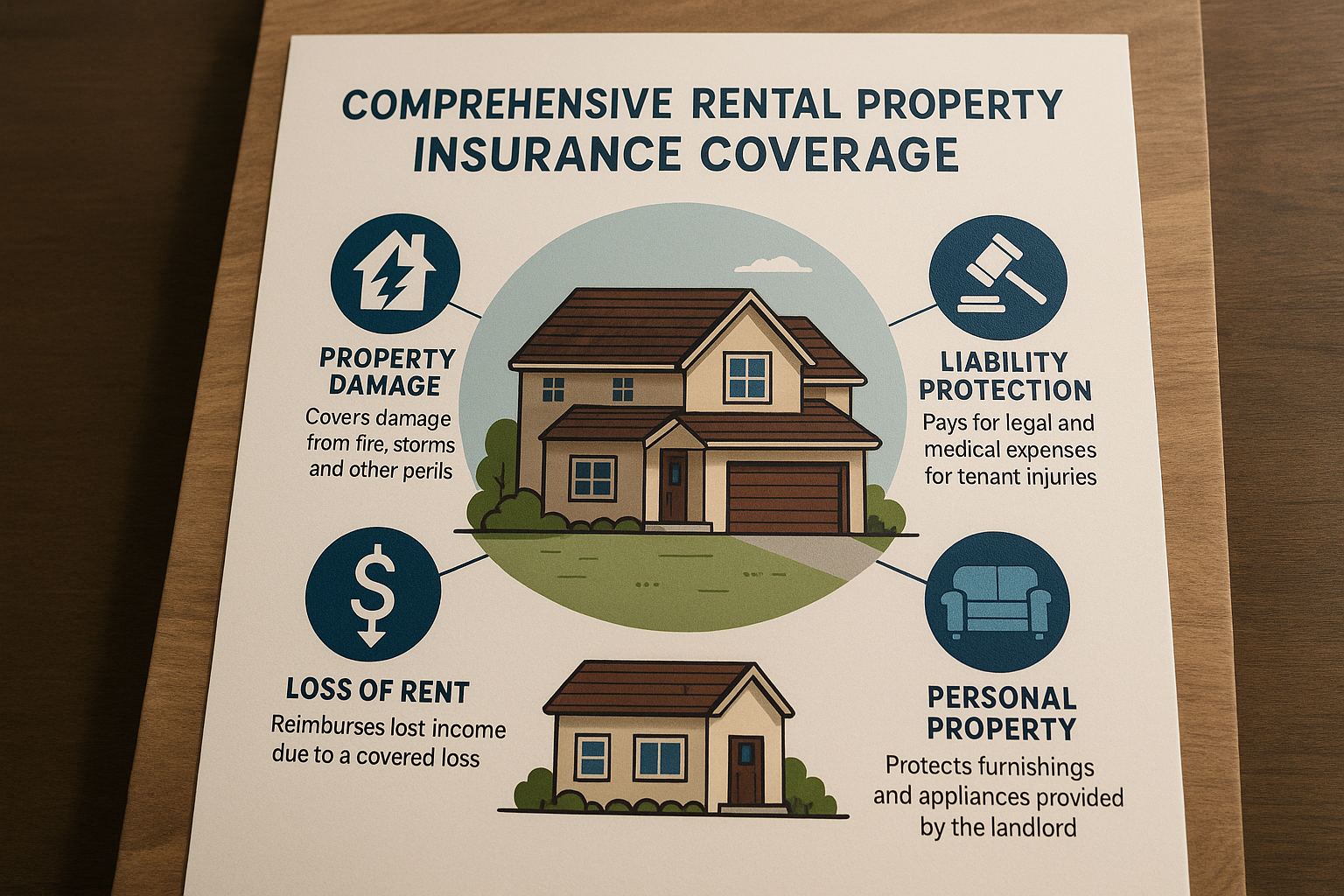

Understanding Rental Property Insurance

Rental property insurance, often referred to as landlord insurance, is a vital component for anyone looking to protect their real estate investments. Unlike standard homeowners insurance, rental property insurance is specifically designed to cover the unique risks associated with renting out properties. This type of insurance typically includes coverage for property damage, liability protection, and loss of rental income1.

Essential Coverage Options

When considering rental property insurance, it's crucial to understand the various coverage options available. Property damage coverage protects the physical structure of your property from perils such as fire, storms, or vandalism. Liability protection covers legal expenses in case a tenant or visitor is injured on your property and holds you responsible. Loss of rental income coverage compensates you for lost income if your property becomes uninhabitable due to a covered event2.

Financial Benefits of Rental Property Insurance

Investing in rental property insurance offers significant financial benefits. By safeguarding against unexpected damages and liability claims, you protect your revenue streams and ensure long-term profitability. Moreover, many insurance providers offer discounts for bundling policies or installing safety features like smoke detectors and security systems. Such incentives can reduce your overall insurance costs, making it a cost-effective choice for landlords3.

Real-World Examples and Statistics

According to industry data, landlords who invest in comprehensive insurance policies typically experience fewer financial setbacks when disasters strike. For instance, a study found that properties with adequate insurance coverage recover 40% faster from natural disasters than those without4. Additionally, landlords who carry liability insurance are less likely to face costly lawsuits, as they are better equipped to manage legal claims.

Exploring Specialized Solutions

For landlords with unique needs, specialized insurance solutions are available. These may include coverage for short-term rentals, multi-unit properties, or properties located in high-risk areas. It's advisable to consult with insurance agents who specialize in rental properties to tailor a policy that fits your specific requirements. You can browse options from various providers to find a plan that offers the best protection at the most competitive rate.

Securing rental property insurance is an essential step for any landlord seeking to protect their investments and ensure steady income. By understanding the available coverage options and financial benefits, you can make informed decisions that enhance your property's safety and profitability. As you explore these options, consider the specialized solutions that can further optimize your insurance strategy, ensuring peace of mind and financial security.